Ready, Set, Retire

Planning Is Crucial For Your Countdown To Retirement

What Will You Do After Your Final Paycheck?

If your retirement date is less than ten years away, it’s a good time to start thinking about the transition from work to retirement. In fact, your “in” retirement plan may be more crucial than your savings for retirement plan has been.

Don’t Leave Your Retirement To Chance

Moving from a steady salary to converting your savings into income for the rest of your life takes some thought. It helps to understand the kinds of risks you might encounter and how to lessen their impact with thoughtful planning.

Help Make Your Money Last

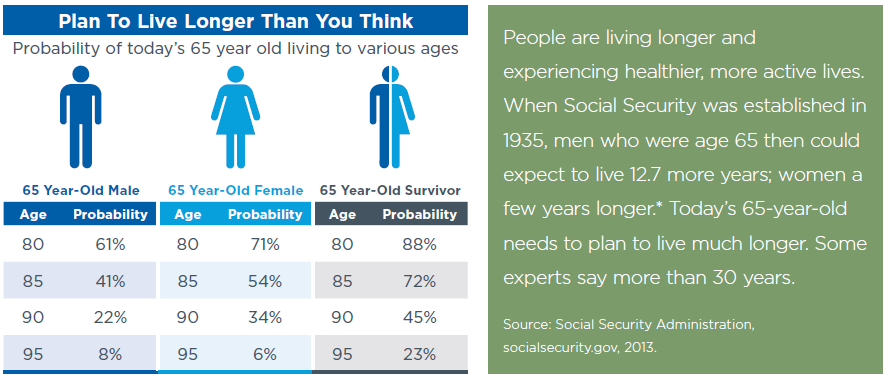

Longevity, or running out of money in retirement, is the biggest risk that most retirees face. A careful plan can help you manage this risk.

Life Expectancy Calculator created by Mary Pat Cambell, FSA, updated July 2010.

Consider These Tips To Overcome Longevity Risk

- Choose a realistic time-frame for how long your money will need to last in retirement. If you retire at age 65, plan for 30 to 35 years.

- Maintain adequate equities (stock funds) in your portfolio. This can potentially help your savings continue to grow in retirement, although it does come with additional risk.

- Pick a practical withdrawal rate. This is the amount you’ll take from your savings each year for income. Between 3-5% is generally considered acceptable.

Protect Your Buying Power

Inflation risk, or your dollar being worth less over time, can have a devastating impact on your retirement security, even when inflation is relatively low. Ideas that may help include:

- Add inflation protection investments to your portfolio.

- Maintain enough equity exposure to help keep investments growing.

- Maximize Social Security payments which are automatically adjusted for inflation. There are a lot of options for how/when to take Social Security. A financial or tax advisor can help review options that might be best for you.

Defend Against A Decline

A market decline, especially right before or early in retirement, can undermine your savings. Your portfolio will usually be at its largest at retirement, resulting in a greater dollar impact. In addition, making withdrawals during a market decline could mean you won’t recover those losses in a market rebound. To help minimize this risk:

- Maximize your portfolio’s diversification. Spreading your money across several asset types that react differently under various market conditions may help balance the markets’ highs and lows. Within stocks, bonds and money markets, you can drill down further to get a better asset allocation.

- Align your asset allocation with your risk tolerance so you’re less likely to panic in a downturn.

- Consider annuitizing part of your portfolio. Annuities can provide income, but can also come with a pretty high price tag.

The Bottom Line

Like any journey you’ll soon embark on, having a plan could mean the difference between success and failure. Before you start your retirement countdown, make sure you have a plan in place to help you get beyond the retirement finish line.

Diversification does not assure a profit nor does it protect against loss of principal.

This material is provided with permission from American Century. It is for informational purposes only and has been obtained from sources believed to be reliable. While every effort is made to ensure the accuracy of its contents, it should not be relied up on as being tax, legal, or financial advice.

American Century Investment Services, Inc., Distributor

© American Century Proprietary Holdings, Inc. All rights reserved.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.