Managing the Hidden Risk to Your Retirement Savings

Read time: 6 minutes

Retirement savings are usually built slowly and patiently. But retiring at the wrong time can deplete portfolios far faster than expected, thanks to a little-discussed hazard called sequence of returns risk. Here’s what it is, as well as several strategies that can be used to help guard against it.

Why Sequence of Returns Risk Matters

Sequence of returns risk, sometimes called retirement timing risk, refers to the threat posed by experiencing poor investment returns early in retirement. Retiring into a market that’s falling significantly, or is about to do so, can seriously reduce the longevity of your retirement portfolio. And that in turn can impact retirees’ financial security.

Under certain scenarios, retirees might be forced to take less income from their portfolios and, in extreme situations, outlive their savings. Needless to say, it’s important to address sequence of returns risk in retirement planning.

Two Portfolios, Two Very Different Outcomes

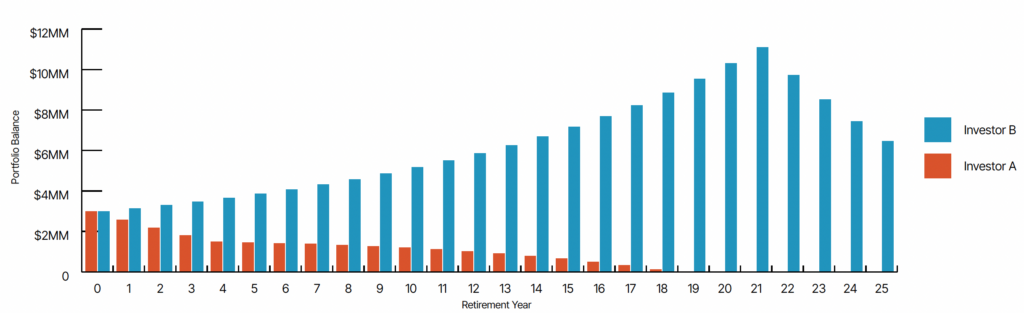

To understand how sequence of returns risk can impact retirement savings, let’s look at a hypothetical example involving two investment portfolios. In this hypothetical example, “Investor A” and “Investor B” retire at the same time, each with a $3 million portfolio. Let’s assume that over a 25-year period, each portfolio averages a 7% return. Both Investor A and Investor B take $150,000 in withdrawals at the beginning of year one and increase those withdrawals by 2% at the beginning of each year thereafter to account for inflation. So far, both investors appear headed for comfortable retirements.

For illustrative purposes only.

Hypothetical assumptions: $3MM balance in Portfolios A and B. $150K withdrawal in year one, with withdrawals increasing by 2% per year over 25 years. Both hypothetical portfolios earn 7% on average, except Portfolio A has a -10% loss a year for the first 4 years, and Portfolio B has a -10% a year loss in the final 4 years of the 25-year period illustrated. This hypothetical illustration is not representative of actual results or any specific investment, which will fluctuate in value. These are not guarantees or projections and no taxes, fees, or expenses are included in the calculations, which would reduce the figures shown.

But let’s assume the two investors’ accounts experience different sequences of returns. Investor A’s portfolio has four initial years of -10% returns. It then has positive returns of 10% in each of the following years. Because of the impact of those early losses, Investor A runs out of money during year 19. That’s despite the fact that his portfolio would have averaged a positive annual return of 7%.

Investor B has a different experience. Her portfolio delivers positive 10% returns in each of its first 21 years. In each of its final four years, however, it returns -10% annually. After 25 years, Investor B’s portfolio will have a 7% average annual return, the same as Investor A’s portfolio delivered during its lifetime. But while Investor A ran out of money after 19 years, Investor B had a positive account balance of slightly more than $6,450,000 after 25 years.

Over that period, Investor B was able to withdraw $1.47 million—or 44%—more than Investor A, with a significant balance remaining. That’s a huge difference in outcomes, and it’s entirely due to the two portfolios’ differing returns sequences.

Watch our brief video for more on the impact of sequence of returns risk.

Compounding Is the Key

The stark difference in outcomes is largely due to the dynamics of compounding. The duration of retirement savings depends heavily on the ability of a portfolio’s reinvested earnings to generate additional earnings over time. Investor A’s poor early investment results diminished the amount of money available to compound.

The good news is that there are several strategies for mitigating retirement timing risk. One is to evaluate your asset allocation. Every investor should regularly confirm that their investments are properly diversified across equities, bonds and possibly other alternatives. Proper asset allocation can help reduce vulnerability to market downturns, which are so damaging in those early years of retirement.

Portfolio Stress Testing

Your wealth advisor can stress test your portfolio to help ensure that you’ve got the right asset allocation. Stress tests use financial modeling to simulate the impact of different market scenarios on a portfolio. Identifying vulnerable assets allows for fine-tuning of portfolio allocations to better withstand potential market volatility.

The Bucket Approach

A bucket strategy can help protect your savings by allocating investments into three buckets: short-term, mid-term and long-term. The short-term bucket includes low-risk assets and cash to be used for immediate expenses, while the mid-term bucket holds lower-risk investments and the long-term bucket focuses on

investments that can generate growth. This approach can help mitigate sequence of returns risk by ensuring that short-term needs are covered by low-risk assets. This gives mid- and longer-term investments time to recover from market downturns without being liquidated at a loss. To replenish your short-term bucket, assets are periodically reallocated—money is moved from bucket two to one and then from three to two.

Buffer Assets

Another approach to managing sequence of returns risk involves the use of so-called buffer assets, such as the cash value of a permanent life insurance policy or lines of credit on real estate. Buffer assets don’t fall in value based on the performance of the market, and tapping into them during volatile markets can allow time for the rest of your investments to recover. In some cases, it can be beneficial to use buffer assets in conjunction with the bucketing technique.

Consult With Your Advisor

Your wealth advisor is well versed in retirement income strategies and can recommend the best approach to managing sequence of returns risk based on your specific situation. At Mariner, we can help you create a wealth plan designed to help you successfully navigate your retirement years.

This article is intended for informational and educational purposes only. The views expressed do not take into account any individual personal, financial, or tax considerations. It should not be construed as personalized advice or a recommendation to engage in any investment strategy. The information contained herein is taken from sources believed to be reliable. However, the accuracy or completeness cannot be guaranteed.

The investment strategies mentioned herein can help manage risk, but they cannot ensure a profit or protect against loss in a declining market. Investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful. Accessing cash value from your life insurance will generally reduce the available cash surrender value and death benefit. Please consult with a advisor before making any financial or investment related decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.