Design Your Retirement Savings Plan

Variety Matters

Your employer’s retirement plan likely offers several investment choices. The right mix of investments plays an important role in helping you save for retirement. It may also help lessen risk to your savings when the stock market moves up and down.

Each Investment Type Plays A Role

When choosing funds for your retirement savings, it’s important to include different types of investments. You want investments that don’t react the same way when market conditions change.

For example, when interest rates rise, stocks may perform well but bond prices usually go down. Having all of one kind of investment can mean big wins at times, but also big losses if the market changes.

Mixing it up, or diversifying your account, helps lower your overall risk. It does this by balancing out your investments. Knowing the role each investment type plays can help you make informed choices.

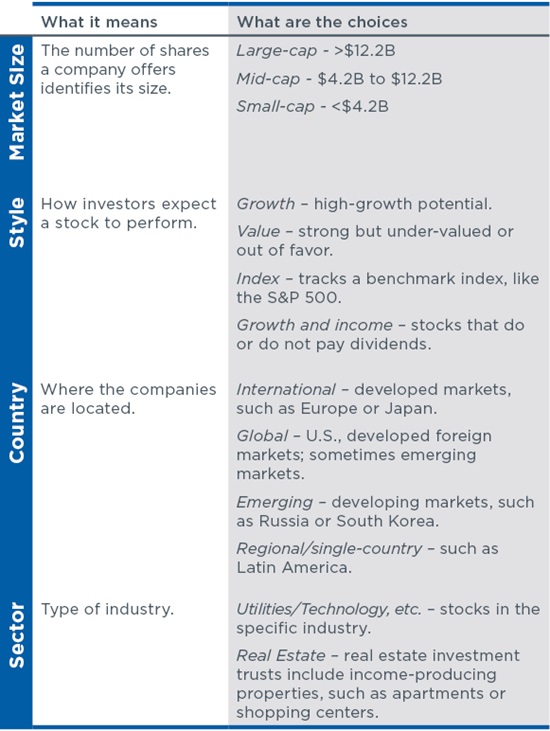

Stock Funds: Designed To Grow

Stock funds may benefit you when individual companies and the economy in general do well. There are several different types of stock funds. They are defined by the types of companies they buy. Some examples are below.

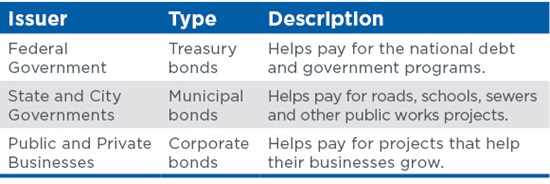

Bond Funds: Seek Income Or Stability

Bonds are built from money you “loan” to an organization, such as a corporation or a government. The organization agrees to repay the loan with interest within a set timeframe. Bond fund prices typically change less than stock funds. This can potentially add stability to your savings.

Money Market Funds: Pursue Preservation

Money markets hold investments, such as U.S. Treasury bills, that mature in less than one year. Their role is to maintain capital.

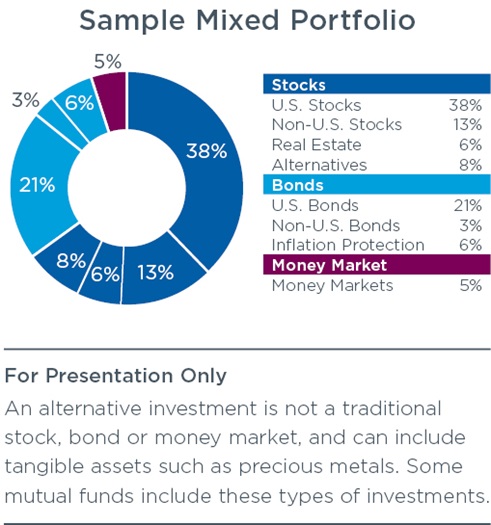

Pre-Mixed Options

You can choose a fund that already includes a mix of stock, bond and money market investments.

Asset allocation funds invest in a mix of individual stocks, bonds and money markets. You choose the fund based on how you feel about risk.

A fund-of-funds invests in stock, bond and money market mutual funds. You select one based on risk, or on how long you have to save for a goal.

The Bottom Line

Select investments by the role each plays. This may give you a better chance of helping you save for the kind of retirement you want

This material is provided with permission from American Century. It is for informational purposes only and has been obtained from sources believed to be reliable. While every effort is made to ensure the accuracy of its contents, it should not be relied upon as being tax, legal, or financial advice.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.

American Century Investment Services, Inc., Distributor

© 2014 American Century Proprietary Holdings, Inc. All rights reserved.