Strategies to Manage Risk Including Rising Inflation

When it comes to reaching your goals—retiring early, buying a second home, paying for your child’s college, travel—one factor could derail your asset accumulation and preservation goals like no other—risk. Learn how to navigate five common risks as you work toward achieving your goals.

Strategies to Mitigate Risk

You might primarily think of risk as being too aggressively invested then watching the market take a swift downturn. But it’s so much more than that.

Five Risks to Your Investment Goals

- Rising inflation

- Taking withdrawals from retirement accounts during a market downturn

- Being too conservative with your long-term investing strategy

- Unexpected health care costs

- Outliving your retirement savings

Inflation Threatens Cash Flow

In 2022, we’ve seen inflation rise to a 40-year high, and everyone is feeling it at the gas pump and grocery store. Gas prices have recently surged ($4.54 as of May 2022, vs. $3.07 in May 2021).1

As measured by the Consumer Price Index, the cost of groceries is at a 40-year high, up 10% as of May 2022.2 And, although wages have been increasing, price increases for goods and services have outpaced compensation growth. In a May 2022 survey, 66% of workers say inflation has exceeded any salary gains they’ve had in the last 12 months.3

What can you do to combat inflation? A starting point is to take time to meet with your wealth advisor to review your asset allocation to ensure you have appropriate growth investments in your portfolio to help outpace inflation and combat the devaluation of the dollar.

Bad Timing Can Affect Lifetime Savings

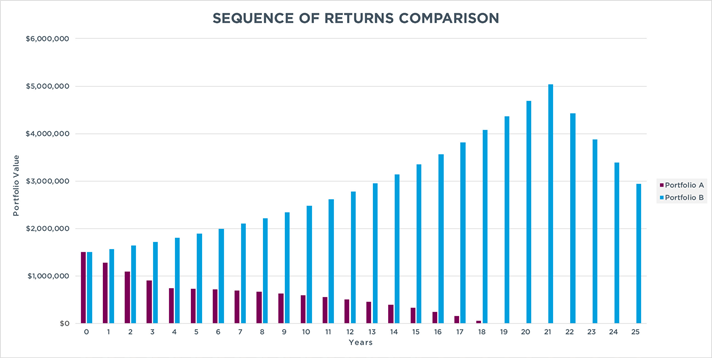

As you start to withdraw money from your retirement accounts, you could experience sequence of return risk. This refers to the markets generating a sequence of negative returns over several years at the same time you begin to take withdrawals. This risk may result in you not having enough savings to last throughout your retirement. Should you find yourself in this position, take a closer look at your cash flow and see where you could reduce discretionary spending until the market levels out.

For illustrative purposes only.

Starting balance for both portfolios: $1.5MM. Ending balance at year 25: Portfolio A: $0; Portfolio B: $2,937,954. Average return: 7%.

Meet with your wealth advisor to review historical returns and “stress test” your portfolio to factor in different volatility scenarios so you can better prepare a withdrawal strategy in anticipation of potential future market uncertainty. For more on this topic, read our article, “Developing a Balanced Savings Strategy to Minimize Risk.”

Being Too Conservative Can Impact Long-term Savings

As you age and near retirement, your portfolio allocation should become more balanced in terms of including equities for growth and bonds for capital preservation. The danger lies in tilting your portfolio too far to the conservative side. Whether you’ve been spooked by market corrections or just have a low tolerance for risk, you still need a growth component of your portfolio to help combat inflation as mentioned above. Growth doesn’t mean taking unnecessary risks, it just means developing a strategy to balance growth and asset preservation to help ensure you can still reach your goals.

Plan for Unexpected Health Care Costs

The fact of the matter is that every day until 2030, 10,000 baby boomers will turn 65 and of those, 70% will need long-term care at some point.4

The cost of long-term care has risen dramatically over the years. For example, in 2021, the annual median cost of a private room in a nursing home was $108,405. Assuming an annual inflation rate of 5%, that same room is estimated to cost $176,580 in 2031,4 keeping in mind that actual costs might vary.

That’s a 63% increase. It’s a good idea to expect to need some level of care as you age and work with your wealth advisor on the best way to fund it. Some may choose to fund it out of their overall savings, while others may choose to purchase long-term care insurance or a new, permanent life insurance policy with a long-term care rider to defray some of the costs.

Outliving Your Retirement Savings

The worry that you could outlive your retirement savings is a common one. Not surprisingly in a 2022 retirement confidence survey, 33% of workers and 25% of retirees who feel less confident about retiring comfortably cite inflation as the reason.5 Across generations, most Americans say the nation faces a retirement crisis and plan to take steps to help mitigate the crisis, including working longer and cutting spending now and in retirement.6 Other strategies include making sure you max out your retirement plan contributions and take advantage of catch-up contributions if you’re age 50 or older, as well as delaying receiving Social Security to receive a higher monthly benefit over time.

Source: 2022 Retirement Confidence Survey, EBRI & Greenwald Research

Consult With Your Wealth Advisor

As you contemplate these risks to your ability to accumulate and preserve assets, it’s a good idea to meet with your wealth advisor.

At Mariner, your wealth team, including your advisor, tax professional, insurance, trust and estate planning professionals, are in-house. Together they’ll work with you on a wealth plan designed to mitigate risk to help you reach both short- and long-term goals.

Sources:

1 U.S. Petroleum & Other Liquids

2 U.S. Bureau of Labor Statistics Consumer Price Index

3 CNBC|Momentive Workforce Happiness Index May 2022

4 Genworth Cost of Care Survey

5 2022 Retirement Confidence Survey

6“Generational Views of Retirement”

The views expressed are for commentary purposes only and do not take into account any individual personal, financial, legal or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. The opinions are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information.

Some services listed in this piece are provided by affiliates of MWA and are subject to additional fees. Additional fees may also apply for tax planning and preparation services.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.