Recession Not on Immediate Horizon

Read time: 7 minutes

Dr. Bob Dieli, who now owns and manages his own economic advisory firm, and I used to work together at Northern Trust in Chicago. I was a high-net-worth portfolio manager (the old version of a wealth advisor) and Bob was a staff economist.

Dieli is an academic economist who received his doctorate from the University of Texas in Austin. I classify myself as a market economist, in other words, someone who received an “advanced degree” in economics from 40-plus years of capital market experiences.

At one time, Bob told me that there was a policy (unwritten) at Northern that forbade the staff economists from muttering the R word (recession). Attempting to call a recession was, in Bob’s words, a “career altering event.” That fear must not be operative today as most economists—both academic and market—don’t hesitate to handicap the onset of a recession.

Recession Probability Higher Than Normal

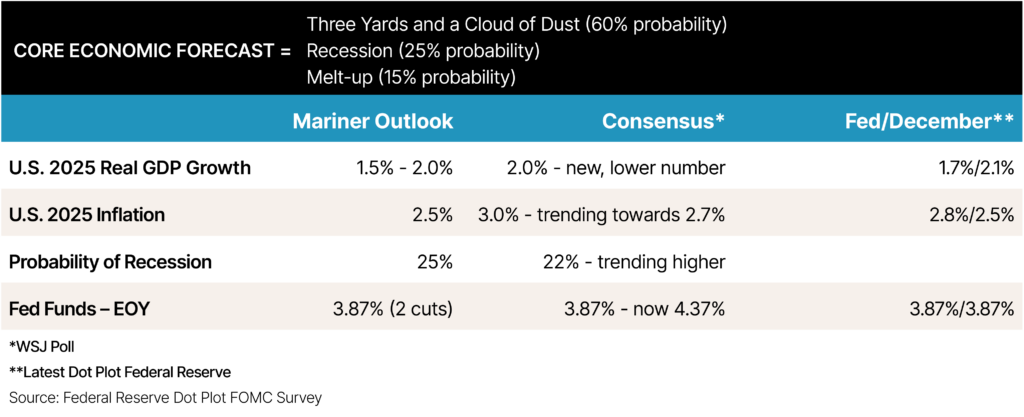

I have titled my core, or main economic theme this year, Three Yards and a Cloud of Dust. I wish to develop in your mind’s eye a vision of slow, labored growth with a lot of noise and distraction occurring. I have been suggesting that the theme has a roughly 60% chance of occurring. Along with my theme, I have been suggesting that yes, we may see a recession this year and have attached a 25% probability of a recession occurring in 2025. Most economists have recently been increasing their forecast for a recession, as the uncertainty unleashed by ever-changing tariff rates is roiling forecasts. I maintain my 25% probability.

Ed Yardeni, another economist I have known and followed since the late 1970s, recently raised his recession forecast probability from 20% to 35%. The latest Wall Street Journal economic poll shows that economists, on average, carry a probability of 22% that a recession will occur in 2025. For comparative purposes, from a historical perspective, the U.S. economy has been in recession 13% of the time since 1945.1 So, all these folks suggest that the probability of a recession occurring this year is higher than normal. I agree with that view.

Why are many economists raising their recession-watch forecasts? The onset of President Donald Trump’s tariff applications, along with the changes from Elon Musk’s efforts with DOGE, are creating economic uncertainty, which is being reflected in not only economic poll results, but also in consumer and small business confidence levels, which have moved downward lately.

Econometric Models are Flashing Yellow

Some econometric models are suggesting a recession may indeed be in the cards. For example, the Atlanta Federal Reserve GDP Now model forecasts first quarter GDP will shrink by 2.8% (real) as of March 28, 2025.2 On the other hand, the New York Federal Reserve Nowcast model predicts first quarter GDP growth of +2.9% as of March 28, 2025.3 Inputs to the models differ. The debate goes on.

Maintaining Our 25% Recession Probability and 60% Probability of Slow Growth

As noted, I haven’t changed my 25% recession probability since last year. Why? Frankly, I’m not seeing a weight of evidence that a recession is on the horizon. Without the evidence, I can’t make a recession call on our core expectation.

First, a recession isn’t currently upon us. Consider that the U.S. added 151,000 jobs in the month of February, and both the unemployment rate and initial unemployment claims remain low at 4.1% (long-term average of 5.7%) and 224,000, respectively.4 One hallmark of a recession is job losses. That isn’t happening, at least not on a macro scale, yet.

Beyond the jobs picture, let me outline other reasons why I’m not yet increasing my recession-odds call.

- In anticipation of rising tariff rates, many businesses have sharply increased their imports since October of last year. Combined with flat export rates, this has led to a $1.5 trillion swing in net imports over the last few months.5 This works against GDP growth calculations, but doesn’t affect final demand growth.

- Business inventories increased by 2.3% on a year-over-year basis in January, led by a 5% increase in retail inventories.6 This too reduces GDP calculations without directly affecting final demand growth rates.

- Typically, if we are moving towards a recession, the Federal Reserve tends to strangle the growth rate in money supply. M2 growth has been ~4% over the last year.7

- The growth in bank lending activity (commercial and industrial, per St. Louis Fed) isn’t collapsing. Over the fourth quarter of 2024, commercial and industrial loans have grown by 2.7% on an annualized basis, as compared to a growth rate of -1.5% three quarters ago, indicating growth demand momentum is slowly rising.8

- Private credit managers raised a net $505 billion in new funds last year, which is fresh capital looking for business loans.9

Then we can look at our three long-held models and find little evidence of an upcoming economic downturn.

- The Treasury yield curve isn’t fully inverted. The two-year Treasury yield was at 3.91% as compared to the 10-year yield of 4.26% on March 28, 2025. Typically, these yields invert (the shorter yield is higher than the longer yield) prior to entering a recession.10

- The six-month rate of change of the Leading Economic Indicators (LEI) is -1.0%. While negative, the six-month rate of change is normally down at least 4.2% prior to the onset of a recession.11

- The ISM/PMI indexes are normally lower than 50 if the economy is coming into a recession. The February reading for the manufacturing PMI is at 50.3 while the services PMI reads 53.5. These are shorter-term momentum indexes and can signal a change in business attitudes/behavior quickly. Again, neither is indicative of a recession on the near-term horizon.11

Following is a table outlining our current Three Yards and a Cloud of Dust 2025 economic theme outlook details along with the current consensus forecast, as reported by the Wall Street Journal economist poll. Also included is the latest data from the Fed’s Dot Plot FOMC survey.

As noted, both the consensus growth expectation of 2.0% and the current the Fed’s growth view is in-line with our current outlook. While we have been carrying a lower growth expectation than previous expectation, both the consensus and the Fed’s views have been reduced to our expectation of slow growth.

Summary

Please note our probability of recession is in line with the new, higher consensus view. Expectations have come to our viewpoint. Frankly, this development makes the contrarian in me nervous!

In-line with our Three Yards and a Cloud of Dust theme, we expect the U.S. economy will stay out of recession this year, but the probability remains higher than normal. We will continue to monitor developments and the weight of the evidence.

Some have asked me: What will it take to change your view? To answer this question, I harken back to a quote from the famous economist, John Maynard Keynes, who, when asked why he changes his view, is credited with saying, “When the facts change, I change my mind. What do you do, sir?” I intend to follow suit.

Sources

1https://www.nber.org/research/data/us-business-cycle-expansions-and-contractions

2https://www.atlantafed.org/cqer/research/gdpnow

3https://www.newyorkfed.org/research/policy/nowcast#/nowcast

4DOL Bureau of Labor Statistics, FactSet

5Data sourced from US Census, FactSet

6US Census as of 1.31.25, FactSet

7Federal Reserve, FactSet

8Federal Reserve

10FactSet

11Conference Board, https://www.conference-board.org/topics/us-leading-indicators

12Source: Institute for Supply Management (ISM), FactSet

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.