Aligning Your Investment Strategy with Your Values

Investors Fueling Growth in SCI

Known by an alphabet soup of acronyms—SCI, ESG, SRI, among others—socially conscious investing is an umbrella term for an investment approach that reflects what we value, how we wish to live and how we spend our money. Increasingly, investors want to do good with their money. Companies, in turn, have both economic and moral reasons to pursue opportunities related to the environment and society. Below are some examples of categories SCI portfolios focus on.

Building a Socially Conscious Portfolio

Underscoring this trend, a majority of asset managers—77%—recently reported having a growing interest in socially conscious investing, driven by pressure from investors.1 Asset managers have responded by introducing investments designed to satisfy investors’ desire to make the world a better place.

As a result, investors have flocked to socially conscious investments, with total assets in U.S. socially conscious investing funds hitting $8.4 trillion in 2022. That figure represents 12.6%, or one in eight dollars, of total U.S. assets under professional management.2

Younger Generations Driving SCI Demand

Given that 50% of investors identify climate change as their top investment priority,3 it’s no surprise that younger people who likely will live longer with the worsening effects of this phenomenon appear to be more willing than their elders to match their financial objectives with their personal values.

Reflecting this attitude, a recent survey found that today’s younger generation is driving demand for investments that advance environmental and social goals, with roughly two-thirds of Millennial and Gen Z investors saying they are very concerned about issues such as rising carbon emissions and wage inequality. On the other end of the age spectrum, about the same percentage of baby boomers say they are only somewhat or not at all concerned about these matters.4

Performance In Line With Traditional Investments

When socially conscious investing began to gain traction in the 1960s, it was dismissed by most asset managers on the belief that such value-focused investments, which avoided companies or industries that, for example, manufactured military equipment or other objectionable products, underperformed “traditional” investments that focused solely on shareholder profits.

Today, asset managers recognize that companies led by good management teams are not only good social stewards but also good employers. As a result, such companies often are more productive—and therefore, more profitable. In other words, they are doing well by doing good.

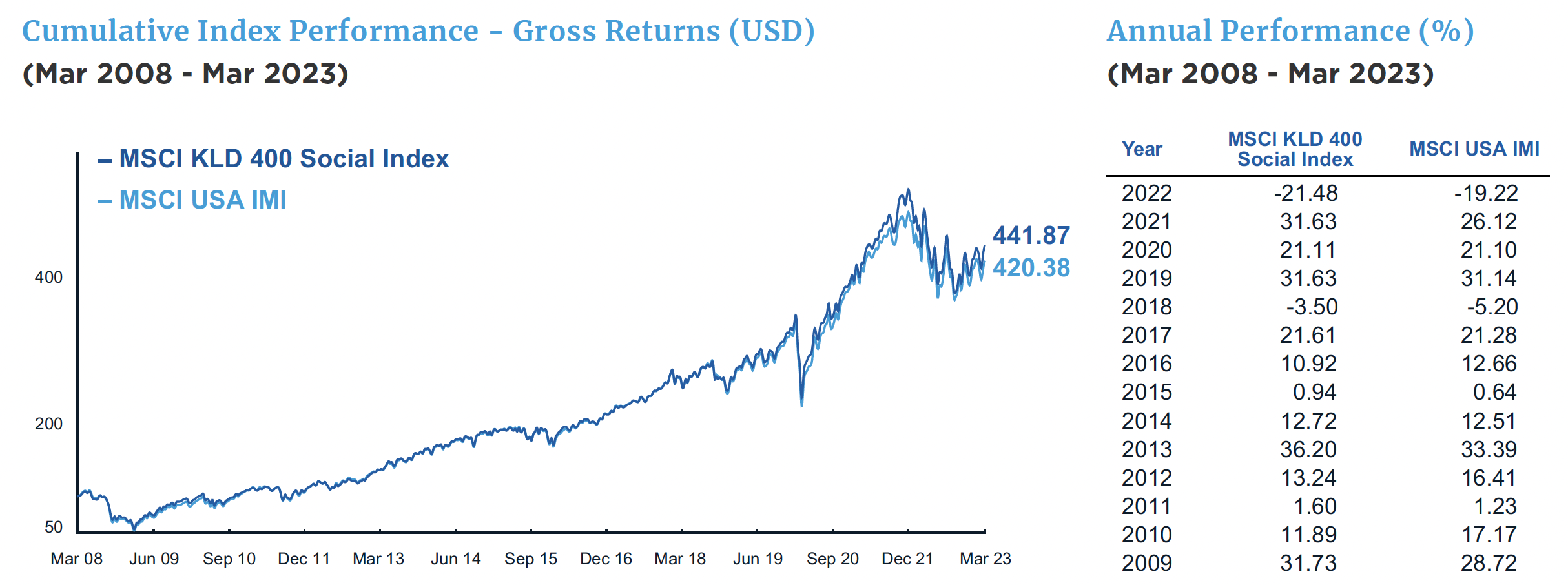

The chart below illustrates this point. Over the past 15 years, the performance of socially conscious companies tracks closely with that of the overall market. What’s more, despite challenging market conditions in 2022 that resulted in losses across the board, demand for socially conscious investments remains strong.

Source: MSCI

The MSCI KLD 400 Social Index is a market capitalization-weighted stock index focusing on companies that maintain high environmental, social and governance (ESG) standards. The MSCI USA Investable Market Index (IMI) is designed to measure the performance of the large-, mid- and small-cap segments of the U.S. market. The indexes are unmanaged and cannot be directly invested into. Past performance does not guarantee future results.

Taking a Blended Approach

Historically, socially responsible investing—or SRI—has applied an “out with the bad” exclusionary process that avoids companies whose products may include tobacco, guns and contraceptives, for instance.

Environmental, social and governance investing, known as ESG, uses a more nuanced “in with the good” inclusionary process that looks at a company’s practices, how it measures up against those criteria and how it plans to better incorporate ESG principles in its business strategy going forward.

At Mariner, we work with our clients to determine if these are strategies that make sense for their goals. Our clients are able to invest with respect to their personal values, and our advisors are always here to help them do so. If we determine that it is, we believe in allowing for flexibility in the approach by offering approaches to SRI and ESG mandates through individual stock strategies, mutual funds, exchange-traded funds and separately managed accounts

Meet With Your Wealth Team

Aligning your investments with your values starts by having an in-depth conversation with your wealth advisor. What role does money play in your life? What’s most important to you? What long-term portfolio return do you need to achieve to meet your investment objectives?

Based on your answers to these questions, your wealth advisor can then collaborate with our in-house investment team to build a portfolio that reflects your values. You can choose socially conscious investments as a complement to other investments within a broader portfolio, depending on your goals.

Sources:

1“Sustainable Signals: Opportunities for Asset Managers to Meet Asset Owner Demands.”

2“2022 Report on US Sustainable Investing Trends.”

3“Sustainable Signals: Opportunities for Asset Managers to Meet Asset Owner Demands.”

4“The ESG Generation Gap: Millennials and Boomers Split on Their Investing Goals.”

Socially Conscious Investing–Depending on the strategy or client-specific restrictions, a client’s account may undergo exclusionary or inclusionary screening based on environmental, social and corporate governance criteria, as well as other criteria based on religious beliefs. These criteria are nonfinancial reasons to exclude or include or security and therefore the client’s account or strategy may forgo some market opportunities available to portfolios that don’t use such screening. Stocks selected following these criteria may shift into and out of favor with stock market investors depending on market and economic conditions, and the client’s or strategy’s performance may at times be better or worse than the performance of accounts or strategies that do not use such criteria.

This article is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.