Health Care Costs in Retirement

Health care is one of the largest expenses in retirement, with costs continuing to increase. In 2022, estimated costs rose 5% from 2021 ($300,000) and have nearly doubled from $160,000 in 2002. The problem is, Americans’ perceptions of cost don’t align with reality. Those surveyed by Fidelity estimated a couple retiring in 2022 would spend just $41,000 on health care throughout retirement.1

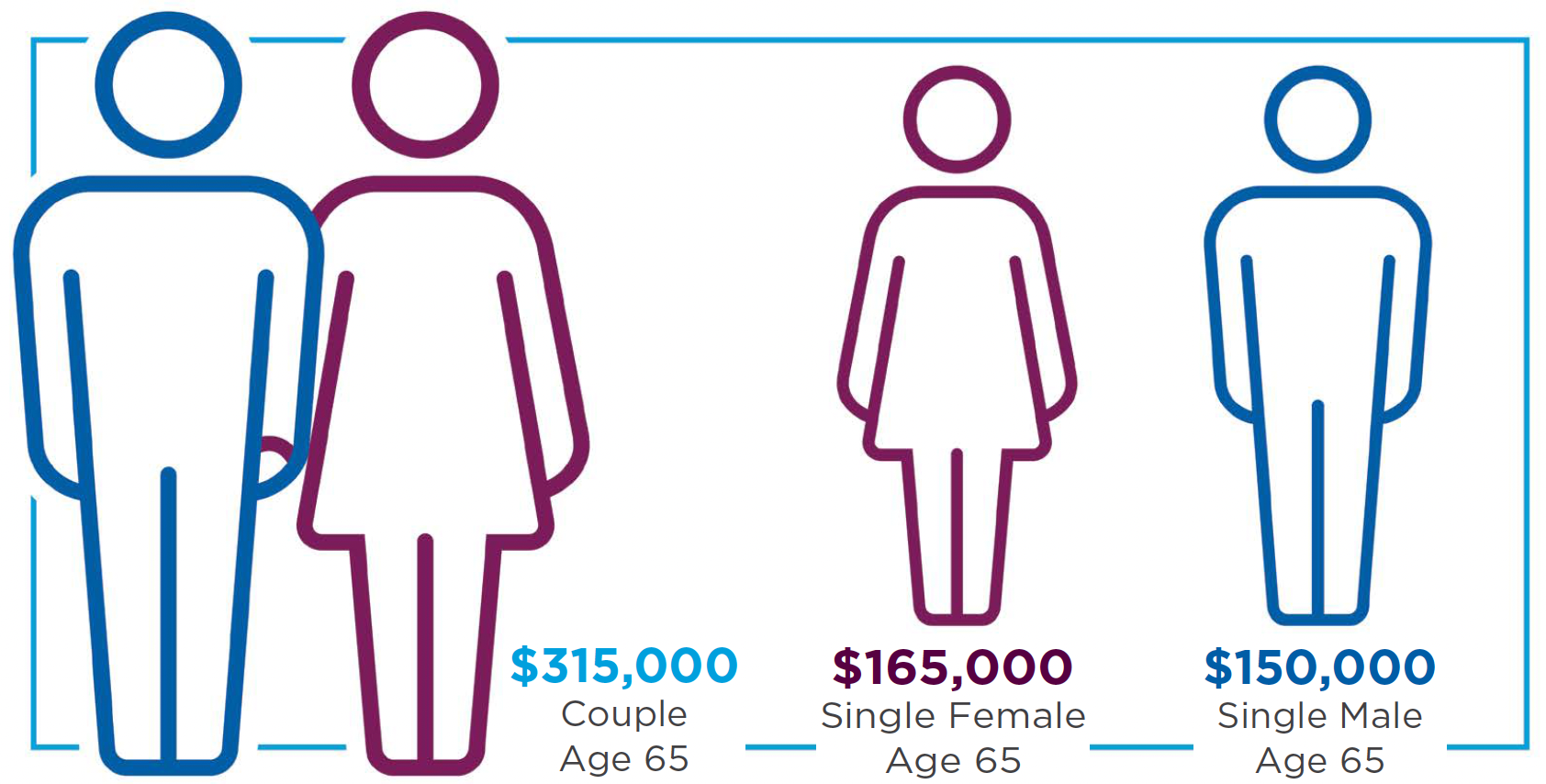

Average Health Care & Medical Costs During Retirement

Source: 21st Annual Retiree Health Care Cost Estimate Study, Fidelity Investments. Data assumes both are enrolled in traditional Medicare Parts A, B and D.

Americans will see some relief on Medicare-related costs. Starting in 2025, out-of-pocket costs for prescriptions will be capped at $2,000.2

Work With Your Advisor

At Mariner, we’ll work with you on a strategy to fund health care in retirement.

Sources:

1 “Fidelity Releases 2022 Retiree Health Care Cost Estimate.”

2 “How Will the Prescription Drug Provisions Affect Beneficiaries?”

This article is for informational and educational purposes only. The information contained herein has been obtained from sources believed to be reliable, but we do not warrant the accuracy of the information. Please consult with a qualified professional regarding your personal situation.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.