Socially Conscious Investing Continues to Grow in Popularity

Most of us try to do our part for the environment. We recycle. Some of us buy hybrid cars. Most of us also tend to support social causes we believe in, and that sense of social and environmental responsibility often carries over into the products we buy and how we choose to invest.

More Individuals Are Investing Sustainably

While there are many names for it—socially responsible investing, environmental, social and governance (ESG) investing, values-based investing, impact investing, most fall under the umbrella term of “socially conscious investing.” More and more individuals and institutional investors alike are investing their dollars to align with their values, and it shows.

According to a 2020 Report on U.S. Sustainable and Impact Investing Trends by the US SIF Foundation, total U.S.-domiciled assets under management using sustainable investing strategies has grown 42% in the last two years. Assets grew from $12 trillion in 2018 to $17.1 trillion in 2020. Put another way, sustainable investing represents one in three dollars of the total U.S. assets under professional management.1

The report also notes that retail and high- net worth individuals are increasingly using this approach, investing $4.6 trillion in sustainable investment assets; a 50% increase from 2018.

Investors Don’t Have to Trade Values for Return

While it may seem unlikely to some, data supports the fact that incorporating values into investment decision- making does not negatively affect performance. In other words, you don’t have to trade your values for positive returns.

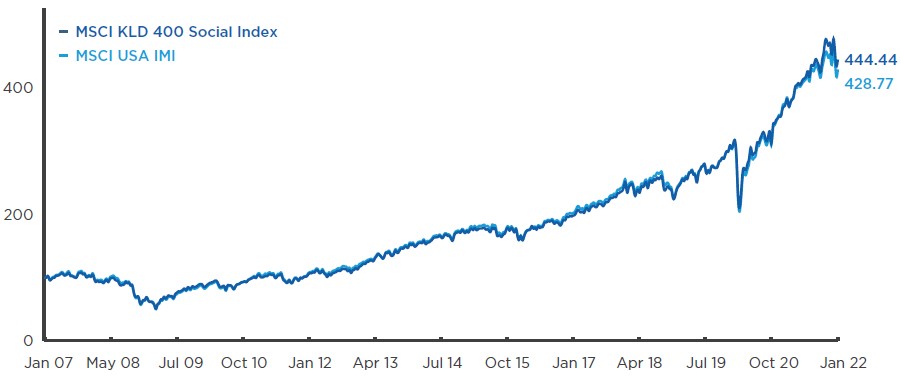

Cumulative Index Performance — Gross Returns (USD)2

Source: MSCI Past performance is not a guarantee of future results.

The chart above demonstrates that, over a 15-year period, the performance of ESG companies is relatively close to that of the overall market.

In addition, a 2020 Morgan Stanley report concluded that, “sustainable investing is proving a rewarding opportunity during times of both market expansion and severe volatility.” The report also said that, despite the pandemic, in the first half of 2020, sustainable equity and taxable bond funds outperformed their traditional peers. The research included the performance of nearly 11,000 U.S. mutual funds and exchange traded U.S.-domiciled funds. The results showed that incorporating ESG criteria can potentially provide financial returns that are comparable if not better than traditional funds with less downside risk.3

Negative and Positive Screening

To help advise individuals on where to put their investments, screening technology allows portfolio managers to select stocks according to an investor’s personal preference. For example, an investor may want to screen out tobacco or oil companies.

Investors can even access free screening tools, such as the one from Morningstar. The firm acquired Sustainalytics in 2020 and has since launched a free ESG screening tool to help both investors and financial advisors screen funds focused on ESG issues. The tool allows for a detailed look at funds that exclude guns, tobacco, alcohol, fossil fuels and thermal coal.4

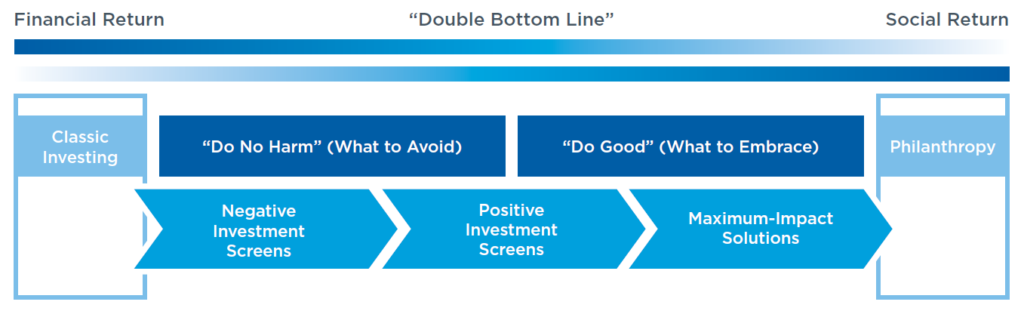

If you are interested in sustainable investing, there are two primary investment objectives beyond the traditional goals of maximizing return and minimizing risk to help you make strategic decisions:

- Do No Harm – Consider avoiding investments in companies that take a stance or profit from activities that conflict with your values. These are “negative” screens of companies or industries to be avoided, such as tobacco, gambling, oil and gas, defense, etc. Obviously, one person’s idea of socially responsible investments can be completely different from another person’s. The key is to differentiate between all of the available fund options and select those that most accurately reflect your values. The Forum for Sustainable & Responsible Investment is a good place to start. For those with a faith-based or religious perspective, the Christian Investment Forum can be helpful.

- Do Good – Actively seek out investments in companies that create real value for their customers, communities and society at large. This approach often applies the aforementioned ESG factors as positive screening criteria.

It is helpful to think of parallels to the medical industry. Physicians take an oath to “do no harm.” It is fundamental to the practice of medicine. The goal is certainly not to stop there—the ultimate goal of medicine is to heal. Likewise, investors who want to integrate their values with investment decision-making may decide to not merely seek to avoid companies doing harm, but ultimately look for companies that heal; those that are helping to make the world a better place.

Factors for Investors to Consider Before Investing

As you work with your wealth advisor on how socially conscious investing fits into your overall financial strategy, consider approaching it as you would any investment. What are your long-term goals and time frame for reaching them and what level of risk are you comfortable with in your portfolio?

In addition, at Mariner, your wealth advisor works alongside our investment team that assists in implementing strategies focused on socially conscious investing if that fits into your overall strategy. Your wealth advisor will listen to what matters most to you to help align your portfolio with your values.

Sources:

1 US SIF Trends Report Highlights, ussif.org.

2“MSCI KLD 400 Social Index,” msci.com.

3“Sustainable Reality: 2020 Update,” Morgan Stanley.

4 “Morningstar Rolls Out Free ESG-Screening Tool,” investmentnews.com.

The MSCI KLD 400 Social Index is a capitalization weighted index of 400 US securities that provides exposure to companies with outstanding Environmental, Social and Governance (ESG) ratings and excludes companies whose products have negative social or environmental impacts.

The MSCI USA IMI is an equity index of large, mid and small cap companies. The Index is designed for investors seeking a diversified benchmark comprised of companies with strong sustainability profiles while avoiding companies incompatible with values screens.

The value of investments held by any strategy may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The value of equity securities is sensitive to stock market volatility. Investments in foreign instruments or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, currency exchange rates or other conditions. In emerging countries, these risks may be more significant.

A client’s or a strategy’s ESG criteria may exclude securities of certain issuers for non financial reasons and therefore the client’s account or strategy may forgo some market opportunities available to portfolios that don’t use an ESG criteria. Stocks of companies with ESG practices may shift into and out of favor with stock market investors depending on market and economic conditions, and the client’s or strategy’s performance may at times be better or worse than the performance of accounts or strategies that do not use an ESG criteria.

This article is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.