Economic Outlook: A Wild Coaster Ride

Read time: 9 minutes

When I was a child, my parents took us children to Disneyland one summer. The ride we have all been on over the last week reminds me of some amusement park rides—it’s seemingly out of control and dangerous, but the ride ends, and all is back to normal. The capital market’s reaction to the announced tariff rates is a bit like a bumpy thrill ride.

The main driver behind the capital markets’ wild ride was President Donald Trump’s announcement of initial tariff rates on various imported products on April 2, followed by additional announcements and changes on April 8.

This has damaged business and consumer sentiment, a decent measure of the willingness to transact. Without the willingness to transact, transaction volume may slow. Now that we have some details of tariff rates and follow-on actions, we need to reconsider our outlook and odds for a recession to unfold later this year.

Markets Recoil Amid Tariff Rate Announcements from Washington

I recently raised my view that inflation may indeed be higher than my original Three Yards and a Cloud of Dust work indicated. In fact, I’m raising my inflation target for 2025 from 2.5% to 3.0% (core PCE). The catalyst behind this move was the knowledge of details of higher tariffs being applied to imports, which supports the risk of higher inflation pressure.

The announced tariff rates are only half the story. The Trump strategy of tariff announcements raises questions of political and financial stability. Where are tariffs going and what kind of impact may they impart on economic activity?

Following the initial announced tariff rates on April 2, the main capital markets revolted. From a global perspective, investors started to worry about potential economic impact on growth and inflation. The uncertainty released during this time shook global stock, bond and currency markets. Price volatility started to escalate following the April 2 announcement. From April 4 to April 9, the S&P 500’s daily high/low range averaged 7.7%.1 This level of high/low price spread is like yearly net price changes of stock prices—all occurring each day over the noted four-day period.

Now, most know that stock prices are inherently volatile. The U.S. Treasury debt and the Foreign Exchange market pricing are historically more stable than the stock market. As opposed to the stock market, these are markets that accommodate global trade and financing activity. Consequently, pricing stability in these markets is very important.

Immediately following the tariff announcements on April 2, the U.S. 10-year Treasury yield fell from 4.18% to 4.01% by April 4, then sharply reversed course, rising to and peaking at 4.48% on April 11—a very significant yield increase over a short period of time.2 Additionally, the U.S. Dollar index declined over 12% from April 2 to 8, then rebounded 9.5% following the announcement of a 90-day delay in the implementation. The average annual price moves in this index going back 40 years is 7%.3 To top it off, gold—the currency the world has turned towards during previous times of stress—increased by 9% from by April 21, and have increased by roughly 26.5% since the first of the year through April 28.4

Following these extremely volatile moves in the capital markets, the Trump administration placed several of the previously announced tariff changes on hold. There is, however, a silver lining to the story: when the markets began to “riot,” the administration adjusted its tariff plans in response.

Why the Changes Occurred

President Trump recognizes that the country must refinance $9.2 trillion in Treasury debt maturing in 2025, with $6.5 trillion of that coming due by the end of June.5 Each basis point increase in interest rates adds roughly $1 billion in annual interest costs for the government (For example, $9.2 trillion x 0.0001 = $920 million). As noted, between April 4 and April 11, the yield on the 10-year Treasury note increased by 47 basis points. This rise would increase financing costs for the $9.2 trillion in 2025 maturities by around $47 billion per year!

While President Trump appears resistant to pressure and influence from many corners, the markets and economic reality carries weight.

Rising Recession Risks

Due to the reasons outlined below, I believe the risk of recession has increased over the last month. Much of the increased risk is centered on sentiment—how consumers and businesses think of things. The willingness to transact has weakened following the recent decline in stock prices. While this isn’t anything new, when combined with the destabilizing effects of a shifting global trading system, we need to rethink our earlier projection of an upcoming recession.

Cranks in Consumer and Business Confidence

Sentiment tends to be a decent reflection of consumer’s willingness to spend and invest. The most recent measures of business and consumer sentiment are showing growing economic concerns. The Business Roundtable CEO Economic Outlook Index dipped modestly during the first quarter, signaling that even large corporate leaders are growing more cautious.

Small Business Owners More Cautious

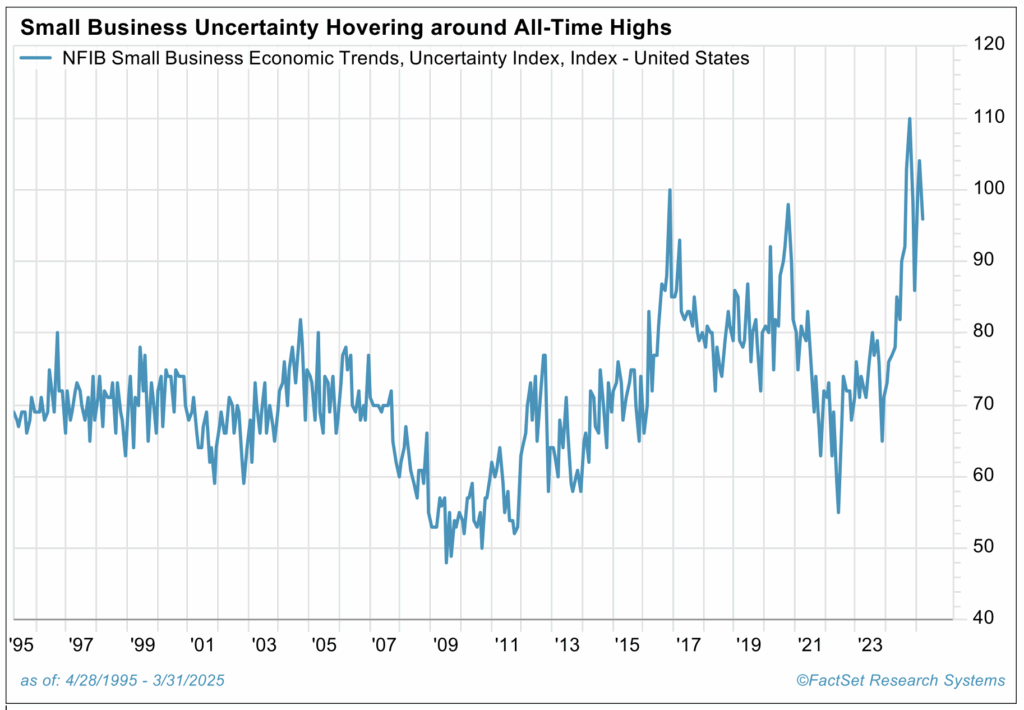

As I have reported in the past, small businesses—those with 500 or fewer employees—accounted for 51% of U.S. non-government workers in 2024. As such, small business owners’ sentiment and viewpoint is important when considering employment trends.6 According to the National Federation of Independent Business, the Uncertainty Index reached 104 in February, marking the second-highest reading on record (chart below). The highest October 2024’s peak of 110. This hints toward a significant change in small business owner’s attitudes towards Trump’s policies, compared to the optimism many expressed following the election last Fall.

Source: FactSet

Consumer Confidence Slipping Further

Along with small businesses, consumers confidence appears to be weakening under Trump 2.0. The Consumer Optimism Index (COI), which is the average of the Consumer Sentiment Index (CSI) and the Consumer Confidence Index (CCI), fell to 75 during March, marking the lowest reading since July 2022.7 Our friend Ed Yardeni states that, according to the CSI survey, consumers are increasingly pessimistic. This is reflected in their five-years-ahead inflationary expectations, which jumped to 4.1% in March, from 3.2% in January (see chart below).

Sources: LSEG Datastream and Yardeni Research and Survey Research Center

Businesses and consumers need to have both the ability and the willingness to transact for spending to take place on a discretionary basis. While many consumers and businesses still have the ability to spend, their willingness to do so appears to be faltering. This is likely due to Trump’s new tariff policies, which are adding to concerns across both sectors.

Balancing the Data

While I see little “hard” evidence that a recession is on our doorstep (employment, consumer spending), I see building “soft” evidence, particularly an increase in recessionary pressures. To fully assess the situation, we need to look at current “hard” data points.

The March employment report from the Department of Labor showed strong trends in the labor market. Net new jobs totaled 228,000 (unrevised) for the month, compared to an average monthly rate of 158,000 for the previous 12 months.8 However, this release covers a period before the recent announcement of new tariff rates.

However, if we look at the labor report prior to the last three “non-covid” recessions (July 1990, March 2001 and December 2007), history shows that job creation trends tend to peak between four and six months before the onset of a recession. That isn’t happening yet. But based on this historical evidence, if a recession develops this year, it would likely not begin until deeper into the second half of the year.

We also need to consider more high-frequency data when looking at the labor market. Weekly initial unemployment claims, which are released every Thursday, remain steady. For the week ending Apil 19, the data shows that 222,000 initial claims were opened, with the four-week average showing a decline of 3,000 claims. In other words, 3000 fewer people have been losing their jobs on a weekly basis over the last 4 weeks.9 This isn’t an indication of an immediate recession.

Three Yards and a Cloud of Dust

That said, the broader sentiment data is troubling. My core economic theme for this year—Three Yards and a Cloud of Dust—still holds, and I maintain a 60% probability of that happening. I’ve been suggesting a 25% possibility of a recession this year, but based on the evolving evidence, I am raising the probability of the U.S. experiencing a recession this year to 40%.

Our GDP growth forecast remains 1.5% – 2.0% and our inflation forecast (core PCE) is 3.0%+. We maintain a 60% probable outcome for this scenario.

Looking ahead, the next question is how policymakers will respond. If we indeed see a weakening in overall economic activity driven by tariff issues, will the Federal Reserve step up and provide additional liquidity? And will Washington act with a tax reduction package to help apply economic salve to the tariff wound? Only time will tell.

Sources:

1-4FactSet

5https://fiscaldata.treasury.gov/datasets/monthly-statement-public-debt/detail-of-treasury-securities-outstanding U.S. Treasury Department

6https://www.bls.gov/web/cewbd/table_f.txt Bureau of Labor Statistics

7FactSet

8https://www.bls.gov/news.release/empsit.nr0.htm Bureau of Labor Statistics

9FactSet using data from Bureau of Labor Statistics

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is AXPunmanaged and cannot be directly invested in.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.