The November market pause just might set the table for a profitable 2026

Read time: 6 minutes

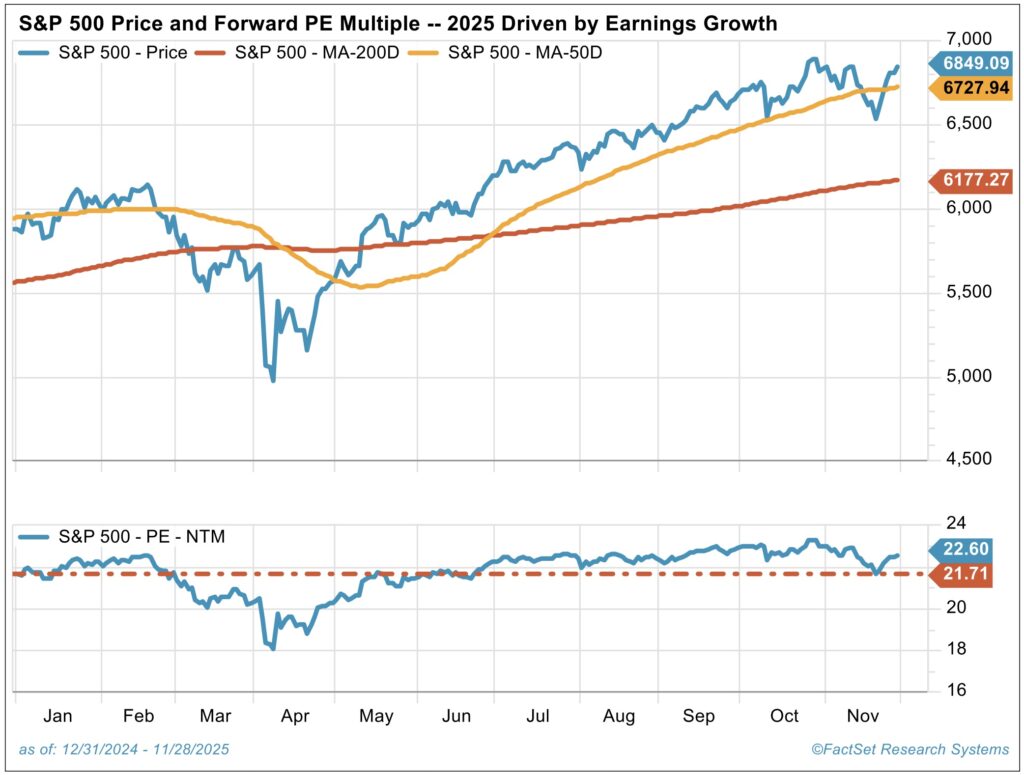

The S&P 500 finished November up 0.2%, bringing year to date returns to 17.8% through month end. A flat month on the surface doesn’t quite capture the experience investors lived through, as it took a late-month rally to pull the index back to where it started.

Beneath the headline number, some of the year’s high-flying stocks came back down to earth, reflecting a modest rotation under the surface during the pullback.

While these week-to-week gyrations make for lively dinner-table conversations, in the broader context of market history and our outlook, November looked very much like a normal month in a healthy market.

In fact, we’re thankful the market decided to take a breather here. We began the year with a 6,600 price target for the S&P 500 and noted that 7,000 was achievable sometime by mid-2026. The index ended November at 6,849, and we’d be perfectly content if it finished the year somewhere around these levels. Frankly, we’d prefer it, as it sets a more constructive stage for the year ahead.

Despite the recent handwringing about valuations, the S&P 500’s price-to-earnings (P/E) ratio sits almost exactly where it did to start the year, up only about one multiple point. That means the bulk of this year’s market advance has been driven not by exuberance, but by earnings growth. In our view, that’s precisely the kind of year we like to see.

Source: FactSet

A clearer picture emerges post–shutdown

Now that the government shutdown has ended, we, along with the Federal Reserve, finally have a fuller set of data to assess the state of the U.S. economy.

On balance, the picture still looks pretty good. Gross domestic product (GDP) growth remains robust, even as the labor market continues to look uninspiring. Inflation, while slightly elevated, is manageable and running below 3%, comfortably off its highs and trending in the right direction.

Market positioning reflects that improvement. The market-implied odds of a December rate cut have climbed to north of 80%1, even as Fed Chair Jerome Powell has reminded investors that a December move is far from a foregone conclusion.

That divergence between Fed rhetoric and market pricing isn’t unusual at this stage in the cycle, but it does underscore how investors are interpreting the data: softer, but not soft enough to derail growth.

Where we have the least ambiguity is in corporate America’s performance. Earnings look excellent, and they remain the foundation of this year’s strong market gains. So far, 83% of S&P 500 companies have reported a positive earnings per share (EPS) surprise for Q3 2025, with earnings growth of 13.4%2. Pretty good indeed, particularly in a year marked by policy uncertainty, geopolitical noise and periodic market indigestion.

Blend it all together and you get a compelling backdrop: strong earnings growth, a stable economy and a Federal Reserve increasingly biased toward accommodation. In our view, that mix supports a continued constructive stance as we head into year end.

We continue to embrace our “clear air turbulence” theme. From a technical standpoint, the recent rotation has actually been healthy. Both the S&P 500 Equal Weight Index and the Russell 2000 closed the month at new highs, signaling a broader and more balanced market than we saw just a few weeks ago.

That said, some caution is still warranted. Valuations remain elevated, parts of the labor market and consumer sentiment are showing signs of deterioration and there is always the potential for a surprise on the capital spending front.

Offsetting those risks, however, are several meaningful tailwinds: robust earnings, a more accommodative Fed and the prospect of significant tax refunds that could bolster consumer spending.

Looking ahead: The year of risk awareness and diversification 2.0

It’s natural to start looking ahead as we approach year-end, and 2026 is shaping up to be what we’re calling the “year of risk awareness and diversification 2.0.” While our year-end 2026 targets aren’t set in stone, it’s safe to say we remain constructive on U.S. equities.

That said, U.S. large caps are no longer the only game in town. Investors should be increasingly aware of what they own, and how much, as leadership broadens and new opportunities emerge across regions, styles and market caps.

We’ll expand on these themes in detail during our Crystal Ball outlook in January, where we’ll outline our updated base case, key risks and the opportunities we believe will matter most in the new year.

Sources:

1https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

2FactSet Earnings Insight

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Fixed-income securities are subject to loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors before investing. Interest rates and bond prices tend to move in opposite directions. When interest rates fall, bond prices typically rise, and conversely, when interest rates rise, bond prices typically fall.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Indexes referenced are unmanaged and cannot be directly invested in. For index definitions visit https://www.marinerwealthadvisors.com/index-definitions/

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.