The Economic Impact of Rising Mortgage Rates

In April 2022, I provided an analysis of home purchase costs in relation to median national household income. In February 2022, 30-year fixed mortgage rates were in the 3.69%1 range and two months later climbed to 4.72%.2

As of the end of August 2023, the national average for a 30-year fixed mortgage was 7.53%.3 This rate is the highest we have seen in more than 20 years and is up from the all-time low of 2.65%4 reached in January 2021. The increase in mortgage rates is being reflected in the U.S. Treasury 10-year note yield of 4.23%,5 the highest interest rate that note has yielded since 2007 prior to the financial emergency and the deep recession of 2008 to 2010.

The median home price in the U.S. is now $416,000.6 The median family income in the U.S. is now $77,290.7 So, the average home price is now 5.4 times the median income. The historical average ratio of family income to home prices has been 3.6 times.8 Given these ratios, the average home is now priced at a 50% premium in relation to historical norms.

But most home buyers don’t really think of housing costs as the home price. People tend to think of housing costs and affordability of the mortgage payment and the ability to pay the mortgage as the key to buying or not buying a home, irrespective of the actual market value of the home.

For a purchaser of a home to qualify for a mortgage, one standard that the lending industry has used in the past is the need for the mortgage payment to be less than 28%9 of household income. As noted above, median household income is now a little over $77,00010 per year. At an interest rate of 7.09%,11 the median household in the U.S. can qualify for a mortgage payment of $1,796 per month. At the current mortgage interest rate, the median-income borrower would qualify for a mortgage of $265,000. With 20% down, the purchaser would probably qualify to purchase a home with a market price of $330,000.

As noted, the median home price in the U.S. is now $416,000.12 With interest rates as high as they have been in more than 20 years, the median family is now priced out of a median home purchase. To qualify for a mortgage at 7.09% and 20% down payment, the purchaser would need a household income level of $95,700, 24% above the current median household income level.

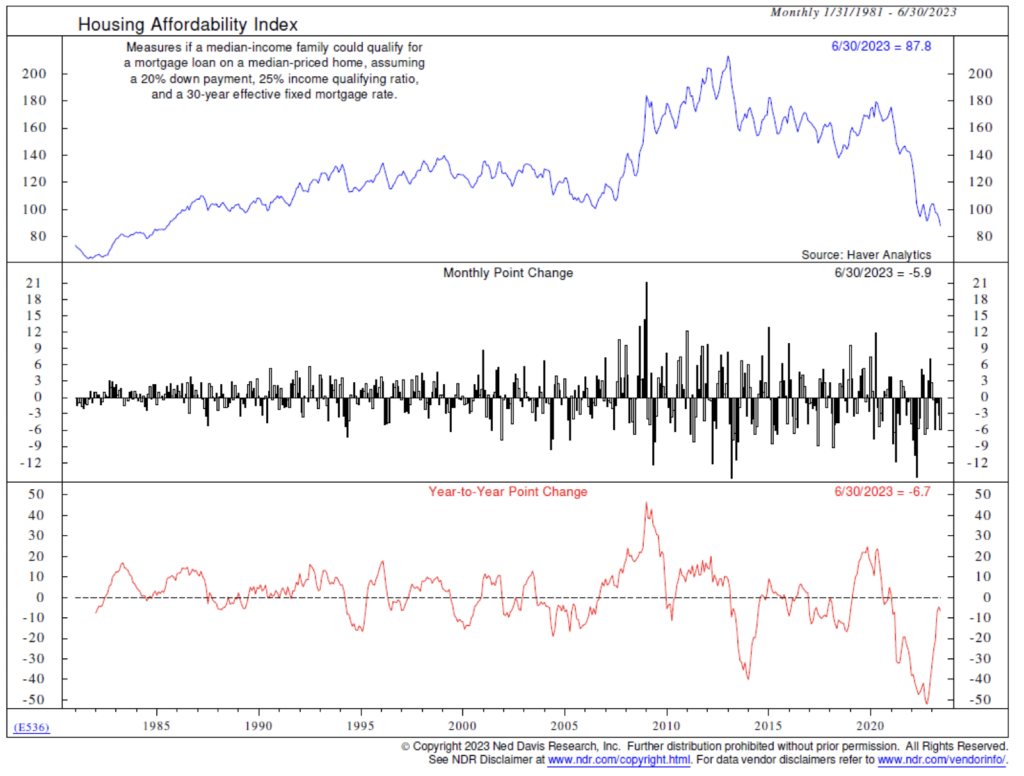

This chart illustrates current housing affordability.13 The top part of the chart shows Ned Davis Research’s Housing Affordability Index, which is lower now than at any time since the early 1980s. Rate of change data is indicated in the bottom part of the chart.

I suggest this scenario isn’t sustainable over the longer term. One of a number of consequences may occur:

- Interest rates come down to about 5% on long-term mortgages. If that happens, the median-income family would be able to qualify for the standard 30-year mortgage.

- Housing prices decline by 21% to $330,000 from $416,000. Of course, this would probably create a negative feedback loop on the consumer’s wealth effect and damage overall economic growth. The last time the nation saw this type of price decline was during the housing meltdown during the Great Recession.

- Purchasers may be able to place more than 20% down and afford more home. Initial buyers may be at a disadvantage in this arrangement, however, as many struggle to afford the 20% down payment.

- Home buyers lower their sights on the type, size and cost of home they are willing to buy from median to something less.

- Potential home buyers seek employment that pays higher income. Or they ask their current employer for a raise. Of course, taken in the macro, this would spur cost-push inflation to the upside.

Or more than likely, consumers delay purchasing a new home hoping that interest rates will decline by about 200 basis points. I fear that if rates were to pull back by that magnitude, the decline may coincide with an economic recession, and consumers’ willingness to move and take on a new financial commitment may be lessened.

What about alternative financing? 3/1 adjustable-rate mortgages are currently priced at 6.12%.14 As noted above, mortgage rates need to be close to 5% for the median household to afford the median home. While this is closer, it is still out of reach for many consumers.

Bottom line, the upward push in home values may stall because market prices have risen to a point where the median buyer is unable to make a purchase. This may not matter much for the economy over the shorter term, as most current homeowners with a mortgage are unwilling (or unable) to give up their 3% to 5% mortgage for a new, 7%+ rate, limiting the available supply of homes on the market.

Footnotes:

1,2 St. Louis Federal Reserve

6National Association of Realtors

7U.S. Census Bureau

8Ned Davis Research

9Chase Mortgage

10U.S. Census Bureau

11Federal National Mortgage Association, as reported in the Wall Street Journal, August 18, 2023

12National Association of Realtors

13Ned Davis Research

14Federal National Mortgage Association

This commentary is for informational and educational purposes only and is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on the information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information that any opinion or forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.