Pressures Weighing on Taming Inflation

Inflation pressures are abating. All are aware of this, at least from a macro perspective. In June 2022, the “all-in” Consumer Price Index (CPI) peaked at a revised 8.9% over the preceding year. The latest data on the CPI in January was 6.3%, down nicely from the 8.9% noted seven months earlier.

The Fed’s actions are taking hold, driving inflation downward as the supply/demand gap that had widened over the previous year appears to have narrowed. At least that is what many contend to be the case, and I suggest this has occurred.

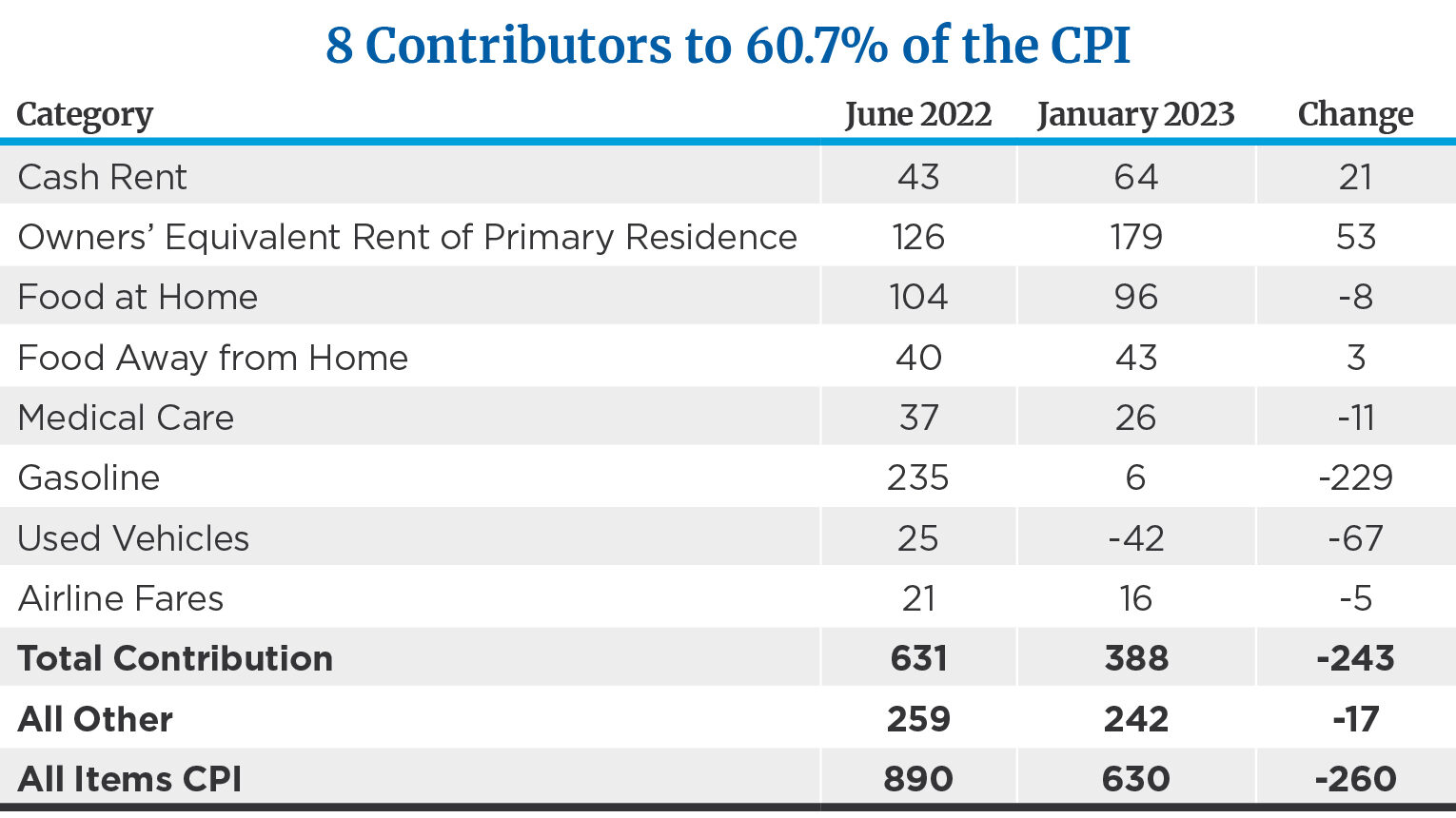

Digging into the numbers on the CPI also reveals that most of the improvement in the lowering of inflation is due to two factors: gasoline and used car prices. Of the 260-basis-point improvement we have seen in the inflation data since last June, a net 298 basis points came from a lowering of gas and used car prices. Cash rent and OERPR (owner equivalent rent of primary residence) both added 74 basis points over the seven-month measurement period.

The adjustments to housing costs tend to rise/fall with a lag. The five contributors to a lowering of inflation have been gasoline, used vehicle prices, airline fares (I don’t believe this to be accurate), medical care and food at home (this must exclude egg prices).

Source: NoSpin Forecast

The weights of the 8 items in the detail add to 60.7% of the CPI. Total changes do not sum to change in total because of separate rounding.

The argument of the future inflation track is a big deal, for businesses and consumers and investors. Most in the investment business fully understand the historical negative correlation between stock market P/E (price/earnings) ratios and interest rates. Most also understand the strong positive correlation between interest rates and inflation. The higher the inflation rate (and expected inflation rate), the lower P/E ratios become. It all has to do with the discounting mechanism that investors place on and embed in stock prices.

Inflation Pressures Starting to Broaden?

While we have seen irrefutable improvements in the rate of inflation—be it “headline” or “core,” be it CPI or Personal Consumption Expenditures (PCE)—we have also started to see signs that inflation pressures are starting to spread into gains in workers’ wages. Some argue that as workers’ wages rise, living standards rise as well. Looked at in this fashion, rising wages aren’t such a bad thing. This is true, unless worker productivity gains don’t match the wage increase. In this case, prices for goods and services rise as businesses are forced to either “eat” the costs of rising wages by lowering profit margins (which theoretically hurts stock prices) or by raising prices for the goods/services to the public, fueling further rounds of inflation on a macro scale.

So, the first question to ask is are wage rates rising? The quick answer to that question is yes. Wage growth, as shown in the chart below from The Economist magazine, has been about 4.5% in the U.S., while labor productivity gains over the same period have been a little less than 1.5%. That “spread” between growth in labor costs and productivity growth is helping drive businesses to raise prices for many goods and services, leading to a potential dreaded “cost/push” inflation cycle and away from the dominant “demand/pull” pressures that occurred from 2021 through early 2022.

Remember the time when there was a broad microchip shortage, driving costs of many items from computers to used cars upward? Today’s inflation pressure isn’t being primarily driven by dislocation in supply chains—it is being driven by rising wage growth, which is a result of the “tight” labor market. Remember, unemployment is the lowest in the U.S. since 1969, the year when the classic inflation cycle started, which carried into the 1970s and was driven by the wage/price spiral.

I’m not proposing that we are heading back to the days of double-digit inflation. Far from it. In those days, the Federal Reserve made mistakes by anticipating a downward turn in inflation by loosening money supplies prematurely, only to see inflation come roaring back. It appears that the current Fed has learned its history lessons and won’t squander gains made in the current inflation fight.

I believe the risk of a cost/push inflation cycle is real but will probably not pan out, at least over the longer term. Why? Fed policies of raising interest rates, taken further than today, would risk pushing the economy into recession—a deeper recession than even I think is currently likely. With economic downturns come rising unemployment rates and a lessening of labor wage gains.

Why 2% Targeted Inflation?

Fed Chairman Jerome Powell has reiterated his goal of 2% inflation. To drive final demand growth downward with rising interest rates is the main tool the Fed has, of course, been using to reach this goal.

I was recently asked to make a presentation in Kansas City to a group of CFA Charterholders (a fraternity to which I belong), covering my economic outlook. I was asked the question, “Why does the Fed think inflation needs to be 2%?” I was immediately stumped by this question—why 2%?

From a historical perspective, since 1982, inflation has risen by an average of 2.8% annually, a little above the Fed’s goal of 2%. The 10-year U.S. Treasury note has yielded, on average, 2.46% above inflation1 over this same time period. Given this data, the central tendency of the 10-year U.S. yield has been 5.29%, well above the current yield of 3.95%. If we apply the trailing 12-month CPI rate of change and add the historical average “real” yield of 2.46%, it leaves us with the frightening thought that the “normal” yield on the 10-year Treasury today would be 8.76% (2.46% “real” yield and 6.3% inflation)!

Of course, yields aren’t at that level, nor will they be for quite some time. But this exercise gives us a view of how low yields still are in relation to historical norms.

With this background, and given the size and growth of the U.S. government’s deficit expenditure, we start to understand why Chairman Powell wishes to drive inflation down to the 2% mark, lower than the longer-term average.

Heavy Lifting: How to Go From 6% to 2% Inflation

Some would say that the easy part of the inflation fix is probably behind us. Supply chain bottlenecks have reportedly been pretty much fixed on a global scale. So, the initial inflation drivers that led to a demand/pull inflation rise have been addressed. Now comes the heavy lifting.

To cool a red-hot labor market, the U.S. economy needs to cool. GDP growth will probably need to recede for the Fed to meet its 2% inflation target. Most forecasters and economists now believe growth will cool as 2023 continues to unfold. The question I am being asked along these lines is, “Will the economy experience an outright recession this year?”

I don’t know the answer to that question. Our disciplined model-driven work tells me that the probability of the Fed making a policy error (too tight, too long) is much higher than normal. Both the shape of the yield curve and the six-month rate of change of the leading economic indicators are suggesting a recession will probably unfold sometime over the next year or so. At least that is the risk.

The Pause That Refreshes

But fear not—all is not lost. While economic growth may be volatile going forward, I have been forecasting that the full-year 2023 will see GDP growth of 0%-2% (central tendency around 1%) and consumer prices will reach 3%-4% by the end of the year (now at 6.3%). What is needed for this happy outcome to occur? A contraction in final demand and with it a rise in the unemployment rate, bringing a cooling breeze to the labor market.

If we see something else—a sticky labor market accompanied by 4%+ wage growth—then I fear the Fed will remain tight in its policies. Taken to a reasonable level, this may push the U.S. economy into a deeper-than-needed recession, and the happy outcome noted above may indeed not occur. The key here is labor costs and the unemployment rate. I have forecasted that the unemployment rate will reach 5% by the end of the year, up from the 3.4% range.

Some say that the prospect of a rise in unemployment to that level won’t happen unless we see a deep recession. Remember, the average unemployment rate in the U.S. has been 6.1% over the last 40 years2. A rise to 5% shouldn’t cause great consternation but may provide the needed medicine to the economy to avoid a continuing cost/push inflation spiral.

Last Word

I remain constructive on my economic outlook for the U.S. economy this year. Could we see a recession unfold? Yes, it is my core view. Could the Fed be so skillful in its execution of slowing economic growth by bringing the economy into a soft landing? It’s possible but, based on the Fed’s previous track record of monetary tightening periods, unlikely.

Is it possible that the economy experiences a “no-landing” scenario in which growth remains stunted and inflation remains stubbornly above the Fed’s 2% goal? Yes, this is possible, but frankly a no-landing scenario may indeed prove to be the worst probable outcome we could rationally experience. I fear under this scenario, the Fed remains tight (even tightening more than most currently anticipate), driving the economy into a rather deep recession.

It makes sense for investors to give the Fed some breathing room here. I think the Fed will react not only to inflation reports but also to reports regarding the labor market condition. I continue to think disinflation (lowering of inflation rates) will occur for the remainder of this year, but we appear to have entered the heavy lifting season.

Sources:

1,2 St. Louis Federal Reserve

This commentary is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on the information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information that any opinion or forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Investing involves risk and the potential to lose principal. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.