The Anticipated Recession Is Tardy But Not Canceled

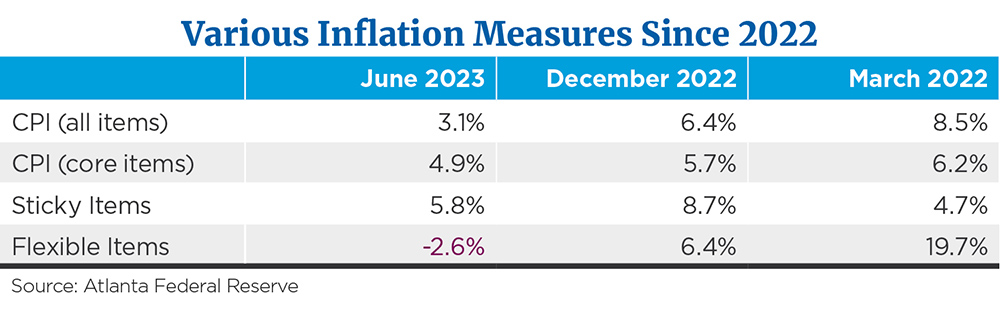

I have been highlighting my thoughts that the U.S. (and the global) economy stands a much higher probability of experiencing a growth recession than normal. I have been writing and talking about this probability since the Federal Reserve started to get serious about its inflation fight. This fight, while not yet won, is moving in the right direction. Inflation, no matter how one measures it (Consumer Price Index or Personal Consumption Expenditures Price Index) has been receding for much, if not all, of this year. And the economy has yet to slip into an outright growth contraction.

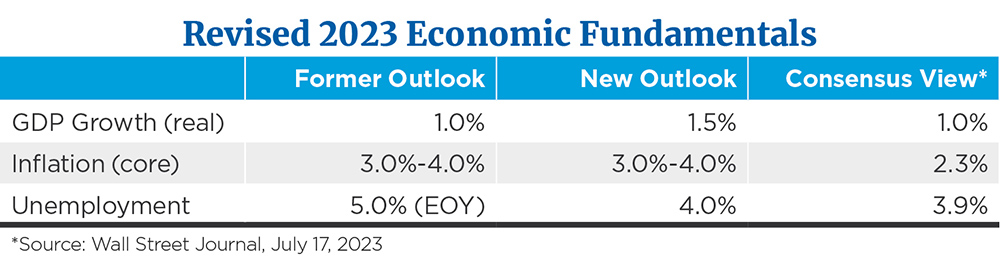

The economic outlook that I have released this year includes growth averaging 1% (4th quarter to 4th quarter annualized), inflation (core CPI) to fall to the 3% to 4% range by the end of the year and unemployment to rise to the 5% level by the end of the year. Compare this outlook to the deep “balance sheet” recession of 2007 to 2009 and one sees that the expected overall economic growth environment is nothing like previous recessions in its severity. I have been looking for a light “income statement” recession, if indeed it is to occur. I have been suggesting that the economy stands a 50% chance of falling into this type of recession sometime this year. Like waiting for Godot, the recession has not yet happened.

The “Right” Recession Medicine

Recessions occur for reasons. Something is out of economic balance and needs to be “fixed.” I think all observers of the economy know that inflation rates of 5%+ are not “normal.” Indeed, the long-term average inflation rate in the U.S. has been 3.7% (CPI all items 1960 to 2023).1 The latest spike in inflation pressure peaked last summer at 8.9% (June 2022).2 The latest inflation rate was 3.1%, down more than 550 basis points over the last year.3 The Federal Reserve has applied the “right” medicine to bring inflation down over the last 12 months.

That medicine was a tightening in the nation’s money supply growth rate and a strong series of short-term interest rate increases, a medicine many believe is still being applied. Of course, in an economy that is highly addicted to leverage utilization, rising interest rates slow overall economic growth. This has happened. The latest gross domestic product data shows the economy has been growing by 2% over the last year, down from the rapid growth coming out of the COVID-induced recession.4 From mid-2021 to mid-2022, the economy grew by 6.8%.5

Remember that the Fed raised federal funds rates by multiple 75-basis-point increases last summer, driving short-term rates well above longer-term interest rates.6 If we look at the last seven business cycles, recessions have started an average of 14 months following the inversion of the yield curve (2-year note vs. 10-year note yields) on a sustained basis.7 We have just passed the one-year anniversary of the latest yield curve inversion cycle. Given that the shape of the yield curve stands as one of our three main forecasting tools for timing the business cycle, this “tool” has yet to produce its real impact on macroeconomic output.

What Does the Jobs Market Tell Us?

Some folks have been trumpeting the view that a recession is almost impossible when the jobs market is strong. After all, the U.S. economy is highly skewed toward consumption, which represents upwards of 70% of GDP. What drives consumption? Jobs and income. While the jobs market remains in good shape, its momentum has been slowly deteriorating.

For those who believe the economy can’t slip into a recession if jobs are being created, history doesn’t back their claim. Over the last seven business cycles, jobs have been created well past the start of the typical recession. Indeed, data shows that the economy hasn’t shed jobs until five months following the beginning of a typical recession.8 But it is true that job creation rates have deteriorated markedly prior to the start of the typical recession.9

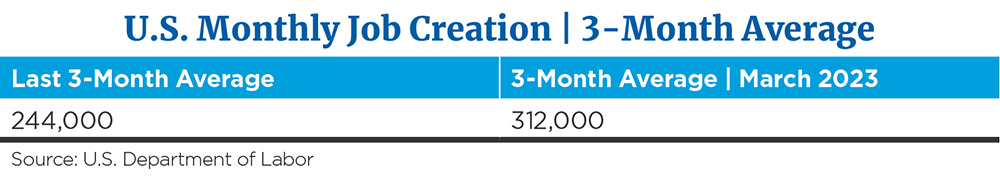

Monthly data on the Labor Department’s jobs report is the gold standard for jobs data. The data tends to be volatile and is revised twice before it is finalized. Some of the revisions are rather large. If one wants to judge the strength of the labor market, it makes sense to not just look at one data point but to average three data points and view the trend of the data.

The jobs market remains robust but at a decelerating pace. From a historical perspective, excluding the oddities of job losses and gains in 2020 (pandemic year), the average rolling three-month job gain rate has been 274,000 monthly, in line with the latest read (2015 to 2023).10 So, while the jobs market has cooled from the robust pace over the recent past, the jobs market remains reasonably healthy.

In addition to a robust jobs market, data now shows that wage gains are rising more rapidly than “headline” inflation rates. Measured by unit labor costs (which also incorporates labor productivity data), worker costs have risen by 3.8% over the last year.11 Over the same period, the CPI has risen by 3.1%.12 Not a big negative, but since 1980 the opposite has, on average, been the case.

Over the last 40+-year period, unit labor costs have risen by an average of 2.3% annually while inflation has been 3.3%, allowing business the flexibility to absorb rising labor costs and changes in productivity growth rates, which at the end of the day enhances the possibility of maintaining good profit margins.13 To the extent that the labor market remains robust and labor productivity growth rates remain subdued, inflation may have a more meaningful negative impact on corporate profit margins than in the past.

Some view the fact that labor costs are rising on a “real” basis to be a good thing. If you are a worker experiencing rising wage rates, this rings true. But the Fed may indeed view this in a different fashion. If the Fed’s goal is price stability (low inflation), then rising real wage gains is a sign that inflation may indeed not be cooling as rapidly as desired, which may lead to continued interest rate increases.

Slower Economic Growth, But No Immediate Recession

With the labor profile in mind, we are lowering our outlook for unemployment for the second half of the year. We are suggesting unemployment may be in the 4% to 4.5% range by the end of the year but will probably not rise enough for the economy and consumer activity to flip into an outright recession in 2023.

Consequently, our view of a 50% chance of recession this year needs to be pushed out. We haven’t changed the view that yes, monetary policy will impact overall economic activity, given a “long and variable” lag. We are now lowering the probability that the U.S. economy will enter a recession by the end of the year to 30% from the previous 50% probability.

We suggest that our view is for further growth deterioration by the end of 2023, but the economy should escape an outright recession this year. 2024 may indeed be a different story, as we maintain our 50% call for recession sometime over the next 12-month period. Our recession call is still on the table, but the emergence of a weakening labor market, which normally goes together with increased recessionary odds, has been “tardy.”

Potential for More Rate Hikes Ahead

If our view holds and the labor market, while weakening, remains robust through the end of the year, GDP growth should also remain a little higher than our previous forecast. That said, our view remains that with a good jobs market, inflation has now entered the “heavy lifting” stage. Gone are the improvements in lower inflation that can occur rapidly (lowering pressure from energy and food inputs) while other price input items remain “sticky.”

Note that both sticky and core inflation rates remain well above both headline (all items) and the Fed’s 2% inflation policy goal. Given the data above and our renewed view of a good jobs market for the next few months, we are suggesting that the fed funds rate may indeed rise another 50 basis points (0.50%) by the end of the year to a range of 5.5% to 5.75%, in line with the Fed’s own policy outlook.

Last Word

Our economic outlook has been guarded over the last year as the Fed has been busy tightening money supply growth as reflected in fed funds rate increases. This type of activity has usually led to economic slowdowns in the past with an outright economic contraction eventually in the cards. We remain of that view, but as Milton Friedman once said (from “A Program for Monetary Stability,” 1960):

“I find it virtually impossible to conceive of an effective procedure when there is little basis for knowing whether the lag between action and effect will be 4 months or 29 months or somewhere in between.”

The anticipated recession is tardy but not yet canceled.

Footnotes:

1-6St. Louis Federal Reserve

7The Conference Board and St. Louis Federal Reserve

8-12St. Louis Federal Reserve and the U.S. Bureau of Labor Statistics

13St. Louis Federal Reserve

This commentary is for informational and educational purposes only. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on the information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information that any opinion or forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Investing involves risk and the potential to lose principal. Past performance does not guarantee future results. Please consult your financial professional before making any investment decision.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.