How the Timing of Withdrawals Can Make or Break Your Portfolio

The saying “timing is everything” rings especially true when you are ready to retire and plan to start withdrawing money from your retirement accounts.

Why Does Timing of Withdrawals Matter?

When you retire, you hope to have enough savings to last as long as you need. As you start to withdraw money from your retirement accounts, you could experience “sequence of return” risk. This risk occurs when the markets generate a sequence of negative returns over several consecutive years as you begin to take withdrawals. This risk shouldn’t be underestimated, because it may result in you not having enough savings to last throughout your retirement.

Let’s take a look at a hypothetical example that illustrates this risk and then strategies you can employ to help manage it.

Two Hypothetical Portfolios, Dramatically Different Results

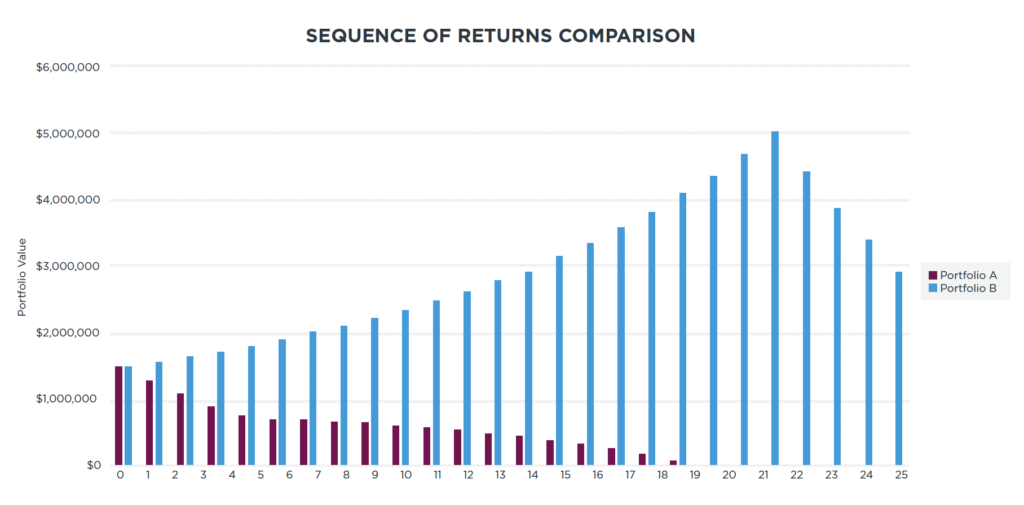

In this hypothetical example (see Sequence of Returns Comparison chart) there are two investors, “Portfolio A” and “Portfolio B,” with the same “average return” of 7% but different sequence of returns (timing).

Hypothetical Portfolio A: This portfolio has four initial years of -10% returns, then consecutive positive returns of 10% for the years following. The investor runs out of money by year 19 in retirement.

Hypothetical Portfolio B: This portfolio has positive 10% returns for the first 21 years and -10% returns for the remaining four years. It has the same 7% average annual return as Portfolio A, but this investor has an ending balance of $2,938,954. That’s a massive difference, all due to timing of withdrawals.

Watch our brief video for more on the impact of sequence of return risk.

For illustrative purposes only.

Hypothetical assumptions: $1.5mm balance in Portfolios A and B. $75k withdrawal in year one, with withdrawals increasing by 2% per year over 25 years. Both hypothetical portfolios earn 7% on average, except Portfolio A has a -10% loss a year for the first 4 years, and Portfolio B has a -10% a year loss in the final 4 years of the 25-year period illustrated. This hypothetical illustration is not representative of actual results or any specific investment, which will fluctuate in value. These are not guarantees or projections and no taxes, fees, or expenses are included in the calculations which would reduce the figures shown.

Strategies to Help Mitigate Risk

Consider the following strategies to help minimize sequence of return risk.

Evaluate Your Asset Allocation

As you near retirement and as you begin to withdraw funds, sequence risk typically increases. For this reason, you might want to revisit how your portfolio is positioned for market pullbacks. For help determining what percentage of your portfolio should be in equities, bonds or other alternatives, we recommend you consult with your wealth advisor.

Estimate Your Income vs. Expenses

It’s easy to focus on how much to accumulate for retirement, but it’s equally important to estimate what you’ll spend. If you’re looking to maintain your current standard of living, work with your wealth advisor on a personal cash-flow analysis to review current sources of income versus expenses. This will give you a reference point for projecting future spending. If the market is down as you start to withdraw funds in retirement, you may choose to reduce discretionary spending. Consider using liquid assets, such as cash, to pay for the essentials and use other income sources for discretionary items.

Stress Test Your Portfolio

Stress testing your portfolio allows your wealth advisor to assess the potential impact of economic scenarios, such as a recession, on your portfolio and other investments. In a stress test, your wealth advisor constructs “what if” scenarios based on real-life macroeconomic uncertainties and measures their potential impact on your portfolio.

Working with your advisor to look at these potential scenarios can help you ensure your portfolio’s asset allocation aligns with your risk tolerance. For example, if you have 80% in equities but can’t stomach a 25% portfolio loss, you may want to rebalance your portfolio to better reflect your risk tolerance.

Take the “Bucket” Approach

A “bucket” approach to asset allocation might help you plan your cash flow for retirement. For example, you could have a short-term bucket that includes cash and money market investments to pay for everyday expenses and emergencies. These types of investments could help prevent you from having to sell securities for cash at a potentially inopportune time to meet expenses.

A mid-term bucket could include combining capital with liquid investments, such as a diversified bond ladder, in which bonds mature quarterly or annually to gradually provide cash flow.

Your long-term bucket could be designed to keep your portfolio growing and outpacing inflation and is typically made up of more volatile investments.

Funding the Buckets

Spending from the short-term bucket means that it will eventually need to be refilled. This is done through distributions from the mid-term bucket, which, in turn, is refilled from the long-term bucket. Since the long-term bucket would be more sensitive to market volatility, turning off the “spigot” of refilling distributions to the mid-term bucket during market pullbacks allows your long-term investments time to recover before tapping into them again. This technique has the potential to extend the longevity of your investment portfolio. Your advisor can help determine the appropriate size of each of these buckets based on your unique situation and when it may make sense to turn the spigots on and off.

Consider Using “Buffer Assets”

Just as the bucket approach can help mitigate the negative effects of sequence of returns risk, so too can using “buffer assets” as a source of funds. Buffer assets are those with values that aren’t determined by the performance of the market. Some examples of these types of assets include the cash value of a permanent life insurance policy or lines of credit on real estate. By tapping into this value to cover expenses when markets are down, it allows time for your investments to recover. Although similar in some ways to the bucketing technique, using the value of buffer assets is somewhat different and can be done in conjunction with bucketing. There may be other financial planning considerations to account for before tapping a buffer asset (potential interest, fees, taxes, etc.), so consult with your advisor about your specific situation.

Allocate Accordingly for Future Health Costs

Health care represents one of the biggest expenses in retirement, and it can drain a portfolio quickly. Having some amount invested to cover these costs is essential, because a health event could occur anytime and pulling large amounts of money out of your retirement accounts during a down market to cover costs could compound sequence of return risk.

Consult With Your Advisor

Work with your wealth advisor on an appropriate strategy for you to create a balanced retirement portfolio and timing of withdrawals for income to help minimize the potential for sequence of return risk. At Mariner, we’re here to help you navigate your financial future.

Disclosure:

This article is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services. The views expressed are for informational and educational purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to engage in any particular strategy. Consult your financial professional before making any financial or investment-related decisions.

There is no guarantee that any strategy referenced herein will be successful. Investing involves risk, including the possible loss of principal. Asset allocation is an investment strategy designed to help manage risk, but it cannot ensure a profit or protect against loss in a declining market.

Depending on the types and amount of securities within a bond ladder, it may not ensure adequate diversification of your investment portfolio. While diversification does not ensure a profit or guarantee against loss, a lack of diversification may result in heightened volatility of your portfolio value. Fixed-income securities carry interest rate risk. As interest rates rise, bond prices usually fall, and vice versa. Fixed-income securities also carry inflation, liquidity, call, credit, and default risks. Any fixed-income security sold or redeemed prior to maturity may be subject to a loss.

Accessing the cash value of a life insurance policy will reduce the available cash surrender value and death benefit.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.