Maximizing your Qualified Business Income Deduction

Have you heard about the 20 percent income tax deduction on “qualified business income (QBI)” and wonder if it applies to you?

Many owners of sole proprietorships, partnerships, S corporations and some trusts and estates may be eligible for a qualified business income (QBI) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income (QBI), plus 20 percent of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income, according to the IRS.1

Defining QBI

QBI is the lesser of 20 percent of: the taxpayer’s QBI, plus 20 percent of the taxpayer’s qualified REIT dividends and qualified publicly traded partnership (PTP) income; or 20 percent of the taxpayer’s taxable income (wages, interest, capital gains, etc.) minus net capital gain.2

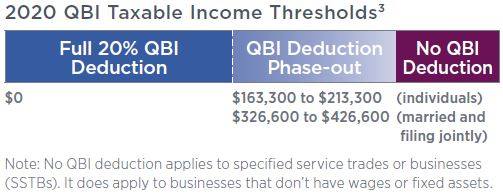

QBI Phase Out Based on Income Levels

Certain individuals and couples don’t qualify for a full QBI deduction if their taxable income exceeds the threshold amount, which is $163,300 for individuals and $326,600 for married couples as of 2020. They could consider using tax planning strategies that bring taxable income to a level below the thresholds to qualify for the maximum deduction.3 The illustration below illustrates the levels at which the phase-out kicks in and at what level the deduction is completely phased-out.

Planning Strategies if Your Income is above Phase-Out Limits

For those households that are over the limits, here are some effective strategies to consider that could potentially qualify a household for the full QBI deduction:

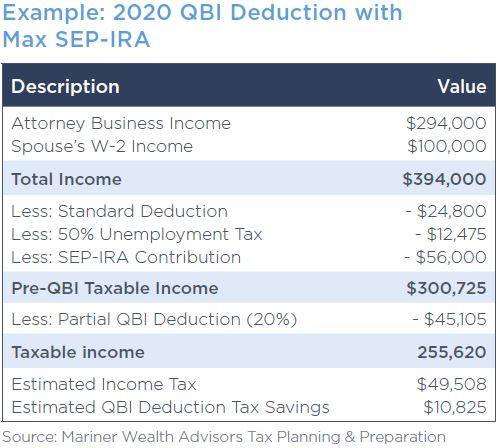

If maximizing a SEP-IRA still doesn’t lower your taxable income far enough to receive a full 20 percent QBI deduction, there are several other strategies you can use in conjunction with the SEP IRA contribution.

Health Savings Account (HSA) Contributions

If you have a high-deductible health insurance plan, you can make a pre-tax contribution to a Health Savings Account (an HSA) for up to $3,550 for an individual plan or $7,100 for a family plan in 2020. An extra $1,000 is available, if you are age 55 or older.4

Lumping Charitable Giving Contributions

Lumping several years of future expected charitable giving contributions into the current year can be an advantage, especially if it pushes you over the standard deduction limit and allows you to reap the tax benefits of itemizing a large charitable gift. You can do this by contributing directly to a charity or through a donor-advised-fund (DAF).

Managing your Income and Expenses

If you have some control over the timing of your business income, you might consider waiting to take on that next project until the next year to keep your income level below the threshold. The same is true for expenses. You might accelerate the payment of some expenses to the current year to reduce your income level.

Specified Service Trade or Businesses (SSTBs)

The following trades or businesses are considered SSTBs and are not eligible for a QBI:

Health care, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, investing, investment management, trading and any trade or business where the principal asset is the reputation or skill of one or more of its employees.2

QBI: Potential for Tax Savings

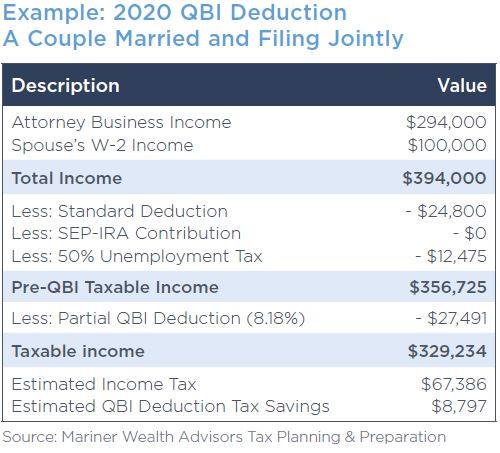

The QBI deduction presents an attractive opportunity for eligible business owners to maximize their tax savings. Please note that the following adjustments could also affect QBI: SEP IRA contributions, half of the self-employment (SE) tax deduction and SE health insurance.

Consult With Your Advisor

The QBI deduction rules are complicated, so it’s a good idea to consult with your wealth advisor to evaluate which strategies may be the most effective for your financial situation.

1 “Qualified Business Income Deduction.”

2 IRS Qualified Business Income Deduction FAQs.

3 “Sec. 199A: Regulations Shed Light on QBI Deduction,” Journal of Accountancy.

4 “IRS Announces 2020 HSA Contribution Limits.”

The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. It is not intended to be personal legal or investment advice or a solicitation to buy or sell any security or engage in a particular investment strategy.

This is limited to the dissemination of general information pertaining to insurance. The information contained herein should not be construed as personalized insurance advice and should not be considered as a solicitation to buy or sell any security or engage in a particular investment strategy. There is no guarantee that the views and opinions expressed in this guide will come to pass.