Opportunity Zones

Qualified Opportunity Funds (QOF) are new investment vehicles that allow investors to potentially defer and reduce capital gains on their investments by moving funds into QOFs focused on “opportunity zones.”

For generations the United States has been referred to as the ‘Land of Opportunity’. Over time, though, certain areas of the country have fallen behind. This creates an economic divide that recent legislation and a resulting new investment vehicle hope to address. Created under the Tax Cuts & Jobs Act of 2017, Qualified Opportunity Funds (QOF) are new investment vehicles that allow investors to potentially defer and reduce capital gains on their investments by moving funds into QOFs focused on “opportunity zones.”1 The ramifications of these new funds are far reaching and could potentially inject billions of dollars into regions that otherwise would not be on the radar for investors, making them not only a tax-deferred investment, but also one with the potential for direct societal benefits. The funds are not without their drawbacks however. Several limitations to investing in an opportunity zone are discussed below. These limitations may make it a poor investment for some. The origins of the QOF arise from legislation included with the new tax code changes, allowing for the designation of opportunity zones throughout the country, a process that began in March 2018.1 The opportunity zones were selected at the discretion of state governors and based largely on the area’s socioeconomic makeup and also by projected economic development or lack thereof.1

Now that the zones have been selected, it’s up to QOF managers to determine what areas to direct funds into, subject to specific requirements under the tax code. Using tax concepts similar to the ones applied to real estate in a 1031 exchange, a QOF incentivizes eligible investors1 to participate in the fund by allowing them to defer the inclusion of recognized capital gains in their gross income and to potentially permanently eliminate a certain percentage of those capital gains. Unlike a 1031 exchange however, a QOF does not have limits on the type of capital gains proceeds it can receive, so the sale of appreciated stocks, real estate, or other private offerings will qualify as long as certain tax code requirements are met.1

Tax Benefits Explained

In order to receive maximum tax benefit, within 180 days of the disposal of preferably highly appreciated capital gains property, investors must take the amount of the gain from the transaction and put it towards ownership in a QOF.2 The gain is then deferred until a “recognition event”, i.e. the earlier of a sale of the interest in the QOF, or until Dec. 31, 2026.2

In addition to adhering to the aforementioned rules, investors must also hold their ownership interest for between five and seven years to exclude up to 10 percent of their capital gain via a basis step-up.2 An additional 5 percent step-up occurs if the investment is held for seven years or more. That seven-year holding period must be at least seven years prior to Dec. 31, 2026, so time is of the essence.2 Any QOF investment held for less than five years is not eligible for any deferral of gains.2

Once the taxpayer has held their investment in the QOF for 10 years or more, a special election can be made to treat the basis of their investment in the QOF on the date of sale as the fair market value of the QOF, effectively eliminating any additional capital gains on the QOF.2 So while some amount of capital gains must inevitably be recognized under the recognition event rule, there is also the potential for capital appreciation without any recognized gain following the ten-year holding period.2

Favorable Elements

As previously discussed, the benefits of deferring capital gains makes the QOF an attractive investment for those with highly appreciated assets that may need to diversify some of their holdings. Subject to holding-period requirements, a percentage of those gains can even be permanently eliminated, leaving the investor with a reduced tax bill until the sale of their interest or until Dec. 31, 2026. The largest potential benefit however, is that if an investor puts funds into a QOF that provides returns several multiples larger than their original capital gain contribution, they are effectively able to receive any appreciation following the 10-year hold period without paying any taxes at the disposition of the QOF.

Finally, the design of the QOF is created in a way that it benefits areas that would otherwise be overlooked for investment. Increasing development in these areas can lead to additional municipal tax revenue down the line. This benefits local government and educational programs, as well as potentially increasing property values within the designated area. The societal impact, while currently a projection, could be significant and bring major change for many regions throughout the country.

Considerations

Because investing in a QOF comes with serious limitations, it must be analyzed on a per-person basis. First, the holding period requirements are not insignificant. There is an opportunity cost to be considered as the funds are effectively locked into the investment, not only to defer gains, but may be a requirement by the fund manager. Simply recognizing capital gains over time, then reinvesting those proceeds into other markets, may yield an equal if not better return for some investors.

Second, simply because the TCJA allows for federal tax deferral and potential elimination of capital gains, doesn’t mean it will be permitted at the state level. Individuals will need to determine how their personal tax situation may leave them susceptible to taxes at the time of sale of their original appreciated investment.

Third, as previously noted, the deferral of capital gains from the original investment can be reduced if held for the required period, but they will be subject to recognition to some degree if the investor exits their investment in the QOF or on Dec. 31, 2026, whichever occurs first. While the investor may not recognize capital gains for subsequent gains on their investment in the QOF, if the investment in a low growth or economically stagnant area doesn’t work out, the avoidance of capital gains will be meaningless as there won’t be any capital gains to be had.

Finally, given that a QOF is a brand-new, never before implemented investment with a multitude of requirements at both the individual level as well as for the fund manager (that are not even addressed in this article due to their complexity) to ensure compliance with the tax code, investment into one of these funds should not be taken lightly. Having a wealth advisor or attorney that can analyze an individual investor’s specific situation and determine if a QOF is right for them is essential to successfully meeting the requirements under the tax code, ensuring it’s a good overall fit for the individual and to, ideally, provide a positive return for the investor.

Examples

To best illustrate some of the ramifications of investing in a QOF, below are five examples of investing in a QOF and the resulting outcomes that could potentially occur.

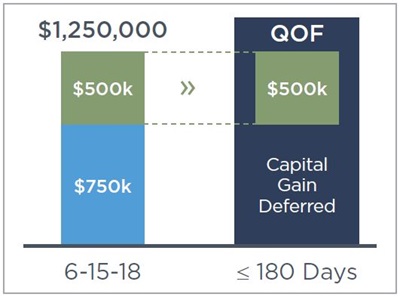

EXAMPLE 1:

On June 15, 2018, Taxpayer sells stock with a basis of $750,000 for $1,250,000 creating a long-term capital gain of $500,000. Taxpayer invests $500,000 in a Qualified Opportunity Fund via a Qualified Opportunity Zone partnership interest within the 180-day period. Recognition of the capital gain is deferred until a recognition event occurs.

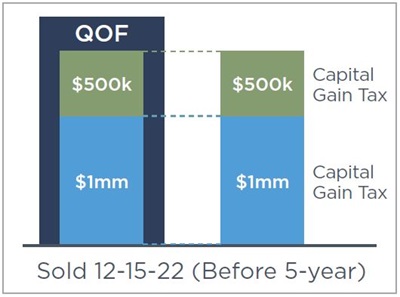

EXAMPLE 2:

Assume Taxpayer sells their entire investment in QOF for $1,500,000 on Dec. 15, 2022. The sale of the QOF occurs before the end of the five-year holding period. The deferral of the original gain would end and the entire $500,000 would be recognized. Further, the gain from the sale of the QOF would be recognized and an additional $1,000,000 long-term capital gain would be recognized.

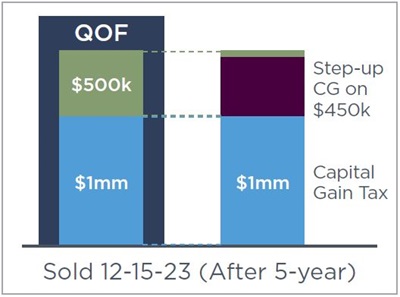

EXAMPLE 3:

Assume the same facts as Example 2, except the sale of the interest in the QOF occurs on Dec. 15, 2023 (i.e. after the five-year holding period requirement is met). The deferral of the original gain would end. However, a special basis adjustment allows for a “step-up” in basis of the investment such that the recognized gain is only 90 percent of the originally deferred gain, or $450,000 would be recognized. The gain from the sale of the QOF would be recognized and an additional $1,000,000 long-term capital gain would be recognized.

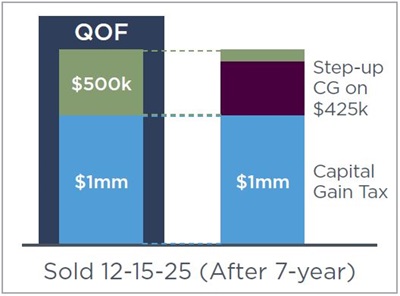

EXAMPLE 4:

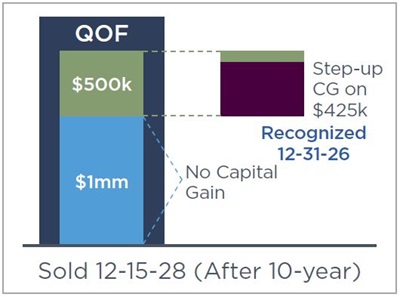

Assume the same facts as Example 2 except that the sale of the interest in the QOF occurs on Dec. 15, 2025 (i.e. after the seven-year holding period requirement is met). The deferral of the original gain would end. However, a special basis adjustment allows for a “step-up” in basis of the investment such that the recognized gain is only 85 percent of the originally deferred gain, or $425,000 would be recognized. The gain from the sale of the QOF would be recognized and an additional $1,000,000 long-term capital gain would be recognized.

EXAMPLE 5:

Assume the same facts as Example 2 except that the sale of the interest in the QOF occurs on Dec. 15, 2028 (i.e. after the 10-year holding period requirement is met). The deferral of the original gain would end on Dec. 31, 2026. However, a special basis adjustment allows for a “step-up” in basis of the investment such that the recognized gain is only 85 percent of the originally deferred gain, or $425,000 would be recognized. This gain would be recognized in 2026 even though no actual disposal occurred in 2026. Taxpayer may elect to have the basis of the investment in the QOF equal the fair market value at the date of sale such that no capital gain would be recognized.

Conclusion

Opportunity zones and their resulting Qualified Opportunity Funds are undoubtedly the most talked-about investment product in the last few months, due largely to their innovative approach in bringing growth to areas that otherwise might not be appealing to outside investors. The potential tax benefits to investors are largely unmatched by other investment vehicles, but they are not without their drawbacks.

Investment into these funds will present challenges in not only selecting which fund to utilize, but also in ensuring due diligence is adequately performed for compliance with the tax code and that the proposed investment will provide a return that outperforms the opportunity cost of investment alternatives. Ultimately, utilizing a wealth advisor or experienced real estate attorney as a guide through these types of transactions could prove invaluable to ensuring that many of these items are addressed prior to investment.

1 Bertoni, Steve. “An Unlikely Group of Billionaires And Politicians Has Created The Most Unbelievable Tax Break Ever”. Forbes, Aug., 21, 2018.

2 26 U.S. Code § 1400Z-2

Services provided by Mariner Trust Company, an affiliate of Mariner Wealth Advisors.

This document is for informational use only. Nothing in this publication is intended to constitute legal, tax, or investment advice. There is no guarantee that any claims made will come to pass. The information contained herein has been obtained from sources believed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information. Consult a financial, tax or legal professional for specific information related to your own situation.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.