3 Steps for Creating a Retirement Cash Flow Plan

Having a clear idea of income sources and estimated expenses in retirement can help you stay on track to live comfortably and even leave a legacy to heirs and charities.

3 steps for creating a cash flow plan for retirement:

- Define Income Sources

- Estimate Expenses

- Develop a “Bucket” Strategy

1. Define Income Sources

Employer-offered retirement accounts like 401(k)s, Roth 401(k)s and 403(b)s often form the backbone of investors’ retirement plans. You may also have an IRA or Roth IRA and be counting on a traditional pension or Social Security to provide additional income once you’ve stopped working. Alternatively, you may opt to work part-time in retirement to boost your savings and stay mentally engaged. Other sources of income could include rental properties, an inheritance and a life insurance policy with a cash value.

Given that rising interest rates, market volatility, inflation and other factors have likely reduced the value of your investments, having multiple income streams can help ensure you have enough retirement assets to last throughout your lifetime.

2. Estimate Expenses

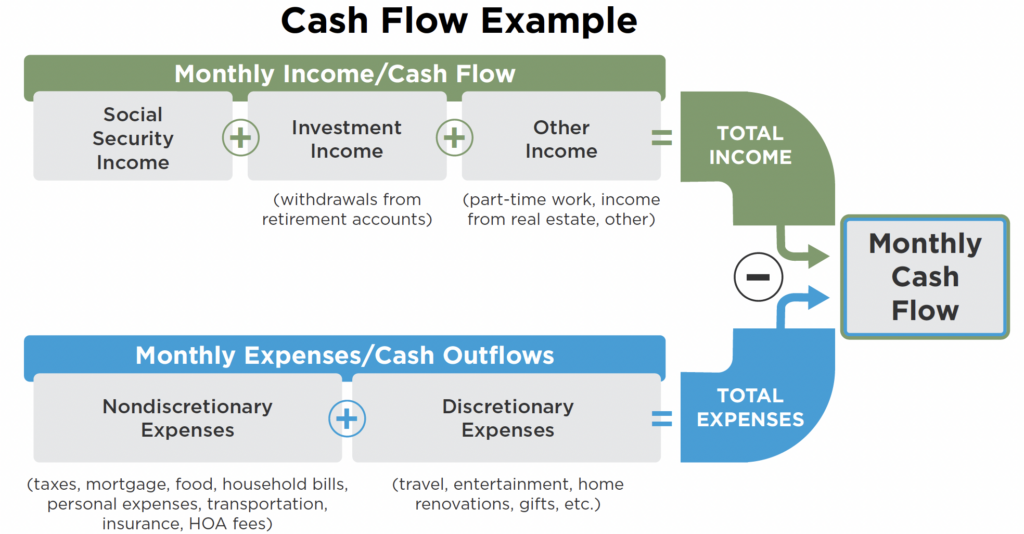

To better estimate what your expenses will be in retirement, it’s advisable to define current pre-retirement expenses, sorting them by nondiscretionary and discretionary. Your wealth advisor can provide tools to help you categorize and track your expenditures or recommend apps or software that can do it for you.

Source: Mariner. For illustrative purposes only.

You’ll also want to work with your wealth advisor to factor in taxes on certain retirement account withdrawals and to consider the impact of inflation.

Likewise, your plan should account for the ever-increasing costs of health care, including long-term care, considering that 70% of us will require long-term care during retirement.1 Your health care cost estimate should also reflect your expected longevity, determined in part by your individual health and your family’s health history. You may choose to use personal assets or an insurance policy to fund these expenses.

3. Develop a “Bucket” Strategy

A bucket strategy, also called a time segmentation strategy, helps you categorize your cash flow by when you’ll need it. For example:

- Short-term bucket: This bucket includes “liquid” assets such as cash and money market investments to pay for everyday expenses and emergencies.

- Mid-term bucket: This bucket contains assets not needed for at least five to 10 years, such as certificates of deposit, bonds and income-focused equities.

- Long-term bucket: This bucket includes growth-oriented assets designed to increase the value of your portfolio and outpace inflation.

When you spend from your short-term bucket, you’ll need to refill it. You can do this via your mid-term bucket, which in turn is refilled from your long-term bucket. During a down market, immediate income needs can be met through distributions from your short- and mid-term buckets. Refilling distributions from your long-term bucket can be delayed, allowing time for the market to recover.

Keep in mind that having to sell securities at inopportune times, such as when the market is trending downward, can hurt the longevity of your portfolio—particularly if you have to do so early in your retirement. This risk can be decreased by using a bucket strategy.

The timing of when you withdraw money from your accounts can determine whether you have enough or run out of money in retirement. For more on this topic, known as sequence of return risk, watch this brief video.

Consult With Your Advisor

Your wealth advisor can help you create a bucket strategy as well as determine the appropriate “size” of your buckets, how to keep them funded based on your needs and which accounts to withdraw from to generate income while minimizing your taxes.

When you’re a client at Mariner, your income sources and expenses can be tracked via financial planning software that also shows your net worth in real time. Your wealth advisor can work with you to update your cash flow plan as needed.

Source:

1“Genworth Cost of Care Survey.”

This article is intended for informational and educational purposes only. The views expressed do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to engage in a particular plan or strategy. Any opinions contained herein are based on sources of information deemed reliable, but we do not warrant the accuracy of the information.

There is no assurance that any plan or strategy will be successful. Investing involves risk, including the possible loss of principal. Please consult your financial professional before making any investment or financial-related decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.