Reality vs. Perception: People Retire Earlier Than Planned

Read time: 5 minutes

Americans’ perception of the age at which they plan to retire often differs from their reality. Most will retire several years earlier than planned, which is why it makes sense to be proactive about saving for retirement.

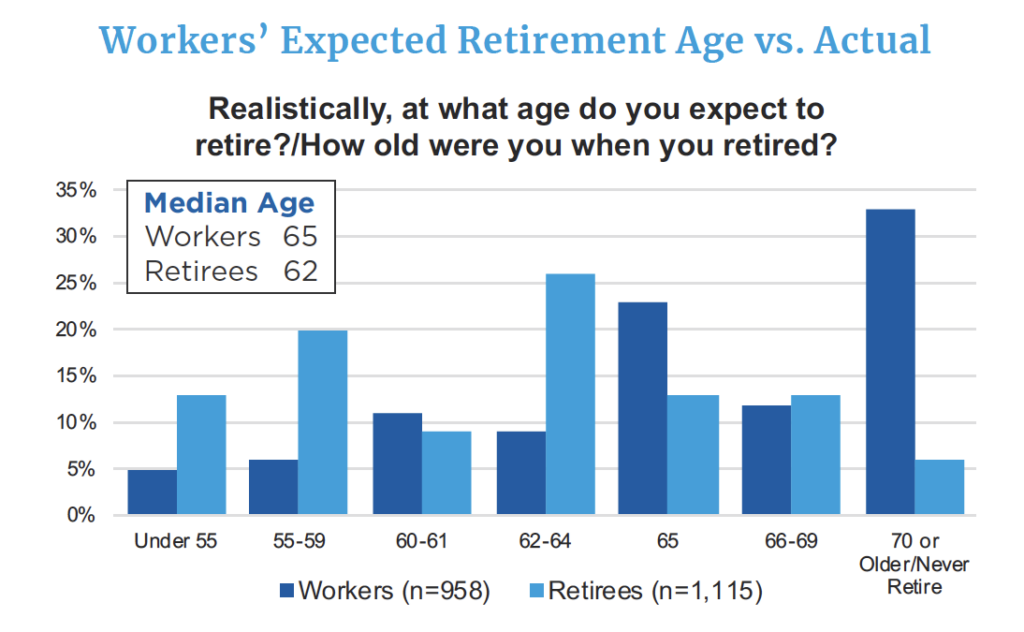

People Typically Retire at 62

The median worker expects to retire at age 65, according to a retirement confidence survey.1 The survey found, however, that retirees left the workforce at a median age of 62. While 33% of workers said they planned to retire at age 70 or later—or not at all—just 6% of retirees waited that long.

Figures and n-sizes presented exclude those who answered, “Don’t know,” said they never worked or refused to answer.

Source: Employee Benefit Research Institute and Greenwald Research, 2023 Retirement Confidence Survey

Early Retirement and Working in Retirement

While 11% of workers surveyed said they planned to retire before age 60, three times that number (33%) of retirees said they stopped working that early. Meanwhile, 73% of workers said they plan to work for pay in retirement, while just 30% of retirees reported that they’d done so.2

People retire early for all sorts of reasons. High earners may retire early because they can afford to, while others may leave the workforce and choose not to work in retirement due to a health challenge or disability.

Considerations About Longevity

A successful early retirement strategy hinges on you having enough income to last throughout your lifetime. First, start by estimating your life expectancy. No one can say for sure how long they’ll live, of course. As of 2023, life expectancy in the U.S. was 79.11 years.3 Your family’s health and longevity should also factor into your estimate.

Estimating Your Rate of Return

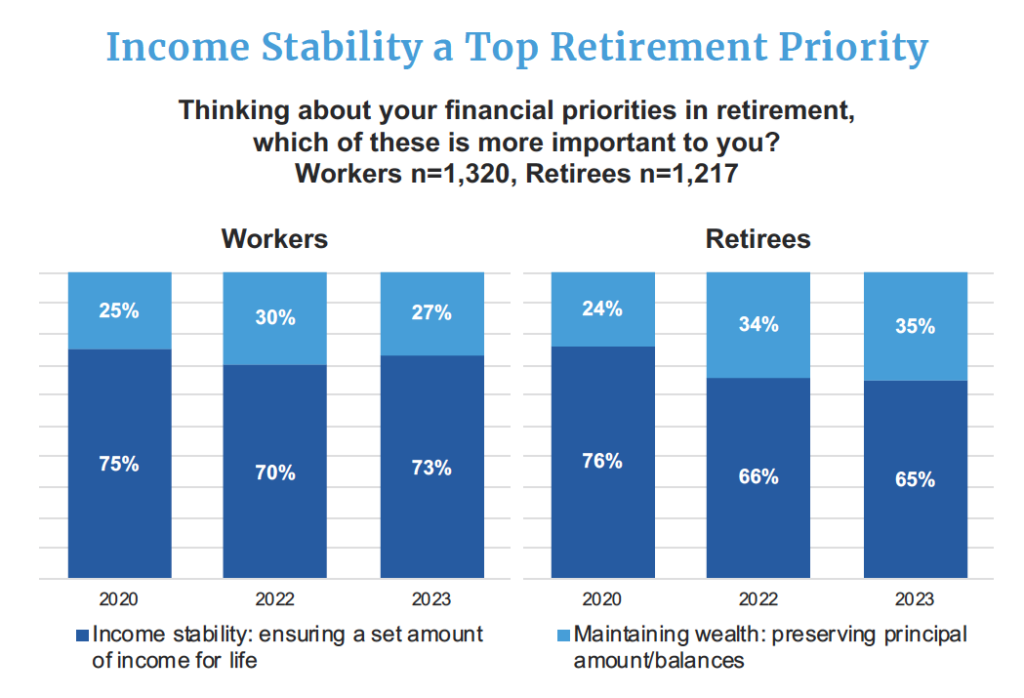

Appreciation from your assets should help you fight inflation as you build your retirement income. Calculating an estimated rate of return based on historical averages can give you an idea of how long your funds could potentially last throughout your lifetime. Market results will vary from year to year, of course. Your wealth advisor can run scenarios based on different hypothetical market conditions to estimate potential investment return. Your advisor can also work with you to build a cash flow plan based on your current expenses and expected sources of income in retirement. As the chart below illustrates, workers and retirees alike prioritize income stability in retirement.

Source: Employee Benefit Research Institute and Greenwald Research, 2023 Retirement Confidence Survey

Early Withdrawals From Certain Retirement Accounts

The earliest age you can generally withdraw money from a 401(k) or traditional IRA without incurring a 10% penalty is 59½, but there are exceptions. If you leave your company after age 55 and before age 59½, you may be able to tap your 401(k) penalty free. Another strategy for avoiding early withdrawal penalties from traditional IRAs and 401(k)s if your retirement plan allows it is to withdraw income in the form of substantially equal periodic payments (SEPP).4 Be sure to contact your employer or plan sponsor to determine whether this option is available to you. If it is, note that you must commit to a series of similar-sized withdrawals from your IRA or 401(k) at least once a year on a schedule that remains in place for at least five years or until you turn 59½, whichever is longer. Remember that distributions are still taxable under both strategies.

How Roth IRAs May Help

Owners of Roth IRAs may withdraw their contributions anytime. Because the accounts are funded with after-tax dollars, doing so does not trigger penalties or taxes. Be careful, though—you must wait at least five years to withdraw earnings penalty free.* In some cases, those who are planning to retire early may want to consider converting their traditional IRA into a Roth IRA. Doing so will trigger a tax bill in the year of the conversion, so it may make sense to wait until retirement, when you may be in a lower tax bracket. Roth IRAs also offer estate planning advantages, including tax-free wealth transfers to heirs.

Budget for Health Care Expenses

You can cover health care costs in retirement using balances accrued in an employer-sponsored health savings account (HSA). These accounts are portable, and retirees can use them to pay for eligible medical expenses. After age 65, the funds can be used to pay for anything you’d like; however, if funds are used for nonmedical purposes, those withdrawals will be subject to income tax. To have an HSA, you’ll need to pair it with a high-deductible health plan (HDHP).

Another way to pay for health care in retirement is by purchasing a private insurance policy or by taking advantage of an employer-provided COBRA plan, assuming you meet the conditions to qualify for it. A common qualifying reason is voluntary or involuntary termination of employment. COBRA provides insurance for up to 18 months. If you’re married, being added to your spouse’s plan would also be an option for funding health care expenses.

Your Wealth Advisor Can Help

Your wealth team is here to help you map out a strategy for retiring with confidence, even if it ends up happening earlier than you expect.

Sources:

1,2“2023 RCS Fact Sheet: Expectations About Retirement”

3“Macrotrends, U.S. Life Expectancy 1950-2023”

4“Substantially Equal Periodic Payments”

*A distribution from a Roth IRA is tax free and penalty free, provided the five-year aging requirement has been satisfied and one of the following conditions is met: age 59½, disability, qualified first-time home purchase or death.

This article is intended for informational and educational purposes only. The views expressed do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal investment or tax advice or a solicitation to engage in a particular investment or tax strategy. Any opinions contained herein are based on sources of information deemed reliable, but we do not warrant the accuracy of the information. Please consult your tax and financial professional before making any tax, investment or financial-related decisions. Investing involves risk, including the potential loss of principal.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.