Utilizing P&G Preferred Shares in Retirement For Charitable Giving

One issue many Procter & Gamble retirees run into is devising a strategy to continue gifting charitably after income from employment ceases. Oftentimes, gifting during working years simply comes from extra cash, but in retirement, cash is needed for living expenses.

If you, like many P&G’ers, take advantage of the net unrealized appreciation opportunity for the preferred shares in the profit-sharing trust (PST) at retirement, there is a gifting strategy that may make more sense than gifting cash in retirement. Simply gifting the preferred shares has many potential benefits.

Most 501(c)(3) charitable organizations will accept stock in lieu of a cash gift. In addition, there are quite a few potential benefits to donating stock. Consider this scenario in which one retiree is gifting cash and the other is gifting stock:

Donor 1: To gift cash, Donor 1 needs to sell his/ her preferred shares. This could result in a long- term capital gains tax, which can range as high as 23.8% at the federal level. The result? The charitable organization receives less than what the stock was worth, or the donor sells more preferred shares to accumulate the desired gift amount.

Donor 2: In this scenario, Donor 2 gifts the preferred shares directly to the charitable organization. The result? The long-term capital gains tax is avoided, and a donor is able to give the charity the desired gift amount without selling more stock.

If you’re unsure of the organization you want to support charitably or want to make significant charitable gifts over a period of time, consider using a donor-advised fund (DAF).

With a DAF, you make a larger charitable donation in one year, allowing you to have a larger impact on your tax return, but then spread the gifting of the donation out over several years.

In addition, you can pass along any ungifted assets in a DAF to a beneficiary, and he or she can gift the assets out over his or her lifetime.

Lumping several years’ worth of charitable deductions into one year rose to prominence with the passing of the Tax Cuts and Jobs Act of 2017. The new tax law capped the amount of state and local taxes that were deductible to $10,000.

Consider a retiree who no longer carries a mortgage (thus, cannot deduct mortgage interest), his or her annual charitable gifts would need to be more than $14,250 to receive a tax deduction for any dollars gifted.

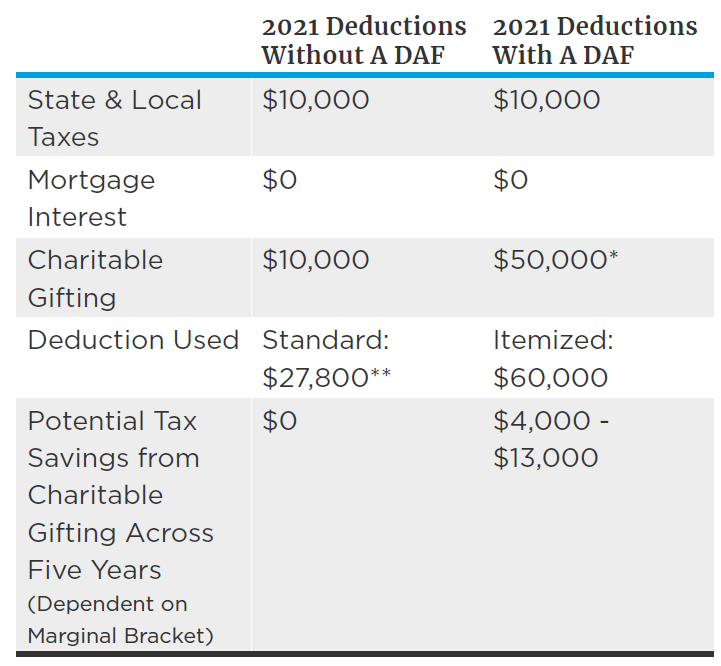

This is where a DAF enters the conversation. Consider the scenario below, in which a P&G retiree decides to gift five times their annual charitable amount ($10,000) in one tax year:

Source: irs.gov

*When gifting long-term appreciated assets (such as preferred shares post-NUA distribution), the charitable deduction is capped at 30% of adjusted gross income.

**Federal deduction for married filing jointly. This assumes both retired spouses are over age 65.

This use of the DAF has three main advantages:

- The lumping of charitable contributions causes you to breach the standard deduction, resulting in a large tax benefit.

- Gifting appreciated assets allows you to access the value of the stock that has large, embedded gains without personally realizing them.

- Lastly, this can be a tool used to hasten your diversification from P&G in a tax-free manner.

Once within the DAF, the P&G preferred shares (or any other appreciated asset) can be sold and reinvested with no taxes incurred. Any market growth can be gifted anytime during the life of the DAF.

If you have any questions on how the use of a DAF and gifting of P&G preferred shares may play into your retirement plans, please contact your team at Mariner Wealth Advisors, or Nate Kunkel and Brad Morgan directly.

This piece is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.

MWA does not provide all services listed in this piece. Some services are provided by affiliates and are subject to additional fees. Additional fees may also apply for tax planning and preparation services.

Certain MWA representatives are licensed insurance agents and are compensated for the sale of insurance-related products through an affiliated insurance agency.

MWA may recommend that clients authorize the active discretionary management of a portion of their assets by and/or among certain manager(s), including mutual funds, private funds or separately managed accounts managed by one or more advisory affiliates, based upon the stated investment objectives of the client. This is a conflict of interest.