Soft Landing Highly Probable Despite Above-Normal Recession Risk

Read time: 12 minutes

It’s that time of the year when it is appropriate to look forward to the next year by looking into our “crystal ball” and making some assumptions about the upcoming economic environment.

As always, there are many possible scenarios and variables that we consider, and coming up with just one outcome is not the way to handle this difficult and complex discussion. Consequently, it is appropriate to bring forward the most probable outcomes for the economy in 2024 as we say goodbye to 2023. The sun is setting on our current year, so I thought it appropriate to include a picture of an Arizona sunset, taken from my backyard (the little white object is my Shih Tzu, Charlie).

2023 in Review

First, we need to set the stage by discussing what happened in 2023 and assign a grade to our forecast for 2023.

The Good and Bad – First, the Bad

We entered 2023 suggesting that economic growth was at risk of entering a recession primarily due to ever-tightening monetary policies, which the Federal Reserve had shifted toward during 2022 in an effort to curb rising inflationary pressures.

Our belief in a heightened level of recession risk was due to our studies of historical data that showed, rather convincingly, when the Fed entered a monetary tightening cycle (raising interest rates), a recession has tended to occur. Historically reliable data from the Conference Board regarding the momentum of the leading economic indicators also suggested the risk of the economy falling into a light, quick downturn was higher than normal.

Staying true to our disciplines, we outlined our view that the probability of economic growth experiencing a quick, light recession was higher than normal. We stayed with this concern until late in the summer when we changed our view that the economy wasn’t going to fall into a recession in 2023, as the labor market remained in a very robust, positive stance.

Coming Out of a Pandemic, Distortions Abounded

Why didn’t we see a recession in 2023 when our historically reliable models were telling us that a recession may occur? To refresh, the Fed started its rate increase process due to rightfully placed concerns about unacceptable inflation pressure, which initially was irritated by supply chain disruptions due to the pandemic-related economic shutdown.

The government distributed upward of $4.3 trillion to the economy in 2020 and 2021 in the form of checks, credits and spending programs in an effort to restart economic growth.1 This level of government stimulus was massive in an economy that, at the time, was generating about $21 trillion in gross domestic product (GDP).2

Within this fiscal stimulus, most taxpayers received three rounds of cash (CARES Act of 2020, Consolidated Appropriations Act, 2021 and the American Rescue Plan Act of 2021). Remember that the pandemic-related lockdown started in March 2020 and ended in August 2020.3 Two of the government payments occurred after the lockdown was over when the economic recovery was already occurring. Arguably, government largesse in 2021 to 2022 spurred consumer demand for goods and services while supply chains for many of these items were clogged due to the global nature of the pandemic. When marginal demand increases more rapidly than marginal supply, prices tend to rise. Inflation soared.

Enter the Fed, as it started raising rates to fight high inflation pressure in March of 2022 and continued that process through July of 2023, a process that brought the federal funds rate up to 5.25%.4 The Fed’s newly found tight policies contrasted sharply with monetary policies employed during the pandemic, as quantitative easing (QE) took center stage at the Fed during 2021 and into 2022.

QE policies centered on the Fed buying massive amounts of U.S. Treasury debt obligations, effectively underwriting the government’s major spending programs to spur overall economic growth. Dubbed Modern Monetary Theory (MMT), these policies smacked of pie-in-the-sky policies where, as opposed to the monetarism school of economic thought, extreme levels of money supply growth have no real negative effects—again, inflation. The pie-in-the-sky crew learned that Milton Friedman’s monetary quantity models hold water, after all.

Over the 16-month period (March 2022 to July 2023), short-term interest rates increased the most since the early 1980s5 as the Fed fought inflation pressures. The Fed was attempting to do so without throwing the economy into outright contraction.

In hindsight, the pandemic created major distortions both during and after the economic lockdown. The level of stimulus from the government in 2021 and 2022 saved the economy from recession in 2023 but spurred inflationary pressure. As economist Thomas Sowell once said, “There are no solutions. There are only trade-offs.” Our 2023 growth outlook proved to be too conservative, but our outlook for a reduction in inflation pressure proved to be correct.

Economic Soft Landing Seems Probable

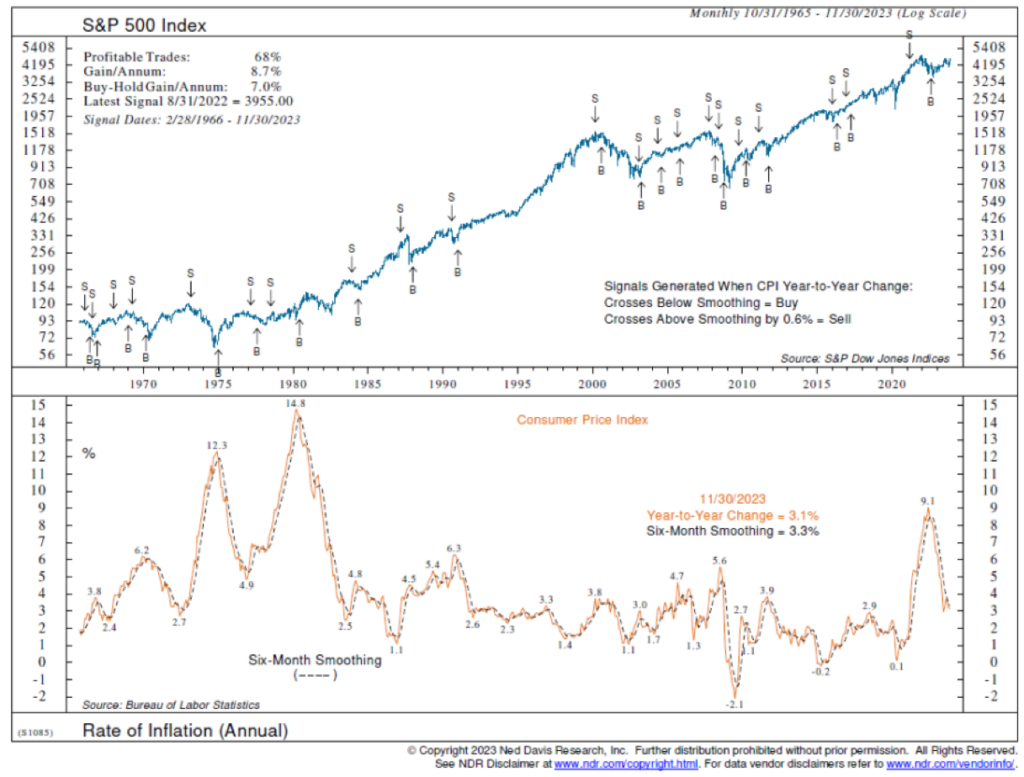

In early 2023, we made the call that inflation should subside in 2023 to 3% to 4%. Currently, inflation is running at 3.1% year over year, down from 7.1% the year before.6 We suggested the Fed was going to be successful in its drive to bring inflation down rapidly. However, as noted before, we also made the call that the risk of the economy falling into a recession was higher than normal.

We also suggested the next-highest probable outcome for economic growth in 2023 was a soft landing where inflation would recede, but the economy would stay out of recession with GDP growth remaining positive throughout the year. We assigned a high probability that the economy would escape a recession and that an economic and a growth soft landing may occur in 2023. So far, that is what we have seen. While our heightened probability of a recession didn’t pan out, the rest of our outlook was reasonably accurate.

2024 Growth Outlook

So what do we think the U.S. economy may have in store for 2024? Below are bullet points that highlight our thoughts for the upcoming year.

- GDP growth should slow slightly from this year’s 2.5%+ growth rate7 to 1.5% to 2.0%.

- Growth in general appears to be cooling. The 5%+ annual growth rate8 witnessed in the third quarter of 2023 contains factors that are probably not repeatable (e.g., inventory build levels and government spending).

- Consumers’ liquidity holdings (savings balances, stated as a percent of disposable income) have fallen from above 20% in 2020 to 4% as of November 2023—below the pre-pandemic average of 6.2%.9

- As savings are depleted, consumers rely on earned income or increasing debt to fuel consumption. The labor market appears to be slowly softening. Continuing unemployment claims are rising. The rolling four-week average of continuing unemployment claims has risen by 10.5% over the last three months.Additionally, the unemployment rate has risen by 0.4% from the trough seen earlier in 2023.10

- Consumers’ use of revolving credit has risen by 9.3% over the last year, among the highest growth rates in this data over the last 20 years.11

- We suspect that lagged effects of the Fed’s rate increase cycle are yet to be fully felt in economic activity. While down from earlier highs, mortgage rates remain elevated as compared to recent averages. As of October 2023, housing starts have dropped by 4.2% over the last year.12

- Wage growth demands appear to be less frequent. We hear of fewer strikes or rumors of major labor shutdowns than was the case a year ago.

- Consumers’ attitudes (sentiment data) have weakened from the high, positive levels seen earlier in 2023. Continued concerns about inflation may be misplaced, but they are still present.

- All in all, we expect to see consumption growth rates cool—they should stay positive but cool from the growth rates we witnessed in 2023.

Regarding areas of economic activity that aren’t directly tied to consumption trends:

- The bite of higher interest rates has hit segments of the economy this past year (e.g., manufacturing, housing and small businesses) more so than others, and all three areas are skirting recession.

- Overseas, major European economies are close to recession. China’s growth rate has slowed to the 3% range,13 historically a very anemic growth profile. U.S. companies may find business slow in 2024 if export growth is a major driver for them.

- Manufacturing has been in a downturn for much of 2023. The ISM Manufacturing Index has registered below 50 for much of the year, remaining mired in the mid-40s.

- The Conference Board’s index of leading indicators was down 7.6%14 year over year as of November 2023,suggesting economic softening is in the offing.

- With 2024 being a national election year, politicians will do what they can to forestall an economic downturn if one is actually in the cards.

- History tells us that incumbent presidents have tended to lose elections if the election comes on the heels of a recession. This occurred in 1960 (Kennedy winner), 1980 (Reagan winner), 1992 (Clinton winner), 2008 (Obama winner) and in 2020 (Biden winner). In all these cases, the incumbent’s party lost the White House. Obviously, politicians understand these trends. Don’t expect any real attempt to cool spending coming out of Washington in 2024.

Given all the current evidence, on balance, we are suggesting economic growth should cool to the 1.5% to 2.0% range for the year 2024, in total, down from the 2.8% rate we expected for 2023. Still a positive environment, but one that is “flying close to the ground.”

As such, the probability of a short, light recession hasn’t yet been eliminated. If a recession is in store, we suggest it should be rather mild, particularly in relation to recent past experiences. Recessions occur for reasons. Our heightened concern about a recession in 2023 was driven by high inflation rates and what would be needed to rid the economy of that problem. It appears the Fed may have walked a high wire in its efforts to reduce inflation and maintain positive growth in economic activity, a feat that in the past has seldom been accomplished.

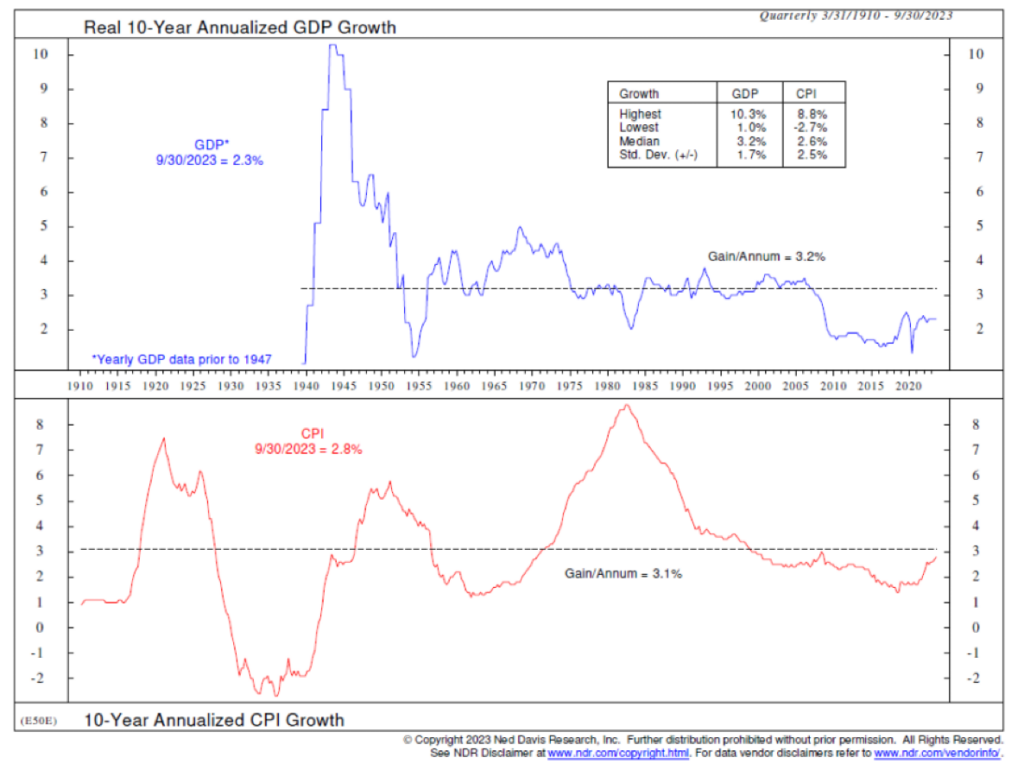

Touching on Inflation Trends (see chart below)

- We suggest that the Fed will lower short-term interest rates in 2024, in line with its “dot plot” current estimates. The Fed is expecting to lower rates by 0.75% in 2024.

- All popular measures of inflation (Consumer Price Index, Personal Consumption Expenditures Price Index) have, of course, fallen rather dramatically from earlier highs. Housing inflation remains elevated but is heading in the right direction. As 2024 unfolds, we expect to see inflation make another move to the downside as housing inflation cools.

- We are targeting 2% to 2.5% inflation (annualized) by the end of 2024.

With our growth outlook of 1.5% to 2.0% and our inflation expectation of 2.0% to 2.5%, we are left with an expectation of nominal GDP growth in the 3.5% to 4.5% range, down from 6.3% nominal GDP growth for the 12 months ending in September 2023.15 Interestingly, the average nominal GDP growth rate for the U.S. economy has been 4.7% annually since 1990.16 It appears to us that the U.S. economy should resume its longer-term averages regarding nominal GDP growth during 2024.

Conditions for a “Normal” Economy

From a micro-expectation perspective, if our economy is returning to a more normal environment following a period of highly abnormal growth and inflation pressures, then what should we expect to see?

- The Fed should start to lower short-term interest rates as inflation normalizes to the 2% to 2.5% range. We are suggesting federal funds rates may decline from the current 5.35% level to 4.0% by the end of 2024.

- The 10-year Treasury note has typically been priced at a 1.7% premium to inflation. With this historical spread in mind, if our inflation forecast is reasonable, then the 10-year Treasury note may trade in the 3.7% to 4.2% range for much of 2024.

- A steepening in the U.S. Treasury yield curve should occur, which is a positive indicator for future lending activity.

- 30-year fixed mortgage interest rates have normally been about 1% higher than the 10-year Treasury note yield. With this in mind, we are suggesting that 30-year mortgages may reach a low of 4.7% to 5.2% during 2024. The 30-year fixed rate mortgage rate was 7.0% as of Dec. 27, 2023.17

- Total corporate sales growth rates tend to be influenced by nominal GDP growth rates, which include unit volume growth (“real” GDP growth) and pricing (inflation). If our outlook of 3.5% to 4.5% nominal GDP growth is reasonable, it may be difficult for total corporate profit growth to exceed 7% in 2024. Historically, 7% profit growth rates have tended to go hand in hand with moderate-to-average sales growth rates of 3% to 4%.

Recession Risks Still Elevated

Going back to the 1940s, history tells us the Fed’s monetary actions affect the “real” economy with a time lag that has been long and variable. The Fed’s monetary tightening cycle was one of the most aggressive we have witnessed in many decades. The full impact of the Fed’s moves may still be in front of the economy. When the economy is growing at a lower-than trend, a shock of some sort could easily throw the economy into a recession. Time will tell.

Final Word

In summary, we are suggesting that economic growth should prove positive for all of 2024. While there may be periods of economic weakening, the economy should show overall growth. Inflation, like “real” growth rates, should continue to retreat for much of 2024. The Fed suspects this all to be the case as we enter a new year. It should eventually bring short-term interest rates down.

Fed Chair Jerome Powell may have walked the tightrope of slowing overall final demand growth rates without throwing the economy into a recession. By this time next year, we will probably know the full story.

Sources:

2St. Louis Federal Reserve

4Federal Reserve Press Release, July 26, 2023

5St. Louis Federal Reserve

6U.S. Bureau of Labor Statistics

7Federal Reserve Bank of Atlanta

9Bureau of Credit Analysis, 2011-2019 data

10St. Louis Federal Reserve, data as of 12/2/23

11Ned Davis Research

12HUD P&R National Housing Market Summary

13China Economic Quarterly

14The Conference Board, November 2023

16St. Louis Federal Reserve

The S&P 500 Index is unmanaged, does not incur management fees, costs, and expenses, and cannot be invested in directly.

Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

This commentary is for informational and educational purposes only and does not take into account any individual personal financial considerations. As such, the information contained herein is not intended to be personal investment advice or a solicitation to buy or sell any security or engage in a particular investment or financial strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on the information and sources of information deemed to be reliable, but we do not warrant the accuracy of the information that any opinion or forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions and forecasts expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Actual results may differ materially from those projected. Consult your financial professional before making any investment or financial related decision.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.