Cash Balance Pension Plans For Dentists

Timing your exit from your practice is critical to make sure you can maximize the amount of money and profit you take with you. In addition to pre-sale business planning, taking certain steps to maximize your retirement assets is also possible with techniques like cash balance plans.

A cash balance pension plan is a tax-deferred (qualified) retirement plan that provides an alternative means of potentially accelerating retirement savings with the benefit of tax deductibility.

Participant accounts exhibit the combined characteristics of a traditional defined benefit (DB) plan, including high contribution amounts and guaranteed benefits, with those of a defined contribution (DC) plan, where each participant maintains an account with a portable balance.

Why Cash Balance?

Tax Reduction

- Contributions are tax deductible, and investment earnings grow tax deferred until withdrawn.

- Significant potential deferral allowances make cash balance a powerful income deferral tool.

- In the event of a change of employment, account values may be rolled into an IRA, sustaining the account’s tax-favored treatment while providing portability.

Accelerated Retirement Savings

- When business principals and partners combine a cash balance plan with a 401(k)-profit sharing plan, pre-retirement savings amounts have the potential to be significantly increased.

- Accelerated contributions may allow for a lifetime of retirement savings to be compressed into a much shorter time period (versus contributions without a cash balance retirement strategy).

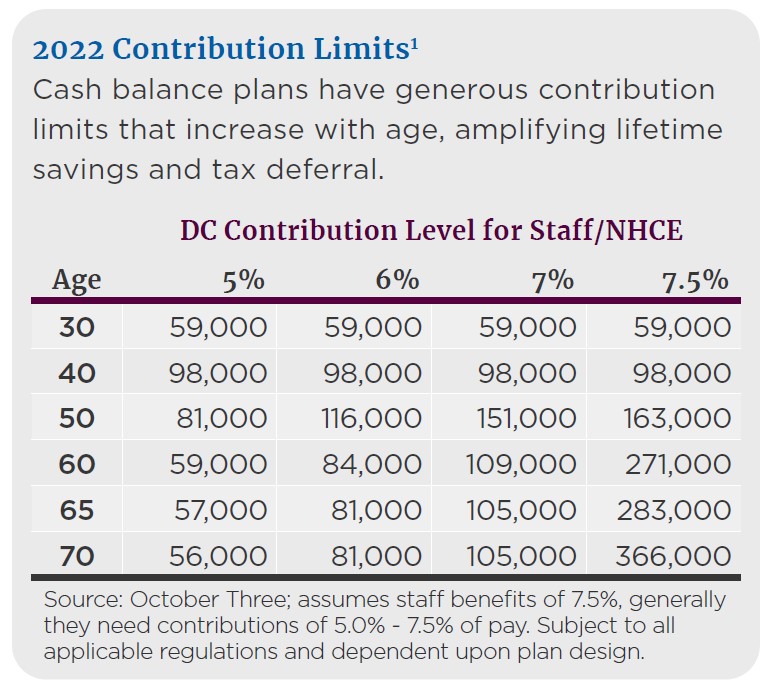

- Annual contributions can range from $59,000 to $366,000, subject to current laws and limitations, with a lifetime benefit of approximately $3 million.1

Stabilized Asset Growth

- Unlike traditional defined benefit plans, growth is achieved primarily through contributions and real earnings and is less reliant on total return strategies.

- Conservative benchmarks, attractive plan design and a short time horizon can be used to diminish volatility in plan values, providing for greater potential contribution stability.

- Cash balance plans may act as a substitute for principal preservation strategies within an overall retirement strategy.

Ancillary Benefits

- Plan assets receive protection from creditors in the event of bankruptcies or lawsuits.

- The generous contribution limits within cash balance plans increase with age, potentially amplifying lifetime savings and tax benefits.

Is Cash Balance Right for You?

- Do partners have an appetite for potentially increasing retirement savings above what is currently available?

- Is this appetite likely to be sustainable for five or more years?

- Is the plan sponsor willing to contribute at least 5% of payroll toward staff retirement benefits?

If the answer to these questions is YES, allow your Mariner representative to provide a comprehensive review of your contribution and tax reduction options through a customized proposal.

Cash Balance Plans: A Powerful Retirement Option

Plan sponsors can tailor their plan to minimize funding risks, while at the same time offering participants a meaningful mechanism to potentially increase tax-deferred retirement savings. In today’s rapidly changing and competitive business environment, the added benefits of a cash balance retirement offering could help attract qualified job candidates and retain valuable employees, which, in turn, helps with business continuity and success.

Mariner has partnered with experienced service providers in the cash balance arena to bring our clients a professional, coordinated and turnkey solution in the areas of plan design, implementation and monitoring, investment management and tax efficiency.

Contact your Mariner representative to discuss whether a cash balance plan may be right for your business team.

Source:

1IRC 415

Some or all services listed in this piece may or may not be offered depending on the needs of each specific plan.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.