Make the Most of Your Retirement Plan Contributions

You may want to consider creating a strategy for maximizing retirement plan contributions. The IRS has upped the amount you can contribute across all qualified retirement plans.

Front-loading a 401(k)

As you think about your strategy, you may wonder whether it makes sense to front-load your retirement plan contributions. The main benefit is that over the long term, your money has the potential to grow in a tax-advantaged account longer, and you get the benefit of compounding interest over time. While most of us take a long-term view of investing, the fact is that it can be a greater advantage to front-load during a period when the market rises versus, for example, during a sustained market downturn.

Company Match Considerations

One of the downsides of front-loading an employer- sponsored 401(k) is that you could forfeit some money in matching employer contributions. For example, if you max out your 401(k), meeting the $23,000 contribution limit early in 2024,1 your employer matching amount could end when your contributions end, if that is what your employer plan stipulates. It may make sense to make monthly contributions throughout the year so you can maintain that monthly employer match.

Maximizing Plan Contributions

No matter what approach you take, it is important to maximize both your employer match and aim to maximize your 2024 401(k) allowable limit of $23,000 and a maximum of $7,000 to an IRA for 2024.2 Keep in mind that unlike 401(k) contributions, which must be made by the end of each plan year, you can contribute to your IRA until the current year’s tax filing deadline.

An easy way to do that with an employer plan is to set an annual automatic increase of a percentage equal to the percentage raise you receive. If your compensation increases by 5%, for example, then increase your retirement contributions by 5%, keeping an eye on when you would reach the maximum of $23,000 in 2024. Once you max out your 401(k), you can make after-tax contributions to an IRA and let those contributions grow tax deferred to continue to build your retirement savings.

Catch-up Contributions

If you’re over age 50, you can contribute even more for the 2024 tax year—$7,500 in “catch- up contributions” to a 401(k) and certain other retirement plans and an additional $1,000 in catch- up contributions to an IRA.3

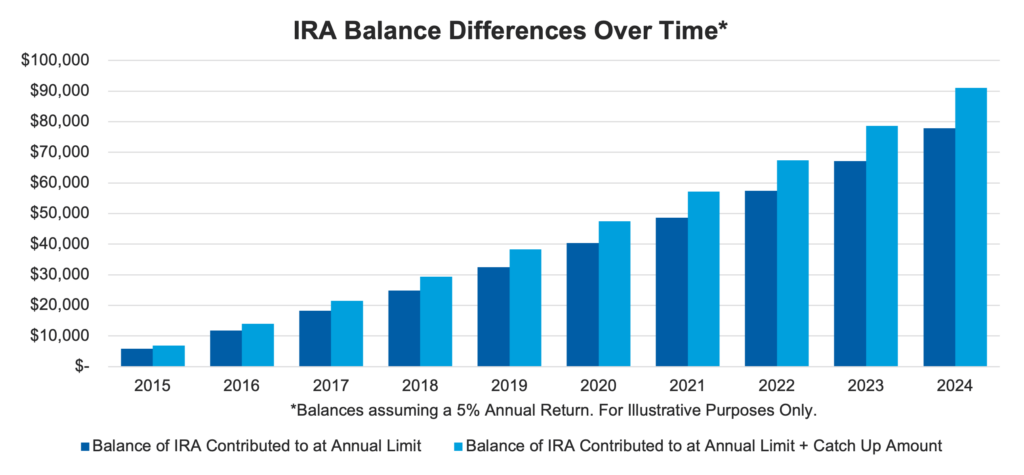

You must make catch-up contributions to a retirement plan via elective deferrals before the end of the plan year, per the IRS. In the example below, if you took advantage of catch-up contributions to an IRA over a 10-year period, you could have accumulated over 17% more in additional retirement savings than if you had made contributions only up to the normal limit.

*Balances assume contributions occur at the beginning of each year and a 5% annual return. This hypothetical example is for illustrative purposes only and is not intended to be representative of actual results or any specific investment, which will fluctuate in value. The determinations made by this example are not guarantees or projections, and no taxes or fees/expenses are included in the calculations, which would reduce the figures shown. Please keep in mind that it is possible to lose money by investing, and actual results will vary.

The Bottom Line

According to the IRS, you can contribute a maximum of $69,000 per year into defined contribution plans in 2024, including your contributions plus any employer contributions.4 If you’re eligible for catch-up contributions, that amount is $76,500 in 2024.5 Plans may include, for example, a 401(k), 403(b) plans or profit sharing plans.

Consider Partnering With Your Advisor

For help creating a strategy for when and how to maximize your retirement plan contributions, reach out to your wealth advisor. We’re here to help you navigate retirement savings and other financial challenges so you may have the retirement that you envision for yourself and your family.

Sources:

1,2,3irs.gov

4,5“2024 Limitations Adjusted as Provided in Section 415(d), etc.”

This material is intended for informational and educational purposes only. It should not be construed as investment or tax advice, or a recommendation to engage in any financial strategy. Please contact your financial, and tax professional for more information specific to your situation. Please consult your tax and financial professional before making any tax, investment or financial-related decisions. Investing involves risk, including the potential loss of principal.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.