SIMPLE IRA vs. 401(k)

Have Your Clients Outgrown Their SIMPLE IRA?

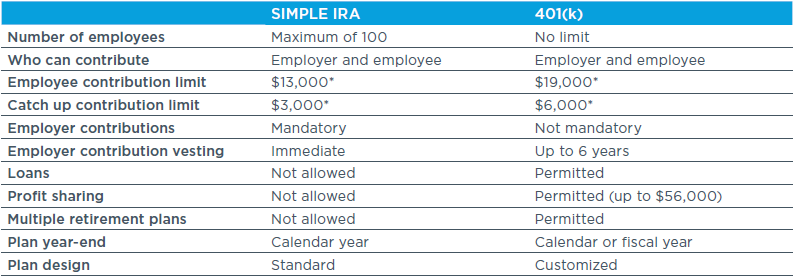

For small companies, a SIMPLE IRA can make sense as a retirement savings option for both the business owner and their employees. But as the company grows, a SIMPLE IRA might no longer be a fitting solution.

By understanding the key differences between the two plans, you can quickly identify if now is the right time to convert to a 401(k) plan.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.