Which Charitable Strategies Can Help Cut My Tax Bill?

With the lifetime estate and gift tax exemption, currently $12.92 million for individuals,1 scheduled to sunset in two years and decrease to around $6 million starting in 2026,2 now is a good time to make the most of your charitable giving strategies.

Q: How Can I Optimize My Charitable Giving While Getting a Tax Benefit?

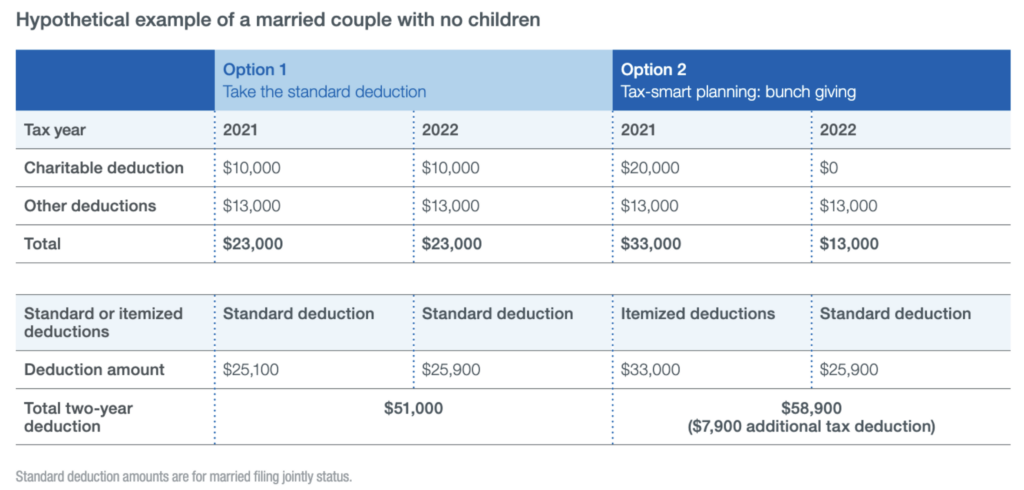

A: Consider “bunching” charitable contributions. Using this strategy, you can make larger charitable contributions less often, for example, every other year, to exceed your itemized deduction limit and potentially benefit from an additional deduction that year, as option 2 in the table below illustrates.

Some charitably inclined individuals may feel uncomfortable “skipping” a year’s worth of donations using bunching, but, in fact, you’re only postponing them. It’s a win-win for you and the charities you choose to support. A donor-advised fund (DAF) is one way to bunch charitable contributions.

Source: www.schwabcharitable.org

Q: What Are the Tax Benefits of a DAF?

A: A DAF offers an immediate tax deduction in the year it was opened and the opportunity to defer your decision of which eligible charity will be the beneficiary of the funds. You end up giving the same amount to charities you otherwise would but reap the tax benefit of itemizing on your current return.

Q: Can I Make a Charitable Gift Directly From My IRA?

A: Depending on your age, yes. Qualified charitable distributions (QCDs) allow those over age 70½ to redirect up to $100,000 of an IRA to charity. This can be a meaningful benefit, as any amount contributed to a qualifying public charity is excluded from adjusted gross income and the calculations that impact overall tax rates, the taxation of Social Security benefits, income tax phase-outs and Medicare premiums. QCDs are not considered an itemized deduction and therefore are not subject to standard or itemized deduction limitations.

Note that for distributions made in taxable years beginning after Dec. 31, 2022, you can make a onetime election of up to $50,000 for qualifying charitable distributions to certain split-interest entities (including charitable remainder trusts; see below).

Q: Can I Generate Income for Myself While Benefiting Charities I Support?

A: Yes. A charitable remainder trust (CRT) is what’s known as a split-interest giving vehicle because it enables you to pursue philanthropic goals while producing an income stream for yourself (or other noncharitable beneficiaries) and reducing your taxable income.

Q: How Does a CRT Work?

A: As the trustor, you set up and fund the CRT with your contributions. Based on the terms of the trust, over a specified period of time—no longer than 20 years or your lifetime (or that of one or more noncharitable beneficiaries)—you or your named beneficiaries will receive regular payments from the trust. You are eligible for a partial tax deduction based on its assets, and any amount left over is donated to the charities you’ve designated in the trust.

Q: What Assets Can I Contribute to a CRT?

A: The following types of assets can be used to fund a CRT:

- Cash

- Publicly traded securities

- Real estate

- Private business interests

- Private company stock

Q: Can I Combine a CRT With a DAF?

A: Yes. If the named beneficiary of your CRT is a charity that sponsors a DAF, you gain the flexibility to easily recommend and modify grants within your DAF. Work with your wealth advisor to explore your options.

Sources:

2“Estate tax current law, 2026, Biden tax proposal”

3“IRS provides tax inflation adjustments for tax year 2023.”

This is provided for informational and educational purposes only, and the views expressed do not take into account any individual personal financial, legal, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, tax advice, or a solicitation to or recommendation to engage in any strategy mentioned. Any opinions expressed are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information. The use of trusts involves complex laws, tax rules, and regulations. Interested parties are strongly encouraged to seek advice from qualified tax, legal, and financial professionals before making any financial-related decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.