P&G Restricted Stock Units

A Restricted Stock Unit (RSU) represents one share of P&G stock that will be delivered to you in five years. For example, if you are granted 100 RSUs, you will receive 100 shares of P&G stock five years later (minus shares that will be sold to cover your taxes). You can then keep the shares of P&G stock or sell them. Unlike stock options, these are full shares of P&G stock that retain value even if the stock price happens to decline over time.

Terms Used With RSUs

Grant date: The date the award is given. The stock price on grant date is used to determine how many RSUs are granted.

Grant price: The stock price on the grant date. The grant price is determined based on the closing price for P&G stock on the New York Stock Exchange on the grant date.

Settlement date: The day that the RSUs will convert into full P&G shares and be delivered to you (minus shares that are automatically sold to cover your local tax obligations, as applicable).

Forfeiture date: The date you must work through in order to keep your award. If you do not work through this date, the RSUs are subject to forfeiture. In some cases such as retirement and special separation, the forfeiture is waived, though you still must wait until the settlement date to receive your shares.

Characteristics of RSUs

As the market price of P&G’s stock changes, so does the value of each RSU. Each RSU behaves like a full value share of P&G stock. As such, RSUs always have value equal to the current market

price of P&G stock.

RSUs do not convert to actual shares until the settlement date. This means that you do not yet actually own the shares of stock. As such, there are no dividends or voting rights.

Depending on the legal requirements in countries at the time of grant, some RSU grants might include unique conditions and restrictions beyond what is described in this guide. Always read your grant letters and related materials carefully.

RSU Example

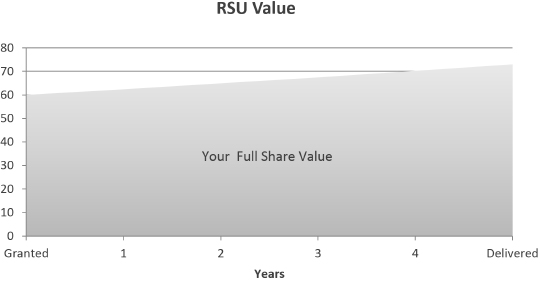

This example shows an RSU with a grant price of $60. You can see how the RSU grows in value as P&G stock grows in value. After the five year restriction is over, your share of P&G stock will be delivered. In this example, the value at the end of five years is about $72.

If You Leave P&G

- If you are employed through June 30 following the grant date, then leave as a retirement or company approved special separation, the RSUs will still be delivered at the end of the five year settlement period. For all other separations you will lose RSUs.

- In the event of termination with a divestiture or separation of any of the company’s businesses, the award is retained and becomes deliverable on the settlement date.

Mariner Wealth Advisors is not affiliated with Procter & Gamble. Any reference to them should not be construed as an endorsement by either party.

This document is for informational use only. Nothing in this publication is intended to constitute legal, tax, or investment advice. There is no guarantee that any claims made will come to pass. The information contained herein has been obtained from sources believed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information. Consult a financial, tax or legal professional for specific information related to your own situation.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.