Bond Ladders

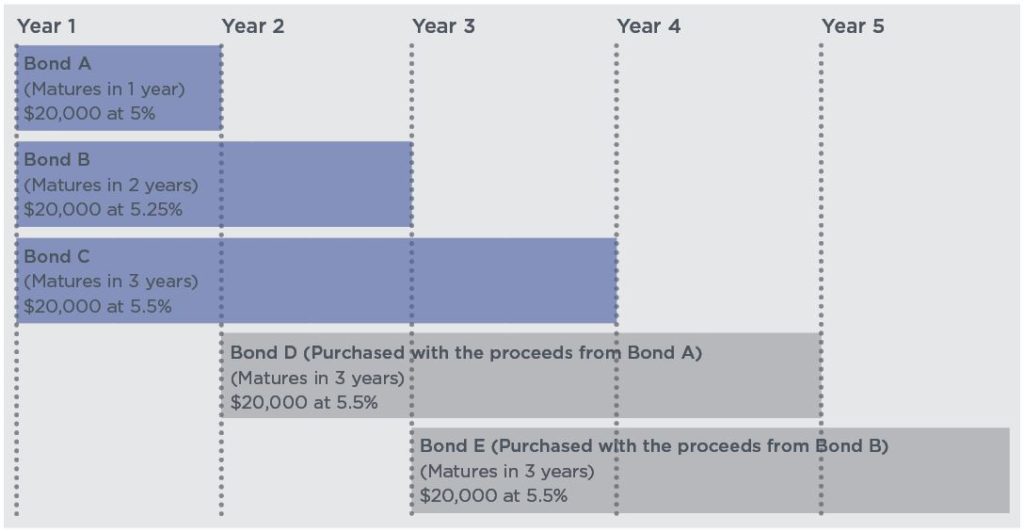

In a bond ladder, the bonds’ maturity dates are evenly spaced across several months or several years so that the bonds are maturing, and the proceeds are being reinvested at regular intervals. The more liquidity that an investor needs, the closer together his or her bond maturities should be.

If interest rates climb in future years, as is likely from today’s low levels, the prices of existing bonds with lower rates will fall. The impact may be felt more keenly by holders of bond mutual funds and exchange-traded funds than by investors who have bought individual bonds. The latter have the option to collect their bonds’ full face value at maturity, while bond mutual funds don’t mature.

Using Bond Ladders in a Retirement Plan

A principle of retirement planning is to have three to five years of predictable cash flow to live on during the first several years of retirement. If you retire at the beginning of a down market, you will not have to sell stocks that are down to have enough cash available to live.

The concept is to create a bond ladder with each rung of the ladder representing one year of budget needs. If the market is positive, you sell stocks that are up and live on that money. The bond that comes due that year is reinvested at a new higher rung on the ladder to become due in a later year. If the market is negative, you use the bond that year for your budget and keep the stocks invested in the market, allowing them to get back into positive territory.

Example of a Bond Ladder

The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. It is not intended to be personal legal or investment advice or a solicitation to buy or sell any security or engage in a particular investment strategy.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.