Considerations for Retirement Plan Withdrawals

At age 59½, individuals are able to begin taking withdrawals from qualified retirement plans without incurring a 10% federal income tax penalty. This is true for IRAs as well as employer-sponsored plans, such as 401(k) and 403(b) plans.

Distributions from traditional IRAs, 401(k) plans and other employer-sponsored retirement plans are taxed as ordinary income. Withdrawals from other types of accounts, such as bank accounts and non-retirement investment accounts, are often subject to lower levels of taxation. And still other accounts, such as Roth IRAs, are exempt from taxation altogether. So, from a tax planning perspective, how should you go about deciding whether to withdraw from qualified retirement accounts or non-qualified sources?

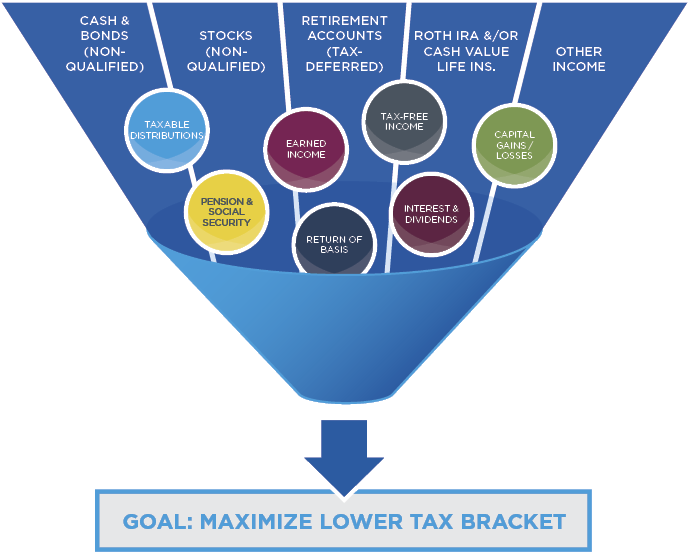

First, consider the different types of accounts you have available to fund living expenses. Just as there are benefits to investing in a diversified manner, there are benefits to having various accounts to provide tax diversification. In terms of tax treatment, there are several different broad categories of income, including:

- Tax-free – Roth IRAs, municipal bonds or return of basis

- Fully taxable –Withdrawals from traditional IRAs, 401(k) and 403(b) accounts

- Partially taxable – Social Security

- Tax-favored – Long-term capital gains, qualified dividends

- Other Income – Earned income, rental income, monthly pension

Think of these as different “buckets” of money. Prior to drawing down your assets, you spread money across a variety of investment vehicles. By doing so, you will provide a hedge against the inevitable changes to future tax laws.

If you have successfully spread out your investments across these different tax buckets, you have an opportunity to be more proactive in your withdrawal strategy, thereby allowing you more control over your tax bracket in retirement. The objective is to monitor the source of your withdrawals so that you can understand the effect on your tax rate and avoid creeping into a higher tax bracket.

The following chart provides a visual representation of this strategy.

There are four basic steps that allow you to proactively manage your taxes in retirement:

Step 1: Identify your expected gross income, living expenses and income gap (the difference between gross income and expenses) for the upcoming tax year before considering any withdrawals from your investment accounts. Then, determine your expected level of deductions and exemptions, and subtract them from your gross income, arriving at an estimate of your taxable income before withdrawals from investment accounts.

Step 2: Choose a marginal tax rate you’d like to target in the coming tax year. A reasonable place to start is the marginal rate associated with the taxable income estimate you identified in Step 1. For example, if you and your spouse expect $400,000 in taxable income before tapping your investment accounts, you could target a marginal rate of 32% for 2020. Just because your joint income falls in the 32% bracket doesn’t mean all of your income is taxed at that rate.

Step 3: Identify and withdraw the amount of additional taxable income (above the level determined in Step 1) you can recognize without affecting your target marginal tax rate. Assuming you need at least this amount in addition to your non-investment income to cover your expenses, withdraw it from a tax-deferred account. For example, if you’re married and file jointly, with taxable income up to $500,000, it is taxed at 35%. So, if you expect $500,000 in taxable income from non-investment sources, you could afford to generate an additional $122,050 through withdrawals from tax-deferred accounts without pushing yourself into the next tax bracket.

Step 4: Withdraw the additional amount needed to fund your expenses and cover your tax liability from a taxable or Roth account. If using a taxable account, try to avoid liquidating securities at a gain because this can generate additional tax liability. If using a Roth account, be sure you’ve met the requirements for qualified distributions or you may face additional taxes and penalties.

This strategy may help you generate the cash flow you need to help meet expenses, while potentially minimizing your tax rate.

The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. It is not intended to be personal legal or investment advice or a solicitation to buy or sell any security or engage in a particular investment strategy.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.