Elimination of the Stretch IRA: Update for Owners and Beneficiaries

Q: When was the Stretch IRA eliminated?

A: As a result of the 2019 SECURE Act, the stretch IRA was eliminated, which dramatically changed how IRA account owners distribute assets to non-spouse beneficiaries.

Q: What was the previous rule and what is the current rule?

A: Prior to the SECURE Act, non-spouse beneficiaries who inherited an IRA were able to “stretch” out distributions based on their own life expectancy. Under current rules, those beneficiaries are expected to deplete the account within 10 years after the original owner’s death.

Q: When do I have to make withdrawals?

A: For non-spouse beneficiaries of IRAs inherited after January 1, 2020, there are no annual required minimum distributions (RMDs) during the 10-year window, but the entire account balance must be distributed by the end of the 10th year after the original owner’s death.

Q: Who still qualifies for the stretch IRA and who is subject to the 10-year rule?

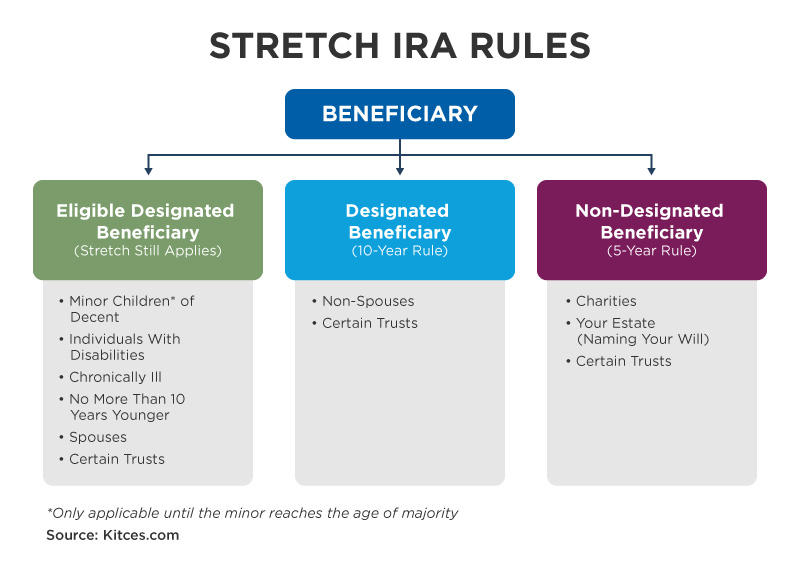

A: There are several exceptions in which a beneficiary doesn’t have to meet the 10-year rule and can follow former guidelines of taking withdrawals over their lifetime, indicated in the informational graphic below.

Work with your wealth advisor

The larger your IRA is the more important it is to carefully examine how it transfers to your beneficiaries, primarily because there is more at stake from a tax perspective. Other questions to look at include whether your beneficiaries should receive their share of the IRA outright or via a trust.

As always, if you have questions as the IRA account owner about whether your beneficiaries will be subject to the 10-year rule, please reach out to your wealth advisor. At Mariner, our tax, estate planning and trust services teams are in-house and can collaborate with your wealth advisor on the most tax-efficient way for you to transfer IRA account assets to your heirs or charities.

Source:

“The Partial Death of the Stretch IRA”

“10-Year Rule: Beneficiary Planning ‘Loophole’ Closed”

Some services listed in this piece are provided by affiliates of MWA and are subject to additional fees. Additional fees may also apply for tax planning and preparation services.

The views expressed are for commentary purposes only and do not take into account any individual personal, financial, legal or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. The opinions are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.