Financial Wellness

Planning for Executives and Employees

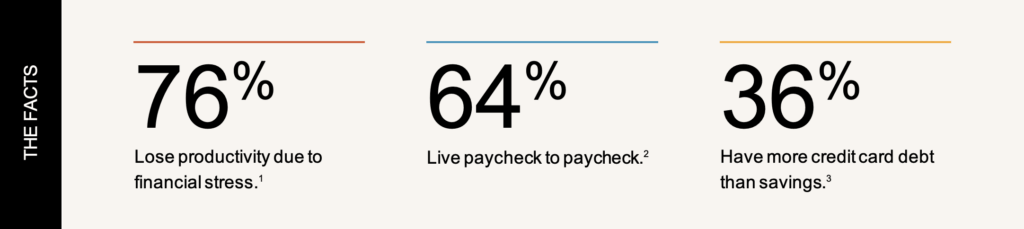

Employees who participate in a financial wellness plan tend to make better financial decisions, plan for retirement, be confident about their financial goals and seem to be happier and healthier.

We provide your employees with financial advice based on their goals. We also help employers communicate the total value of a compensation package, which helps employees make educated financial decisions. Understanding these benefits packages can help boost employee retention, satisfaction and productivity.

Who We Are

We offer 360° Advice Designed to Last

At Mariner, we believe in helping people pursue something beyond wealth…pursuing a larger calling…a passion. Key to this pursuit is confidence that your wealth advisor is committed to being here for everything life brings your way. We are a wealth management firm working with clients and their families to help them identify what’s important so they can achieve their goals, preserve wealth and build a legacy.

What We Do

Partner with your employees to create a financial strategy that’s flexible enough to change along with them.

Whether your employees need help transferring wealth to heirs, creating a strategy to protect assets or creating an investment strategy that aligns with their goals, Mariner is here to help. We’ll work with your employees to create one, coordinated financial strategy developed specifically for them. We’ll partner with your employees one-on-one, to provide them with advice based on their goals. We will also provide regular, firm-wide educational seminars on topics ranging from retirement planning to proactive tax planning. By acting as the primary resource for all financial matters, we are able to incorporate an employee’s corporate benefits with their private resources to create one comprehensive financial strategy.

Financial Planning

- Deferred Compensation Planning

- Stock Option Planning

- Estate Planning

- Cash Flow Analysis and Recommendations

- Retirement Goal Setting

- Retirement Account Withdrawal Strategies

Tax Planning and Preparation

- Integrating Tax Strategies Into a Wealth Plan

- Keys to Minimizing Tax Consequences

- Proactive Tax Strategies and Tax Preparation Services

- Tax-Efficient Gifts, Trusts, Foundations and Funds

Investment Advisory

- Asset Allocation

- Diversification Among Asset Classes

- Portfolio Construction

- Performance Reporting

- 401(k) Asset Allocation

Insurance Solutions

- Asset and Income Protection Strategies

- Life Insurance

- Long-Term Care Insurance

- Disability Insurance

Sources:

1“2022 PwC Employee Financial Wellness Survey”

2“High Inflation Leads More Employees to Live Paycheck to Paycheck”

3“Bankrate’s 2023 Annual Emergency Savings Report“

This material is provided for informational and educational purposes only. It does not consider any individual or personal financial, legal, or tax circumstances. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind. Where specific advice is necessary or appropriate, individuals should contact their professional tax, legal, and investment advisors or other professionals regarding their circumstances and needs.

Any opinions expressed herein are subject to change without notice. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties. There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal.

Some of the services referenced herein are provided by affiliates and are subject to additional fees. Also, some wealth advisors are licensed insurance agents and are compensated for the sale of insurance-related products through an affiliated insurance agency. For additional information refer to https://www.marinerwealthadvisors.com/legal/.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.