2024 Retirement Plan Limits

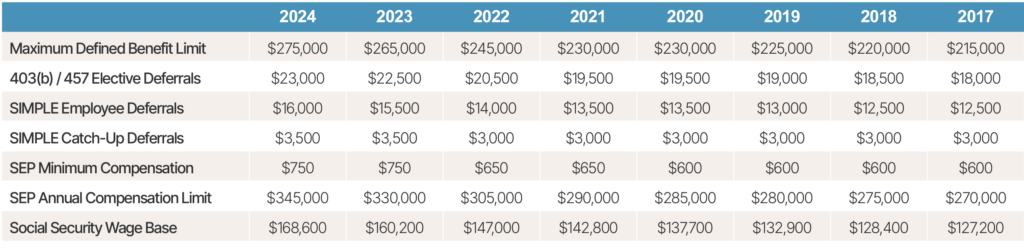

The Internal Revenue Service announced cost of living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2024. The contribution limit for employees who participate in 401(k), 403(b), most 457 plans and the federal government’s Thrift Savings Plan has been increased to $23,000 in Additional information regarding the new limitations can be found in the table below.

401(k) Plan Limits

Non-401(k) Related Plan Limits

Don’t Let the Unexpected Derail Your Retirement Goals

When it comes to your golden retirement, don’t leave it up to chance. These 3 major factors could make or break your plans.

Source:

Individuals who are age 50 or over can make annual catch-up contributions.

This material is intended for informational/educational purposes only. It should not be construed as personal investment advice. Investing involves risk and the potential to lose principal. Please contact your financial advisor for more information specific to your situation.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.