Download Our Article:

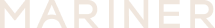

5 Ways for Apple Employees to Avoid Owing Big on Tax

Take proactive steps to help reduce tax exposure from earned compensation.

Download our comp strategies guide to help minimize year-end taxes.

Why Mariner?

With over 20 years of experience working with Apple employees, we manage, advise, and execute on your goals to help you pursue and achieve financial security.

Growing with Apple means your wealth has the opportunity to grow as well. We can help you manage all of the moving parts:

- RSU grants

- Vesting periods

- 401K matching

- Employee Stock Purchase Plan (ESPP)

- Deferred Comp Plan

- Self-Directed Accounts (SDA)

Take Steps Now to Improve Your Year-End Tax Picture

Consider a handful of proactive strategies that may help you avoid owing more taxes due to your Apple compensation program.

Download our comp strategies guide to help minimize year-end taxes.

Interested in Working

With a Top-Ranked Advisor?

Barron’s has ranked our firm as a top five RIA for the last nine years. As a nationally recognized firm with a local presence across the country, we offer wealth management from advisors focused on helping you navigate your financial future.

___________________________________________________

Barron’s Top RIA Firms: Barron’s awarded 2024-2023 #4, 2022-2020 #5, 2019 #4, and 2018 #3 rankings to Mariner Wealth Advisors (MWA) based on data compiled for MWA registered investment adviser subsidiaries and the 2017 #2 and 2016 #1 rankings to Mariner Holdings (MH) based upon data compiled for MH registered investment adviser subsidiaries. Rankings for 2016-2024 were published in September of each award year and were based on June 30th data, including annual figures for the previous three years. No fee was paid for participation in the rankings; however, MWA has paid a fee to use the ranking. The rankings are based on firm surveys, and filings with the regulatory databases were used to cross-check the data provided. The rankings are based on assets managed by the firms, technology spending, staff diversity, succession planning, and other metrics. The formula Barron’s uses to rank firms is proprietary. The number of firms included in the rankings was: 20 (2016), 30 (2017), 40 (2018), 50 (2019), and 100 (2020-2024). The ranking does not indicate future performance, and there is no guarantee of future success. For additional information, visit www.barrons.com.