Slow Start: Strategies To Help You Stay In The Race

Many Boomers Started Late

Americans ages 55 to 64 who have retirement accounts have accumulated approximately $100,000 in savings. That will produce just a few hundred dollars a month to add to their Social Security payments. Those without a savings account have accumulated about $12,000 for retirement. Most likely, they’ll need more.

National Institute on Retirement Security, The Retirement Savings Crisis: Is It Worse Than We Think? June, 2013. Values represent the median amount and not the average.

Retirement Checkpoints

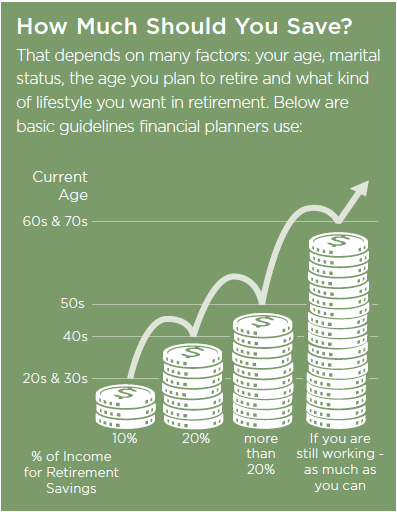

If you are in your 20s and 30s, you still have the luxury of time when it comes to saving for your future. Beyond your 30s, it is time to get realistic about your savings strategies. Whether you got a late start or you just plain haven’t been saving enough, there are some ways you can start to potentially increase your retirement savings now.

Reduce Your Expenses

You’ve probably heard it many times, but the best way to save for the future is reduce how much you are spending now. Not only does that free up money to invest in your retirement plan, but if you’re in your 50s, it also means you will be used to living on less when you retire.

Plan To Work Longer

Age 65 seemed like the magic retirement age for so many years, and was the age set for retirement in 1935 when Social Security was established. It may even be the age you are still aiming for. However, it’s best to be realistic. Working longer gives you more time to save and may help you get the best benefit from Social Security.

Have The Right Mix Of Investments

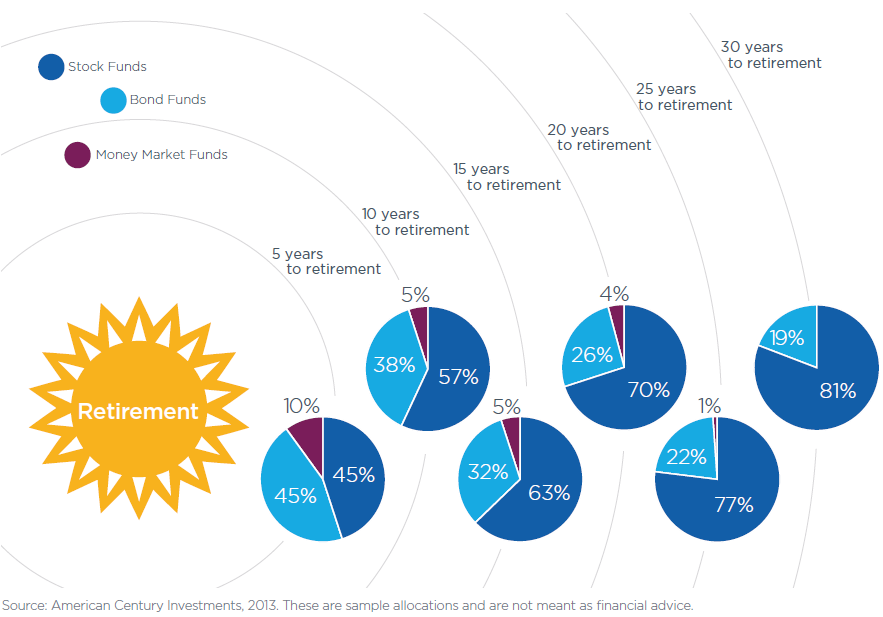

While people in their 20s and 50s should not have the same kind of retirement savings make-up, you do want to make sure you have enough stock investments to potentially keep your money growing at any age.

The Bottom Line

Regardless of where you are in your retirement savings time-line, the best time to review your retirement savings strategies is now.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

This material is provided with permission from American Century. It is for informational purposes only and has been obtained from sources believed to be reliable. While every effort is made to ensure the accuracy of its contents, it should not be relied upon as being tax, legal, or financial advice.

American Century Investment Services, Inc., Distributor

© American Century Proprietary Holdings, Inc. All rights reserved.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.