Procter & Gamble Stock Option Reporting Changes

With the move of the P&G stock options plan to E*Trade, employees and retirees should consider paying special attention to their stock option income reporting for tax year 2019 and beyond.

In previous years, P&G employees found all of their option income reported on their W2, which could simply be imported into their tax software or reported to their CPA to account for option income and withholding. For 2019 filings, for the first time, you will also be receiving a 1099 from E*Trade. This 1099 will report any stock option proceeds that were taken after the move to E*Trade (May 20, 2019). Note – these option proceeds will ALSO be reported on your W2, Code V. If both are imported to your tax software, you will be reporting 2x the option income – both as ordinary income, and as capital gains on Schedule D – on any options taken after the May 20, 2019 move to E*Trade. This is an error we have already seen with numerous clients.

How to Correctly Report your E*Trade 1099

One solution we have seen is to simply not report the E*Trade 1099. This is incorrect and will likely result in a future audit as the 1099 from E*Trade will be reported to the IRS and does need to be accounted for. Instead of simply ignoring the 1099, please use the steps below to adjust the basis appropriately to what should be showing on schedule D.

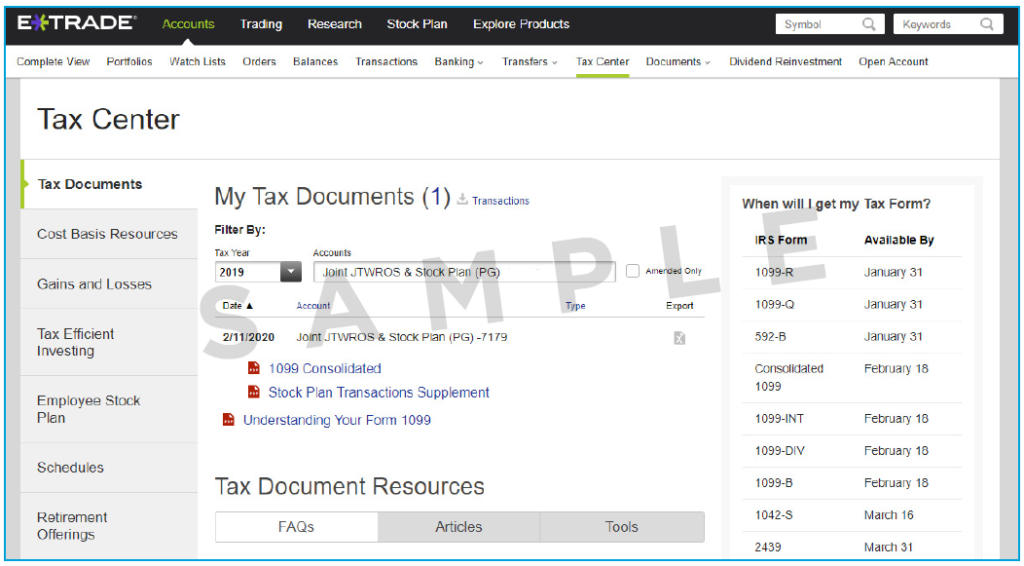

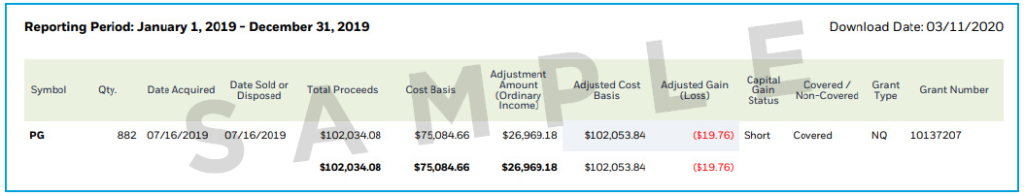

Logging onto your E*Trade account, under the Tax Center banner and in the Tax Documents section, you will find your 1099 Consolidated, which you have already likely received, but in addition you will find the Stock Plan Transaction Supplement. You will want to download this supplement and note (see second image below) the Adjusted Gain (Loss) column. This column represents the adjusted loss that you should report on your 1099 taking into account the option income that was reported on your W2 – this is shown under adjustment amount (ordinary income).

A manual adjustment of your basis is then required on the 1099 from E*Trade so that this loss is reflected, and you are not doubly taxed on this option income. With this change, the addition of your 1099 from E*Trade should add no additional tax liability to your return.

If you have any questions or concerns, please reach out to your wealth advisor or accountant or feel free to reach out to Brad Morgan.

Mariner Wealth Advisors is not affiliated with Procter & Gamble. Any reference to them should not be construed as an endorsement by either party.

This commentary is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.