Discover the Benefits of Establishing a 401(k) over a SEP or Simple IRA

A 401(k) plan not only offers higher contribution limits but provides more options to your business for managing costs and deductions, maximizing contributions and accessing funds penalty-free.

Manage Costs and Tax Deductions Better with a 401(k) Plan (vs. a SEP or SIMPLE IRA)

- While SEP and SIMPLE IRAs may be easier initially for plan sponsors to establish over 401(k) plans, there are clear gaps in the benefit of these plan types for both employers and employees.

- Compared to a SIMPLE IRA, a 401(k) plan provides higher contribution levels for all employees, especially owners and highly compensated employees.

- Compared to a SEP, a 401(k) plan provides for lower contribution costs for eligible employees, and owners can vary their contributions between themselves rather than having to put in the same contribution percentage.

Disadvantages of SEPs and SIMPLE IRAs

- SIMPLE IRAs restrict employee contribution limits and minimize the amount they can invest for retirement. They also require immediate vesting by you as the plan sponsor—this may run counter to your business goals and hinder your plan design flexibility.

- SEPs can only be funded by the employer, limit allocation flexibility, require immediate vesting and can be prohibitive from an investment and administrative standpoint for employees.

- Both plan types have significant early withdrawal penalties.

- Both SEPs and SIMPLE IRAs do not have any withdrawal restrictions for employees, which unfortunately, can cause these plans to be used as savings accounts for employees versus retirement accounts.

- Neither SEPs nor SIMPLE IRAs offer a loan provision, which causes employees to take taxable distributions with pre-retirement penalties.

401(k) Advantages Over SEP and SIMPLE IRAs

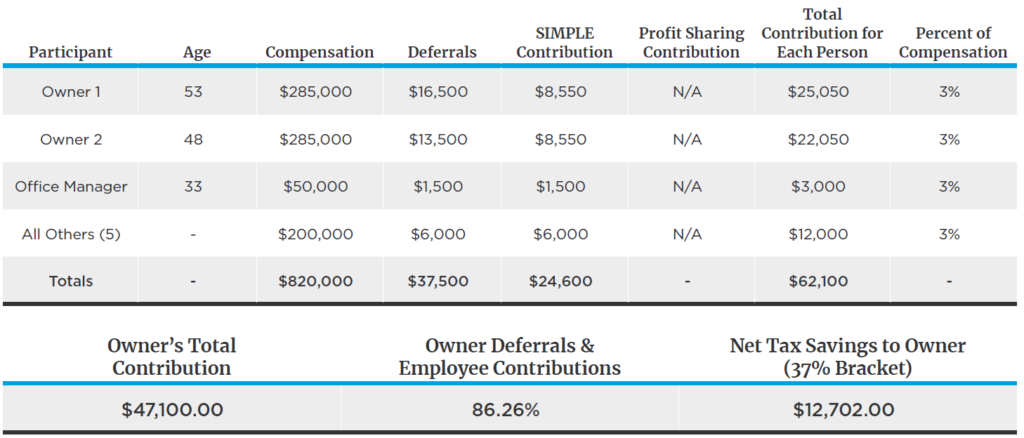

SIMPLE Illustration

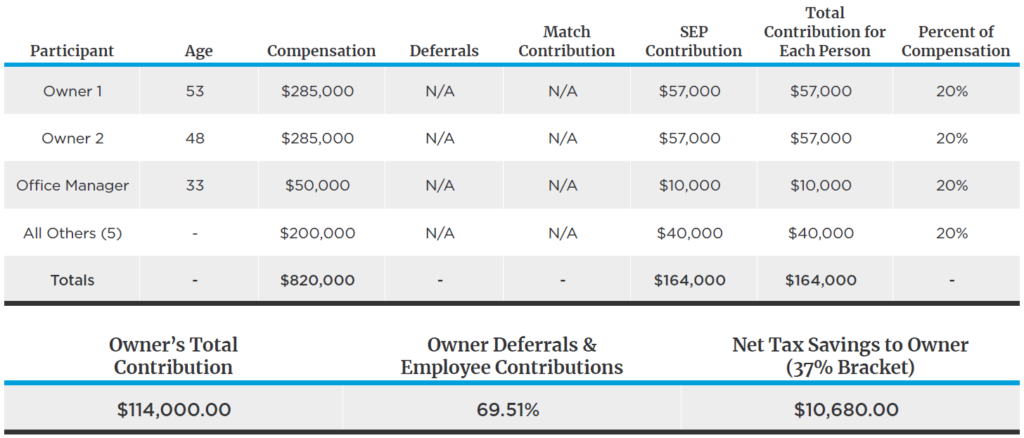

SEP Illustration

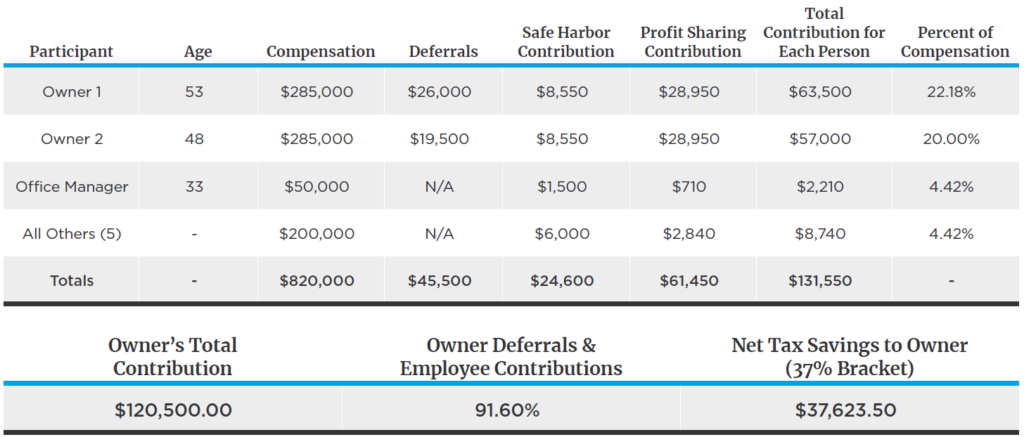

401(k) with Safe Harbor 3% NE & Cross-Tested Illustration

Inflation is lighting your money on fire at a record pace.

What investments can help battle inflation?

Download Inflation: Hedge Strategies to Combat its Effects to learn more.

Source: ERISA Services Midwest

The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. It is not intended to be personal legal or investment advice or a solicitation to buy or sell any security or engage in a particular investment strategy.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.