U.S. Macro Economy Growing, Albeit Slowly

Read time: 9 minutes

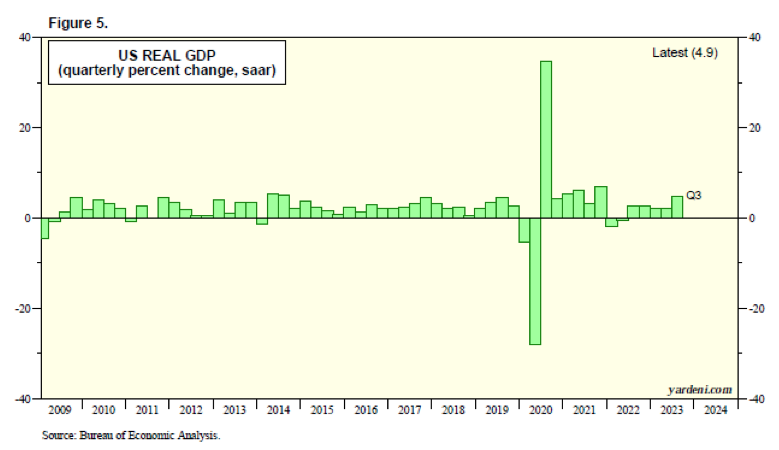

On Nov. 1, the Bureau of Economic Analysis (BEA) released its first report concerning growth of the U.S. macro economy for the third quarter. The report showed the U.S. economy grew by a stunning 4.9%, up from the second quarter growth of 2.1%. I am raising my estimate for 2023 gross domestic product growth from 1.5% to 2.2%. I retain my view that “core” inflation will continue to improve (decline) to 3.8% this year, down from 4.1% year over year.

Happy Days!?

Before we don our party hats and toot the noisemakers, we need to understand if this upshift in growth rates is sustainable. Much of what I am seeing tells me that while 4.9% is a good number (better than expected), much of the stimulus leading to this number is probably not sustainable. Let’s take a look at the numbers.

Chart source: Yardeni and Associates

As noted, the latest quarter real GDP growth rate is among the highest we have seen for quite some time (excluding the post-pandemic rebound of late 2020).

That being said, if we look under the hood, we find much of the growth in the third quarter may not prove sustainable. First, we need to x-out the inventory build/depletion rate to understand the number, as this line item tends to reverse itself quickly. Businesses increased their inventory accumulation rate, which accounted for a full 1.3% of the 4.9%.1 Residential investment accounted for 0.5%, and government spending chipped in 0.8%.2 Housing permits have recently taken a decided turn for the worse due to the upward spike in mortgage interest rates. Government spending, while perhaps sustainable over periods of time, isn’t counted as a true “growth” additive over the longer term.

So, a full 2.6% of the 4.9% growth rate came from factors that could be argued as “non-sustainable” or may reverse rather quickly. That still brings the GDP number to 2.3%, a respectable result, driven by personal consumption.

Risk-based asset prices swooned on the BEA report, as investors tended to focus on the Federal Reserve’s potential action of another interest rate increase due to the strength of the report. As of its November meeting, the Fed chose not to raise rates. As I have outlined, the majority of the report’s positive additives are classified as non-sustainable items.

Finally, it is important to understand that inflation reports continue to show good news, on balance. Core PCE (Personal Consumption Expenditures – the Fed’s favorite measure of inflation pressure) was +3.7% on a year-over-year basis ending in September.3 The Conference Board report for the third quarter shows that core PCE came in at +2.4% annualized versus +3.7% annualized in the second quarter.4 The data indicates the downward pressure in inflation pressure is continuing.

This all adds up to the Fed placing its upward march in interest rates on hold for the time being. We suggest if another rate increase occurs, it probably won’t happen this year.

Initial 2024 Outlook – Slower Growth and Lower Inflation Expected

As many are aware, I have been suggesting that the probability of an upcoming recession is higher than normal. Since the end of World War II, our economy has been in recession 12% of the time.5 This suggests that the “baseline” probability of the economy being in recession is 12%. We have been suggesting the probability going forward is closer to 50%. While I haven’t thought that an economic recession is absolutely going to happen, I have suggested the probability is higher than normal.

I have used two main models in the past to gauge the probability of an upcoming downturn: the yield curve models and the rate of change of the leading economic indicators (LEI). Both still suggest the possibility of an upcoming economic downturn to be higher than normal. Why hasn’t a recession occurred yet? I covered that issue in my October commentary and won’t go in to the statistical and fundamental data here, but I still carry an outsized chance that, yes, the U.S. economy may indeed see an economic downturn sometime in 2024.

With that probability comes an increase in the unemployment rate and a possible decline to one degree or the other (probably for a short period) where corporate profits contract. Along with that, the Fed may indeed start to reduce interest rates, because during an outright downturn, inflation will probably become yesterday’s worry and should recede back to the Fed’s target of 2%.

If a recession is forthcoming, I suggest it should be rather mild, particularly in relation to the 2007 to 2010 Great Recession’s intensity. The downturn should not only be mild but short-lived.

Following are my estimates for GDP growth and inflation (core) levels for 2024.

| 2023 | 2024 | “Street” Estimates – 2024 | |

|---|---|---|---|

| Real GDP Growth | 2.2% | 1.5% | 0.7% |

| Inflation | 3.8% | 2.5% | 2.9% |

Per the most recent CNBC poll reported on Oct. 31, 49% of those polled thought the economy was going to be in recession sometime in 2024. In addition, 42% of those polled thought the economy was going to stay out of recession but would experience a soft landing, or a period of weak growth accompanied by a reduction in inflationary pressures. I concur with those thoughts, in general.

Drivers of the expected slightly lower GDP in 2024 versus 2023:

- Since the end of the pandemic, consumption has represented 88% of economic growth, as compared to the long-term trend of 70%.6 Consequently, we need to focus on that segment of economic activity to notice a general slowing in activity.

- The level of “excess” savings (personal savings levels over and above long-term trends) is now less than $1 trillion, down from a high of $3.5 trillion.7 Much of this is in the hands of the upper-income levels, which have a lower marginal propensity to consume.

- Consumer revolving credit (primarily credit cards) utilization increased by 10.8% over the last 12 months and by 30.6% over the last two years.8 The consumer is starting to become financially challenged.

- With 30-year average mortgage rates now above 8%,9 homeowners are hesitant to place their homes on the market. According to CoreLogic, upward of 80% of homeowners who have mortgages are paying less than 5% for their existing loan. This has led to a lack of supply in the market. I have previously written that data shows the average household income is insufficient to qualify for the average home purchase at 8% interest rates. It appears the housing market is frozen. Demand is stagnant, as new mortgage applications have contracted recently.10

- With a weakening overall growth profile, I suspect unemployment may rise slightly next year. I am targeting unemployment to rise to about 5% by the end of 2024, which should place pressure on consumption spending growth.

If my outlook starts to become reality in 2024 (lower inflation and lower GDP growth), I suspect the Fed may eventually pivot its policy and start to reduce the federal funds rate, particularly if we see short-term weakness develop in reported GDP growth rates, the probability of which is still higher than normal, in my opinion.

Other Thoughts Regarding 2024

I remain in the camp where, if a recession is to occur, it will probably be much weaker than the Great Recession of 2007 to 2010. I have written extensively about the fact that a new economic “regime” is unfolding. Gone are the days where rising economic globalization is supplanted by more nationalistic trends along with the friction that accompanies this new environment.

- From a global perspective, I expect trade to represent less of overall global economic activity than has been the case in the past. This weakening trend has been in place since 2008, when global trade peaked at 61% of global GDP, up from 35% in 1982.11 In 2021 trade had fallen to 56% of global economic activity.12 Onshoring and multichannel distribution channels are becoming normal. The days of sub-2% and extremely low interest rates are probably behind us.

- As the developed world ages, I expect to see continued oversized government deficits, not only in the U.S. but also in other major western economies. On balance, this trend should continue to support higher interest rates than we have witnessed over the last decade.

- International political and economic tensions may remain heightened in 2024.

- I think 2024 will contain surprises on the political front, being an election year. As most politicians in Washington are up for reelection in 2024, I suspect government spending certainly won’t retreat, and the deficit may become a big issue on voters’ minds as they enter the voting booth.

- Interestingly, U.S. GDP growth rates have averaged 3.30% during previous presidential election years since 1947. Overall GDP growth, on average, over that period for all years has been 3.14%.13 The presidential election years haven’t been historical standouts for growth, one way or the other.

Wrap-Up

Much of the initial growth shown in the third quarter GDP report will probably prove unsustainable. We also need to remember that the quarter report is the initial report for the quarter and will be revised twice before it is finalized.

Inflation data continues to point to the view that the real work, the heavy lifting if you will, of the Fed’s inflation-fighting activity is gaining traction. The BEA third quarter GDP report points to the view that, yes, the Fed’s interest rate increase action is now on pause. The question is, how long will the pause last? I don’t know the answer to this question.

Going forward, I suggest a brief recession may indeed be in the cards, but it may prove to be the pause that refreshes longer-term sustainable growth. Unemployment may rise slightly, consumption growth may slow, but if the projected slowdown does its work, the stage should be set for a nice rebound in the economic environment as 2024 ends and the political merry-go-round in Washington becomes clearer.

After 10 long years, I have adopted a more positive bias toward the bond market. Has enough medicine been applied to cure the economy from the inflation spike? Again, I don’t know. But if the cure is in, investors may want to look toward the fixed income market for opportunities.

At 5% yield, the 10-year U.S. Treasury note is priced to pay a “real” return of 2% (at 3% sustained inflation), which is the average “real” return the 10-year note has paid over the last 50 years.14 This is the first time we can say that, yes, bonds across the “curve” pay positive yields in relation to inflation. A good development for fixed income investors.

Footnotes

1,2Mortgage News Daily

3,4Bureau of Economic Analysis

5The Conference Board

6Bureau of Economic Analysis

7,8St. Louis Federal Reserve

9Bankrate.com

10National Mortgage News

11,12World Bank

13,14St. Louis Federal Reserve

This commentary is provided for informational and educational purposes only. The information contained herein is not intended to be personalized advice or a solicitation to buy or sell any security or engage in a particular investment or other strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass.

Any opinions or forecasts contained herein are based on information and sources deemed reliable, but we do not warrant the accuracy of the information. You should note that the materials are provided “as is” without expressed or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Investing involves risk and the potential to lose principal. Past performance does not guarantee future results.

This information is not a substitute for specific individualized tax, legal, financial, or investment planning advice. Where specific advice is necessary or appropriate, we recommend that you consult with a qualified professional.

The Leading Economic Index (LEI) consists of 10 components that indicate the short-term future course of various sectors of the economy, combined into a composite indicator of general economic performance.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.