Retirement Savings: What’s Holding You Back?

Enroll In Your Workplace Retirement Plan Now

It may seem tough to save for retirement when you have today’s bills to pay. But the reality is that YOU are the most important piece in banking enough money for the retirement you want.

Join The Crowd

When it comes to saving for retirement, forget the rhetorical question: “If everyone else is jumping off a bridge, will you too?” With nearly 80% of eligible workers1 saying they contribute to their employer’s retirement plan, in this case, you should follow the crowd.

Your employer offers one of the simplest ways for you to save for retirement. Better still, many employers match some employee contributions. Regardless of how long you’ve been working, it’s important to start now, and not miss out on this opportunity.

Debunk The Myths

Below are some common reasons you may be unsure about saving for retirement and reasons why you actually should.

MYTH 1

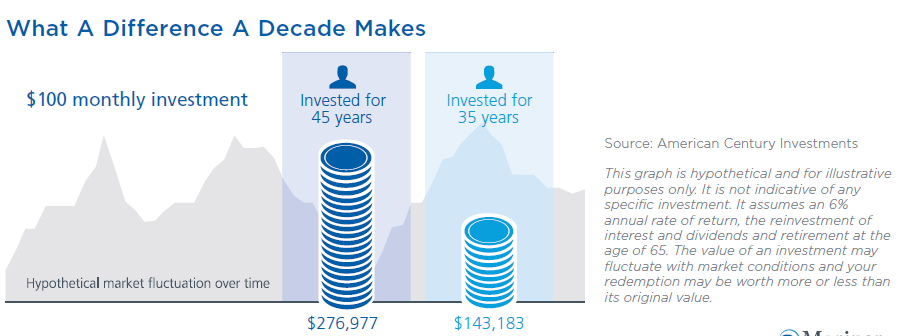

I have plenty of time before I retire

Actually, the longer your money is invested, the greater the potential impact on your savings. See the potential that ten additional years may have on your retirement.

MYTH 2

I don’t have enough money right now

Even if you can only afford a little each month, the key is to start now. Small sacrifices—like movie night at home or eating out less— free up money to invest.

MYTH 3

I have already saved enough

If you’re saving on your own, congratulations. Just make sure it’s enough. Depending on your age and when you retire, you may need more than you think. Also, consider the impact of inflation: Today’s $100 will only equal $74 in ten years with just 3% inflation2.

Advantages Now And Later: Don’t Miss Out.

Experts say you’ll need about 80%3 of your current income every year in retirement. Multiply that by 25 to 30 years and you’re looking at a pretty high price tag. Enrolling in your employer’s plan is a critical step towards aiming to help you cover future costs. Plus, your plan offers advantages you can use while you’re still working.

CONTRIBUTIONS ARE AUTOMATIC

Once you enroll, you’re set. You choose the amount and investments; your employer does the rest.

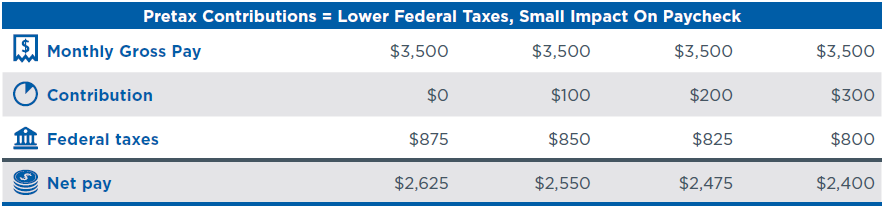

YOUR CURRENT TAXES ARE LOWER

The money is taken from your paycheck before federal and most state income taxes are withheld. That means your current taxable income will be lower and you will pay less in taxes.

YOU CAN TAKE IT WITH YOU

If you leave your current job, the money can be rolled over into a new employer’s plan or a Rollover IRA — helping you avoid taxes and penalties, and keeping your money invested for your future.

The Bottom Line

Enrolling in your employer’s retirement plan is one of the smartest choices you can make for your future.

1 According to the Employee Benefits Research Institute (EBRI), 79.5 percent of workers say they are contributing to their employer’s retirement plan. Source: The 2012 Retirement Confident Survey, ERBI, Washington, DC.

2 Source: American Century Investments inflation calculator; Effects of inflation on a dollar amount over 10 years.

3 Source: American Society of Pension Actuaries

This material is provided with permission from American Century. It is for informational purposes only and has been obtained from sources believed to be reliable. While every effort is made to ensure the accuracy of its contents, it should not be relied upon as being tax, legal, or financial advice.

American Century Investment Services, Inc., Distributor

© American Century Proprietary Holdings, Inc. All rights reserved.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.