As Inflation Weakens, Rate Cuts Are in the Offing

Read time: 7 minutes

As a practicing economic/capital market commentator, I believe it is good to understand viewpoints that matter and those that are simply interesting. One viewpoint that matters is the view of the Federal Open Market Committee’s (FOMC) voting members. Those Federal Reserve Board members can change outcomes, not just pontificate as to what may happen, as is the case with yours truly.

As most know, I have been suggesting the U.S. economy will experience a growth slowdown—not a recession—this year. I have also been suggesting that inflation pressures will continue to recede this year, albeit at a slower pace than we have seen over the last two years. It has become apparent from the inflation data that the season of “heavy lifting” has been ongoing for the past number of months. The latest report shows the all-in Consumer Price Index at 3.3% over the last year following readings of 4.1% in May 2023 and 9.0% in June 2022.1 So, the progress of lower inflation pressure has been sticky.

Rate Cuts on the Horizon

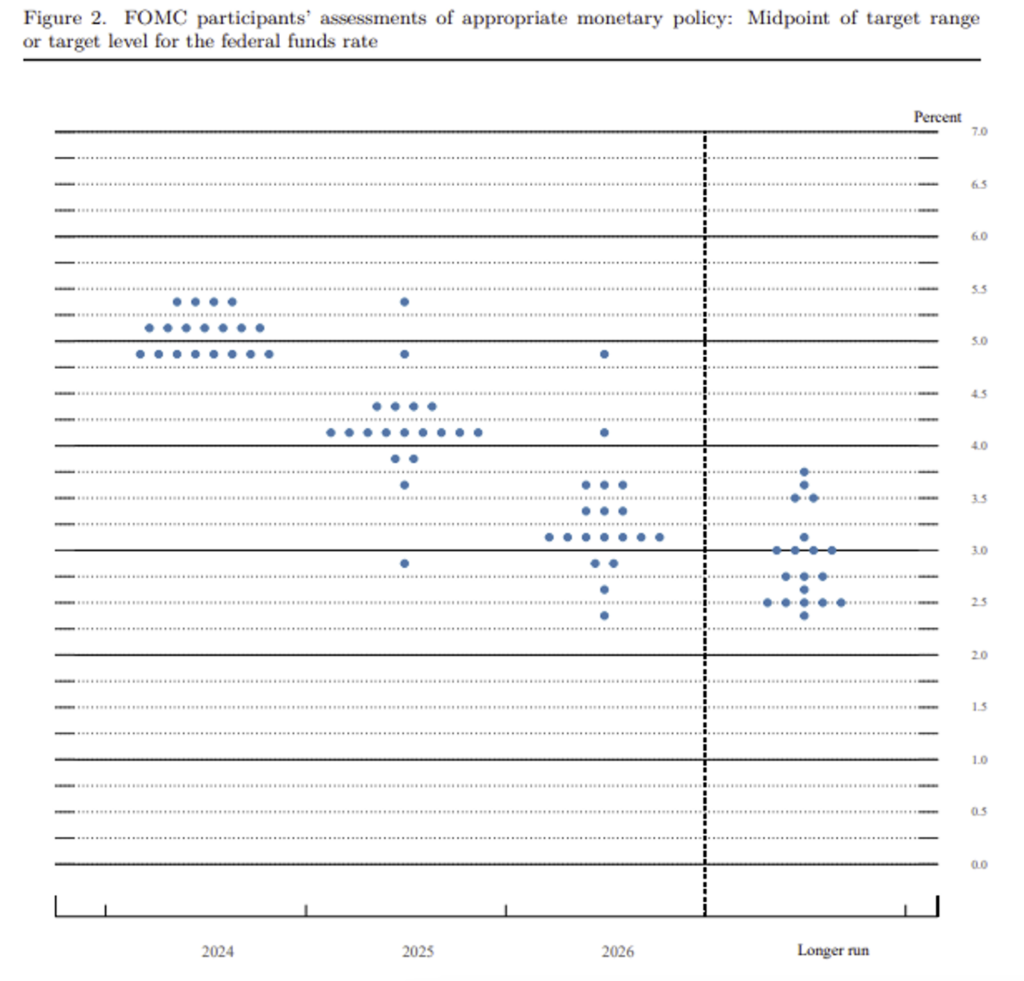

Getting back to the Fed, Fed policymakers decided at their latest FOMC meeting to hold the federal funds rate the same as the prior meeting. That was expected. What was interesting following the meeting was the Fed members’ (including the regional president’s) view of the economic landscape and their best guess as to where short-term rates are heading. This outlook is highlighted in their “dot plot” graphic, which is published every three months and is pictured above.

A few observations. First, note the downward slope of the expected fed funds rate. The voting members currently believe we are moving toward a rate of a little over 3% by 2026, down from today’s 5.25%. So, they are of the view that short rates are expected to fall by 200 basis points (bps) over the next 24 months. If this occurs, and historical averages hold, that suggests the 10-year Treasury yield should be at 4.7% in two years and, importantly, the 30-year fixed-rate mortgage should include a “5-handle” as compared to today’s “7-handle” (“handle” refers to the first number in the yield). Also note the longer-term expectation for the fed funds rate at the 2.5% to 3.0% range, which, if inflation is at 2%, would allow for a “real” fed funds rate of 0.5% to 1.0%, in line with traditional thinking of R* (the real neutral interest rate estimate).

The data also suggests that the Fed expects to reduce rates later this year. The latest data suggests one rate cut of 25 bps is expected to be in the cards, while some on the Board believe two rate cuts of 25 bps each may be in the offing. I have held the view that two cuts should occur in 2024 and maintain that expectation.

Slower Economic and Jobs Growth Ahead?

What of the general economic environment? Below is a table that highlights the Fed’s main economic assumptions along with the assumptions I have held this year.

Some points regarding the data above:

- I am expecting slightly slower growth for this year than the Fed, but the spread is small.

- I am suggesting the employment picture may be a little weaker by the end of the year than the Fed is currently expecting. Not a big deal, but I think we are starting to see data that suggests the employment picture is slowing.

- The difference between the Fed’s inflation expectation and ours is fairly minimal. The same could be said of our outlook of nominal gross domestic product growth and the Fed’s.

- It is interesting to highlight that the Fed poll is, on average, looking for the fed funds rate to be at 3.25% by the end of 2025, down a little more than 100 bps from the current level.

- This decline is expected to occur even though the Fed’s inflation outlook for 2025 remains above its “target” of 2%. Perhaps this underscores the Fed’s view that R* is still around 0.75% in relation to 2.5% inflation.

Rates Expected to Fall Before Inflation

The data above represents “headline” inflation, not “core” (which excludes volatile food and energy prices). Core inflation is currently running at 2.8%, while headline CPI is at 2.7%. As noted earlier, the Fed expects to lower the fed funds rate by about 200 bps by the end of 2025, while it expects inflation to decline by a mere 50 bps. This is an important fact that some seem to be missing. The Fed’s own internal FOMC poll shows the majority of voters don’t expect the Fed to reach its inflation target for at least 18 months, but they expect interest rates to decline nonetheless.

If we take the Fed at its word, rates should start to decline prior to inflation coming down to 2%.

World’s Central Banks Not in Lockstep

As the Fed sticks with its inflation-fighting guns, many other of the world’s central bankers are shifting monetary policies to the other side of the ship, as monetary easing actions outside of the U.S. have become de rigueur. Central banks in Canada, Sweden, Switzerland, Hungary and the Czech Republic, as well as the European Central Bank, have all recently lowered interest rates. Banks in the U.S., England, Japan and China are retaining their “tighter” monetary policy stances. The world’s central bankers are moving in different directions.

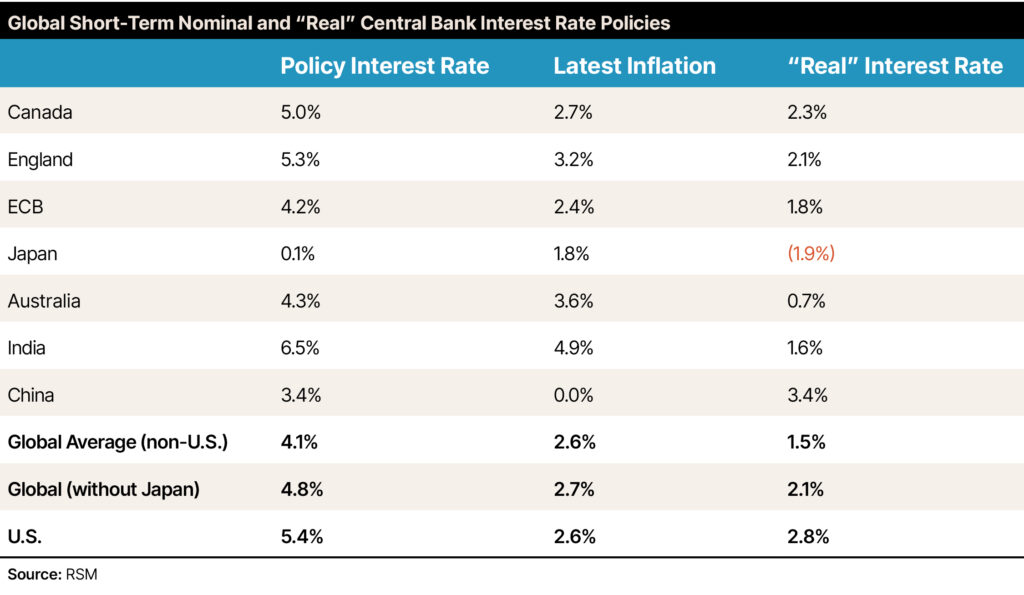

This isn’t unusual but is a change from what we have seen over the last couple of years. As noted above, the U.S. inflation profile is weakening. The inflation profile of the rest of the world is also lower, as noted in the chart above.

Looking at this data comparatively is revealing. It shows that U.S. monetary policies are tighter than all noted major foreign economies’ policies except China’s. This is one of the reasons that the dollar has been strong in relation to other globally traded currencies. From a global perspective, “real,” after-inflation U.S. interest rates are 1.2% higher than other offerings.

I suggest we are seeing more evidence that yes, there is room for the Fed to lower interest rates this year.

Source:

1St. Louis Federal Reserve

This commentary is provided for informational and educational purposes only. It is not intended to be personalized advice or a recommendation to buy or sell any security or engage in a particular investment or other strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Actual results or developments may differ materially from those projected. The information is deemed reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties. Any opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Investing involves risk and the potential to lose principal. Past performance does not guarantee future results. Please consult your financial professional before making any investment or financial decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.