Inflation Reduction Act: Could It Lower Your Medicare Drug Costs?

The Inflation Reduction Act recently signed into law by President Biden includes many provisions designed to cut the cost of Medicare’s prescription drug program. Find out how you could benefit from this new legislation.

Q: How Will the Inflation Reduction Act Impact Medicare Beneficiaries?

A: Starting in 2025, one of the biggest—and likely most popular—changes Medicare enrollees will see is a $2,000 annual cap on out-of-pocket expenses for Medicare Part D prescriptions, including drug coverage provided by Medicare Advantage plans. Currently, there is no yearly limit on what beneficiaries pay out of pocket for prescription drugs. Although payments made toward deductibles, co-pays and coinsurance will be capped at $2,000 per year, that restriction does not include monthly Part D Medicare premiums.

Q: What Are Some of the Act’s Other Cost-Saving Provisions?

A: There are many, which are summarized below.

Beginning in 2023:

- The price of a one-month supply of insulin will be capped at $35. This includes insulin covered by Part D and Medicare Advantage prescription drug plans as well as insulin administered via an insulin pump that is covered by Part B plans.

- Out-of-pocket costs will be eliminated for Part D-covered vaccines that are recommended by the Centers for Disease Control and Prevention.

- Manufacturers of Part B drugs (administered in a doctor’s office or hospital/outpatient facility) and Part D drugs (prescriptions purchased at a retail pharmacy) whose price increases exceed the rate of inflation will be required to rebate that cost difference to Medicare.

Beginning in 2024:

- Currently, Medicare recipients must spend $7,0501 out of pocket before qualifying for Part D “catastrophic coverage”—which is either a copayment of $10-$20 per prescription or a coinsurance percentage that is set at 5% of the cost of the drug. The new law will eliminate these copayments.

Beginning in 2024 and continuing through 2029:

- Increases to the base monthly premium for Part D-covered prescriptions will be capped at 6% year to year.

Q: Will Medicare Have the Ability to Negotiate Drug Prices With Manufacturers?

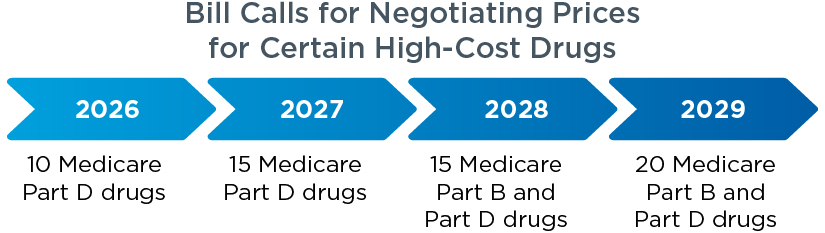

A: Yes. Medicare will begin negotiating the costs of the 10 most-expensive Part D-covered prescription medications in 2023, but the reduced prices won’t take effect until 2026. By 2029, a total of 60 prescription drugs will be subject to negotiated prices. The table below shows the year-by-year rollout of this provision.

Source: Kaiser Family Foundation

Q: Will the New Law Cut Medicare Benefits or Take Money Away From Medicare?

A: No. The Inflation Reduction Act will lower Medicare spending by reducing the price of some prescription drugs it covers—not by slashing benefits. The new law is a win-win: Not only will the program and its enrollees realize significant savings, but those savings will allow it to provide enhanced benefits to millions of seniors.

Source:

The views expressed are for commentary purposes only and do not take into account any individual personal, financial, legal or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. The opinions are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.